J.C. Monahan, age 40, bought a straight-life insurance policy for $210,000. Calculate her annual premium. (Use Table 20.1.) If after 20 years J.C. no longer pays her premiums, what nonforfeiture options will be available to her? (Use Table 20.2.) Annual premium Nonforfeiture options Option 1: Please chose one of the following: 1. Cash Value, 2. Extended Term, 3. Marketing Expense, 4. Operating income, 5. Other utilities 6. Paid-up insurance Option 2: Please chose one of the following: 1. Cash Value, 2. Extended Term, 3. Marketing Expense, 4. Operating income, 5. Other utilities 6. Paid-up insurance Option 3: Please chose one of the following: 1. Cash Value, 2. Extended Term, 3. Marketing Expense, 4. Operating income, 5. Other utilities 6. Paid-up insurance

J.C. Monahan, age 40, bought a straight-life insurance policy for $210,000. Calculate her annual premium. (Use Table 20.1.) If after 20 years J.C. no longer pays her premiums, what nonforfeiture options will be available to her? (Use Table 20.2.) Annual premium Nonforfeiture options Option 1: Please chose one of the following: 1. Cash Value, 2. Extended Term, 3. Marketing Expense, 4. Operating income, 5. Other utilities 6. Paid-up insurance Option 2: Please chose one of the following: 1. Cash Value, 2. Extended Term, 3. Marketing Expense, 4. Operating income, 5. Other utilities 6. Paid-up insurance Option 3: Please chose one of the following: 1. Cash Value, 2. Extended Term, 3. Marketing Expense, 4. Operating income, 5. Other utilities 6. Paid-up insurance

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter8: Insuring Your Life

Section: Chapter Questions

Problem 6FPE

Related questions

Concept explainers

Question

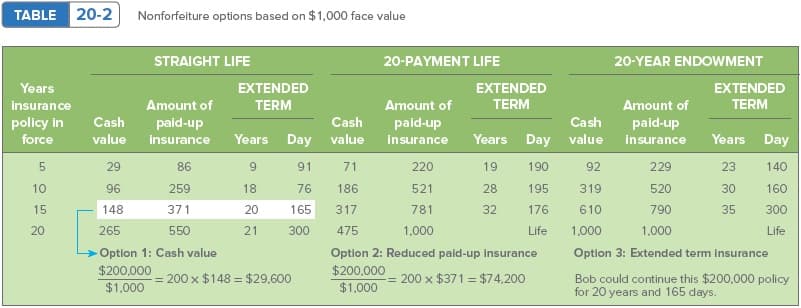

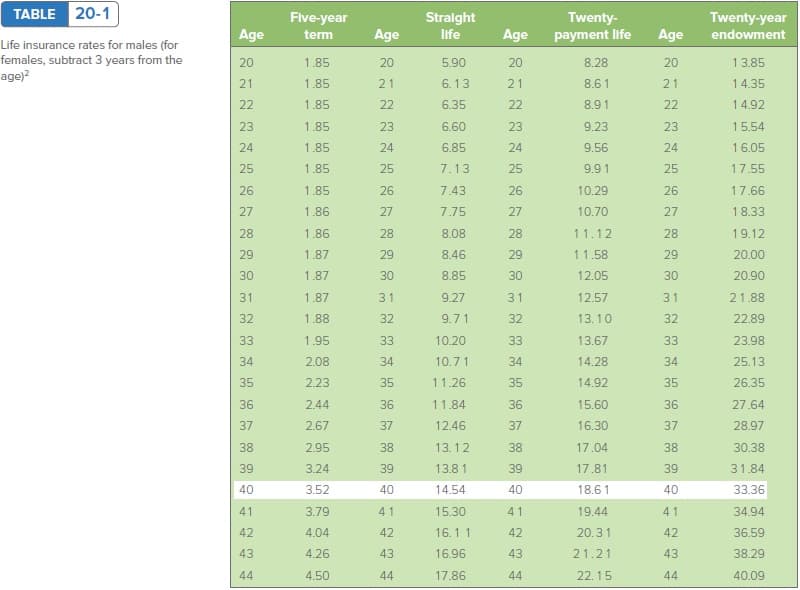

J.C. Monahan, age 40, bought a straight-life insurance policy for $210,000. Calculate her annual premium. (Use Table 20.1.) If after 20 years J.C. no longer pays her premiums, what nonforfeiture options will be available to her? (Use Table 20.2.)

|

Transcribed Image Text:TABLE 20-2

Nonforfeiture options based on $1,000 face value

STRAIGHT LIFE

20-PAYMENT LIFE

20-YEAR ENDOWMENT

Years

EXTENDED

EXTENDED

EXTENDED

insurance

Amount of

TERM

Amount of

TERM

Amount of

TERM

policy in

Cash

paid-up

Cash

Cash

paid-up

Years Day value insurance

paid-up

force

value

insurance

Years Day value insurance

Years Day

5

29

86

9.

91

71

220

19

190

92

229

23

140

10

96

259

18

76

186

521

28

195

319

520

30

160

15

148

371

20

165

317

781

32

176

610

790

35

300

20

265

550

21

300

475

1,000

Life

1,000

1.000

Life

Option 1: Cash value

Option 2: Reduced paid-up insurance

Option 3: Extended term insurance

$200,000

$200,000

= 200 x $148 = $29,600

= 200 x $371 = $74,200

Bob could continue this $200,000 policy

for 20 years and 165 days.

$1.000

$1.000

Transcribed Image Text:TABLE 20-1

Five-year

Stralght

Twenty-

payment life

Twenty-year

Age

term

Age

life

Age

Age

endowment

Life insurance rates for males (for

females, subtract 3 years from the

age)?

20

1.85

20

5.90

20

8.28

20

13.85

21

1.85

21

6.13

21

8.61

21

14.35

22

1.85

22

6.35

22

8.91

22

14.92

23

1.85

23

6.60

23

9.23

23

15.54

24

1.85

24

6.85

24

9.56

24

16.05

25

1.85

25

7.13

25

9.9 1

25

17.55

26

1.85

26

7.43

26

10.29

26

17.66

27

1.86

27

7.75

27

10.70

27

18.33

28

1.86

28

8.08

28

11.12

28

19.12

29

1.87

29

8.46

29

11.58

29

20.00

30

1.87

30

8.85

30

12.05

30

20.90

31

1.87

31

9.27

31

12.57

31

21.88

32

1.88

32

9.71

32

13.10

32

22.89

33

1.95

33

10.20

33

13.67

33

23.98

34

2.08

34

10.71

34

14.28

34

25.13

35

2.23

35

11.26

35

14.92

35

26.35

36

2.44

36

11.84

36

15.60

36

27.64

37

2.67

37

12.46

37

16.30

37

28.97

38

2.95

38

13.12

38

17.04

38

30.38

39

3.24

39

13.8 1

39

17.81

39

31.84

40

3.52

40

14.54

40

18.61

40

33.36

41

3.79

41

15.30

41

19.44

41

34.94

42

4.04

42

16.11

42

20.31

42

36.59

43

4.26

43

16.96

43

21.21

43

38.29

44

4.50

44

17.86

44

22.15

44

40.09

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning