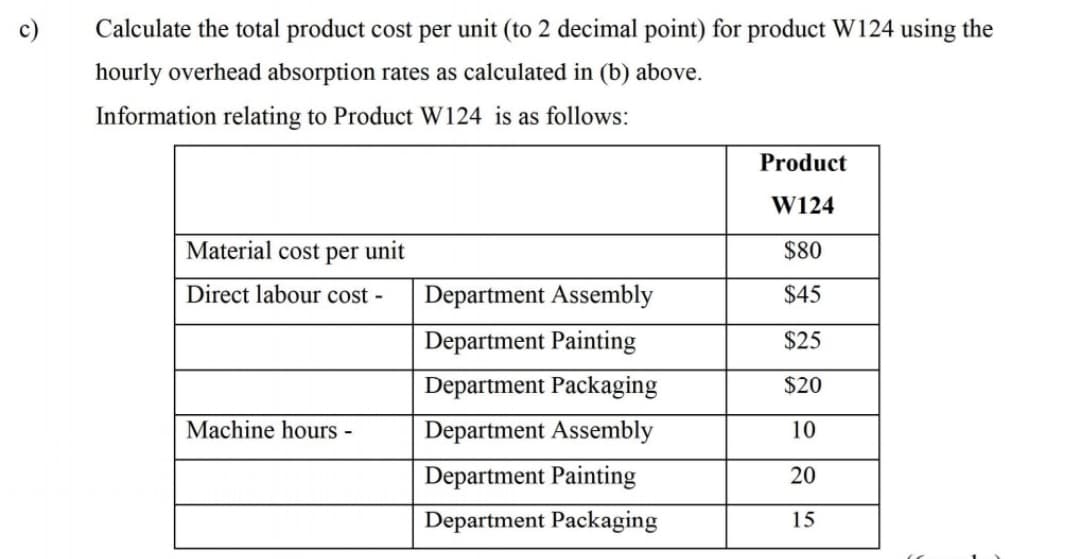

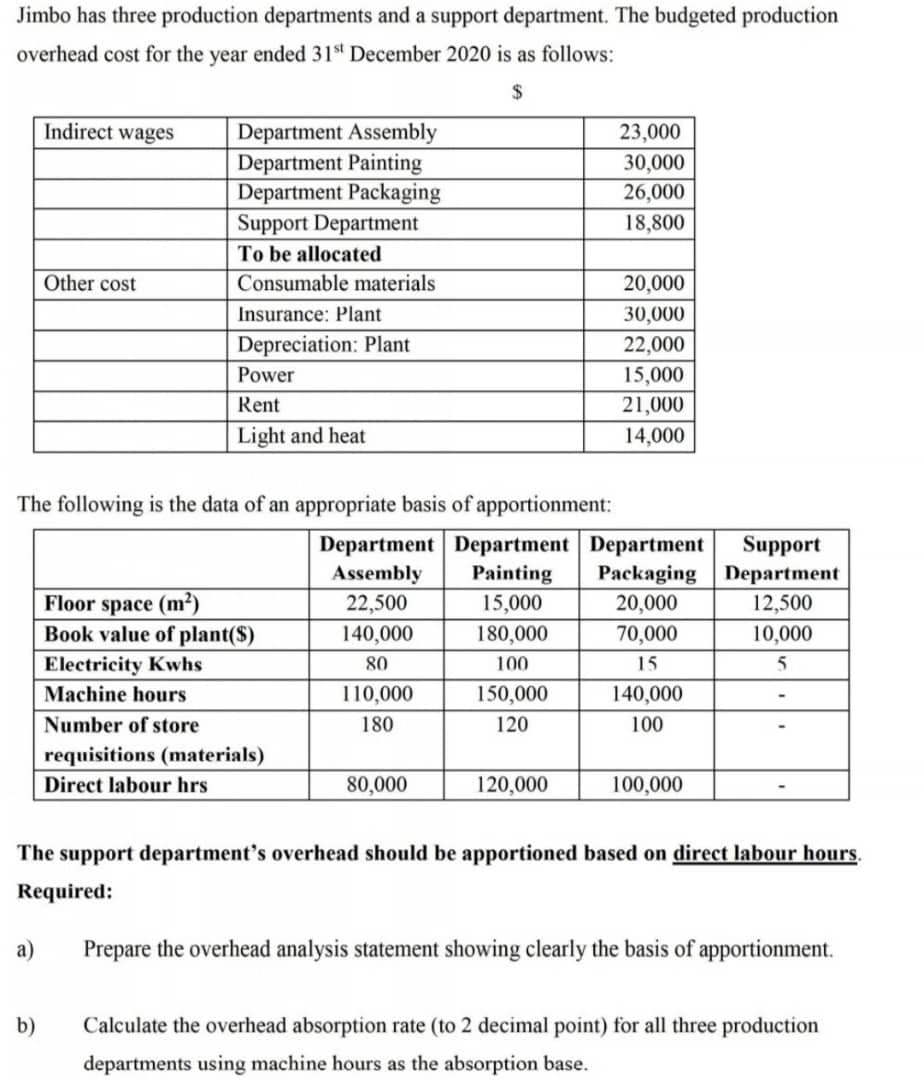

Jimbo has three production departments and a support department. The budgeted production overhead cost for the year ended 31st December 2020 is as follows: 2$ Indirect wages Department Assembly Department Painting Department Packaging Support Department 23,000 30,000 26,000 18,800 To be allocated Other cost Consumable materials 20,000 Insurance: Plant 30,000 Depreciation: Plant 22,000 Power 15,000 Rent 21,000 Light and heat 14,000 The following is the data of an appropriate basis of apportionment: Department Department Department Assembly 22,500 Support Department Painting Packaging Floor space (m²) Book value of plant($) 15,000 20,000 12,500 140,000 180,000 70,000 10,000 Electricity Kwhs 80 100 15 Machine hours 110,000 150,000 140,000 Number of store 180 120 100 requisitions (materials) Direct labour hrs 80,000 120,000 100,000 The support department's overhead should be apportioned based on direct labour hours. Required: a) Prepare the overhead analysis statement showing clearly the basis of apportionment. b) Calculate the overhead absorption rate (to 2 decimal point) for all three production departments using machine hours as the absorption base.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps