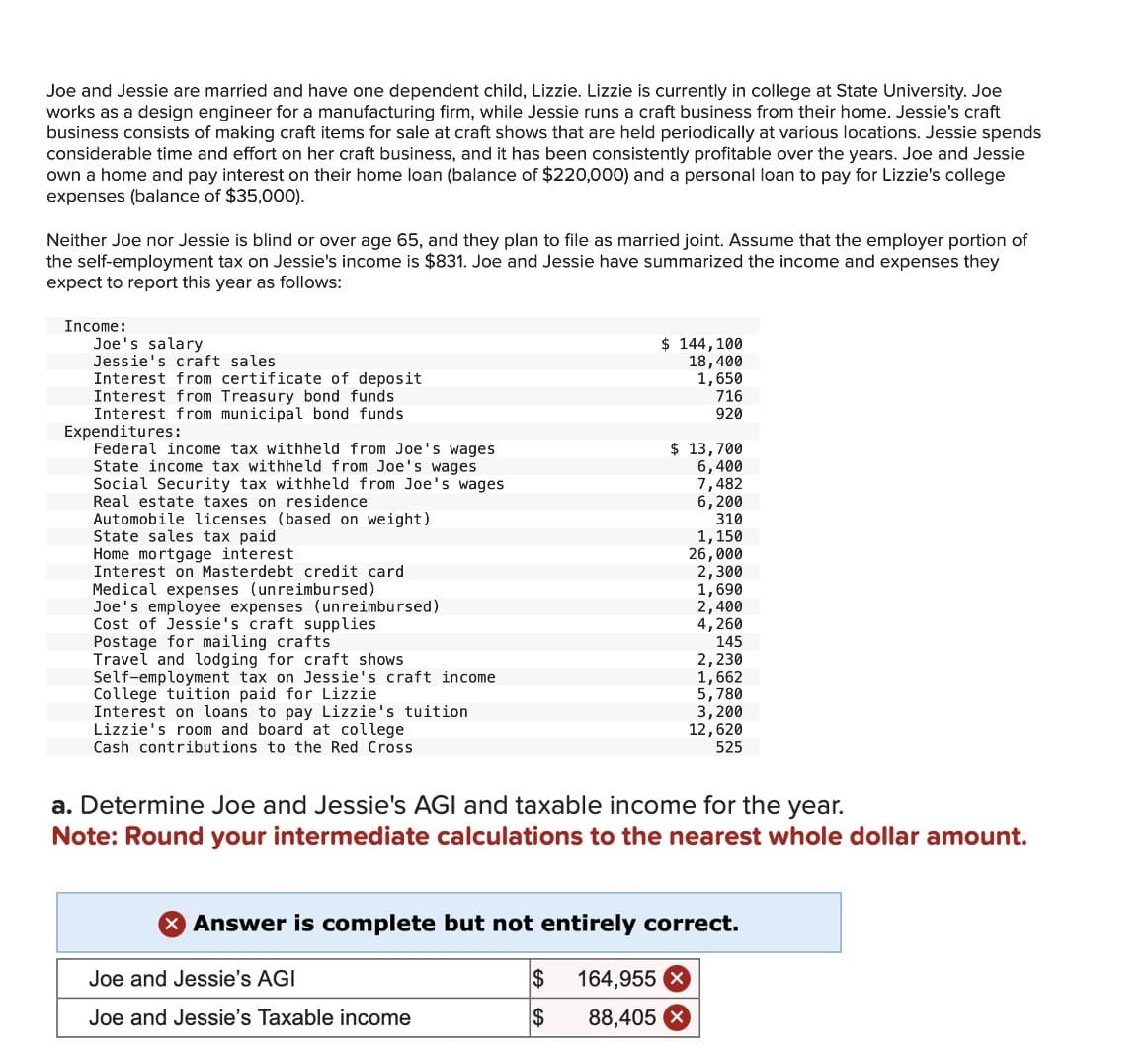

Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe works as a design engineer for a manufacturing firm, while Jessie runs a craft business from their home. Jessie's craft business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie's college expenses (balance of $35,000). Neither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary Jessie's craft sales Interest from certificate of deposit Interest from Treasury bond funds Interest from municipal bond funds Expenditures: Federal income tax withheld from Joe's wages State income tax withheld from Joe's wages Social Security tax withheld from Joe's wages Real estate taxes on residence Automobile licenses (based on weight) State sales tax paid $ 144,100 18,400 1,650 716 920 $ 13,700 6,400 7,482 6,200 310 1,150 26,000 2,300 1,690 2,400 Cost of Jessie's craft supplies 4,260 145 Travel and lodging for craft shows 2,230 Self-employment tax on Jessie's craft income 1,662 College tuition paid for Lizzie 5,780 Interest on loans to pay Lizzie's tuition 3,200 Lizzie's room and board at college 12,620 Cash contributions to the Red Cross 525 Home mortgage interest Interest on Masterdebt credit card Medical expenses (unreimbursed) Joe's employee expenses (unreimbursed) Postage for mailing crafts a. Determine Joe and Jessie's AGI and taxable income for the year. Note: Round your intermediate calculations to the nearest whole dollar amount. Answer is complete but not entirely correct. Joe and Jessie's AGI $ 164,955 x Joe and Jessie's Taxable income $ 88,405 ×

Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe works as a design engineer for a manufacturing firm, while Jessie runs a craft business from their home. Jessie's craft business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie's college expenses (balance of $35,000). Neither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary Jessie's craft sales Interest from certificate of deposit Interest from Treasury bond funds Interest from municipal bond funds Expenditures: Federal income tax withheld from Joe's wages State income tax withheld from Joe's wages Social Security tax withheld from Joe's wages Real estate taxes on residence Automobile licenses (based on weight) State sales tax paid $ 144,100 18,400 1,650 716 920 $ 13,700 6,400 7,482 6,200 310 1,150 26,000 2,300 1,690 2,400 Cost of Jessie's craft supplies 4,260 145 Travel and lodging for craft shows 2,230 Self-employment tax on Jessie's craft income 1,662 College tuition paid for Lizzie 5,780 Interest on loans to pay Lizzie's tuition 3,200 Lizzie's room and board at college 12,620 Cash contributions to the Red Cross 525 Home mortgage interest Interest on Masterdebt credit card Medical expenses (unreimbursed) Joe's employee expenses (unreimbursed) Postage for mailing crafts a. Determine Joe and Jessie's AGI and taxable income for the year. Note: Round your intermediate calculations to the nearest whole dollar amount. Answer is complete but not entirely correct. Joe and Jessie's AGI $ 164,955 x Joe and Jessie's Taxable income $ 88,405 ×

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 75TPC

Related questions

Question

Vijay

Transcribed Image Text:Joe and Jessie are married and have one dependent child, Lizzie. Lizzie is currently in college at State University. Joe

works as a design engineer for a manufacturing firm, while Jessie runs a craft business from their home. Jessie's craft

business consists of making craft items for sale at craft shows that are held periodically at various locations. Jessie spends

considerable time and effort on her craft business, and it has been consistently profitable over the years. Joe and Jessie

own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie's college

expenses (balance of $35,000).

Neither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of

the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they

expect to report this year as follows:

Income:

Joe's salary

Jessie's craft sales

Interest from certificate of deposit

Interest from Treasury bond funds

Interest from municipal bond funds

Expenditures:

Federal income tax withheld from Joe's wages

State income tax withheld from Joe's wages

Social Security tax withheld from Joe's wages

Real estate taxes on residence

Automobile licenses (based on weight)

State sales tax paid

$ 144,100

18,400

1,650

716

920

$ 13,700

6,400

7,482

6,200

310

1,150

26,000

2,300

1,690

2,400

Cost of Jessie's craft supplies

4,260

145

Travel and lodging for craft shows

2,230

Self-employment tax on Jessie's craft income

1,662

College tuition paid for Lizzie

5,780

Interest on loans to pay Lizzie's tuition

3,200

Lizzie's room and board at college

12,620

Cash contributions to the Red Cross

525

Home mortgage interest

Interest on Masterdebt credit card

Medical expenses (unreimbursed)

Joe's employee expenses (unreimbursed)

Postage for mailing crafts

a. Determine Joe and Jessie's AGI and taxable income for the year.

Note: Round your intermediate calculations to the nearest whole dollar amount.

Answer is complete but not entirely correct.

Joe and Jessie's AGI

$

164,955 x

Joe and Jessie's Taxable income

$

88,405 ×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT