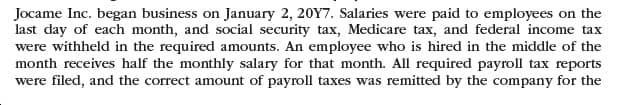

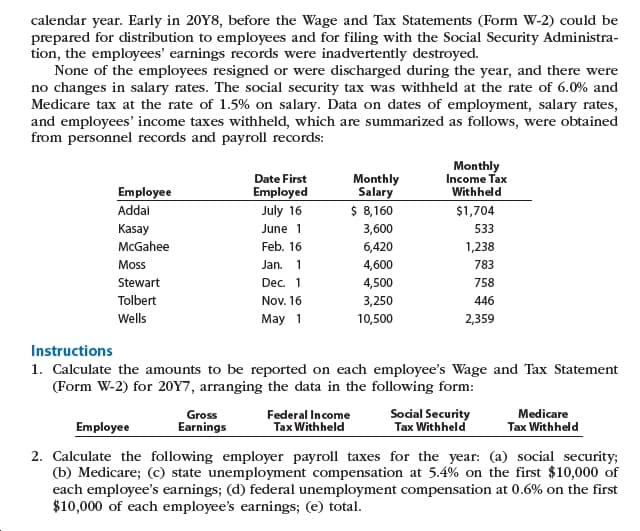

Jocame Inc. began business on January 2, 20Y7. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correct amount of payroll taxes was remitted by the company for the calendar year. Early in 20Y8, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administra- tion, the employees' earnings records were inadvertently destroyed. None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and employees' income taxes withheld, which are summarized as follows, were obtained from personnel records and payroll records: Monthly Income Tax Withheld Date First Monthly Salary $ 8,160 Employee Employed July 16 Addai $1,704 Kasay McGahee June 1 3,600 533 Feb. 16 6,420 1,238 Mss Jan. 4,600 783 758 Stewart Dec. 1 4,500 Tolbert Nov. 16 3,250 446 Wells May 1 10,500 2,359 Instructions 1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) for 20Y7, arranging the data in the following form: Social Security Tax Withheld Medicare Tax Withheld Gross Federal Income Tax Withheld Employee Earnings 2. Calculate the following employer payroll taxes for the year: (a) social security; (b) Medicare; (c) state unemployment compensation at 5.4% on the first $10,000 of each employee's earnings; (d) federal unemployment compensation at 0.6% on the first $10,000 of each employee's earnings; (e) total.

Jocame Inc. began business on January 2, 20Y7. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correct amount of payroll taxes was remitted by the company for the calendar year. Early in 20Y8, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administra- tion, the employees' earnings records were inadvertently destroyed. None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and employees' income taxes withheld, which are summarized as follows, were obtained from personnel records and payroll records: Monthly Income Tax Withheld Date First Monthly Salary $ 8,160 Employee Employed July 16 Addai $1,704 Kasay McGahee June 1 3,600 533 Feb. 16 6,420 1,238 Mss Jan. 4,600 783 758 Stewart Dec. 1 4,500 Tolbert Nov. 16 3,250 446 Wells May 1 10,500 2,359 Instructions 1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W-2) for 20Y7, arranging the data in the following form: Social Security Tax Withheld Medicare Tax Withheld Gross Federal Income Tax Withheld Employee Earnings 2. Calculate the following employer payroll taxes for the year: (a) social security; (b) Medicare; (c) state unemployment compensation at 5.4% on the first $10,000 of each employee's earnings; (d) federal unemployment compensation at 0.6% on the first $10,000 of each employee's earnings; (e) total.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:Jocame Inc. began business on January 2, 20Y7. Salaries were paid to employees on the

last day of each month, and social security tax, Medicare tax, and federal income tax

were withheld in the required amounts. An employee who is hired in the middle of the

month receives half the monthly salary for that month. All required payroll tax reports

were filed, and the correct amount of payroll taxes was remitted by the company for the

Transcribed Image Text:calendar year. Early in 20Y8, before the Wage and Tax Statements (Form W-2) could be

prepared for distribution to employees and for filing with the Social Security Administra-

tion, the employees' earnings records were inadvertently destroyed.

None of the employees resigned or were discharged during the year, and there were

no changes in salary rates. The social security tax was withheld at the rate of 6.0% and

Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates,

and employees' income taxes withheld, which are summarized as follows, were obtained

from personnel records and payroll records:

Monthly

Income Tax

Withheld

Date First

Monthly

Salary

$ 8,160

Employee

Employed

July 16

Addai

$1,704

Kasay

McGahee

June 1

3,600

533

Feb. 16

6,420

1,238

Mss

Jan.

4,600

783

758

Stewart

Dec. 1

4,500

Tolbert

Nov. 16

3,250

446

Wells

May 1

10,500

2,359

Instructions

1. Calculate the amounts to be reported on each employee's Wage and Tax Statement

(Form W-2) for 20Y7, arranging the data in the following form:

Social Security

Tax Withheld

Medicare

Tax Withheld

Gross

Federal Income

Tax Withheld

Employee

Earnings

2. Calculate the following employer payroll taxes for the year: (a) social security;

(b) Medicare; (c) state unemployment compensation at 5.4% on the first $10,000 of

each employee's earnings; (d) federal unemployment compensation at 0.6% on the first

$10,000 of each employee's earnings; (e) total.

Expert Solution

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 9 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning