Concept explainers

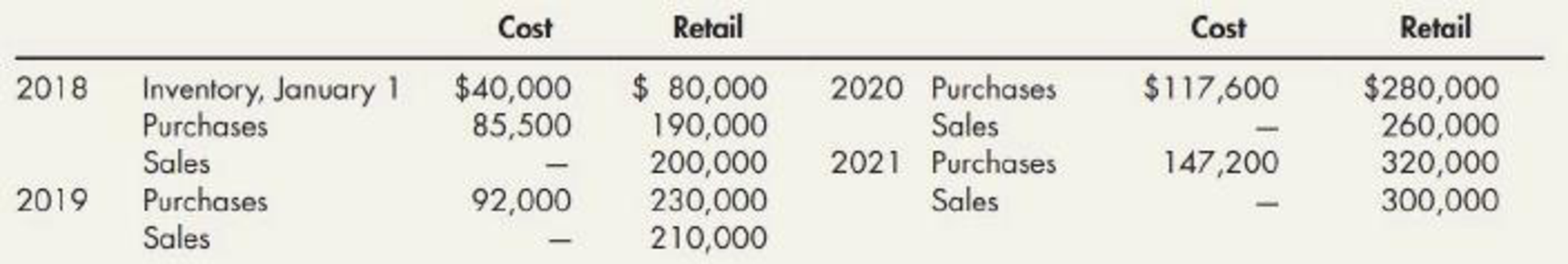

Dollar-Value LIFO Retail Intella Inc. adopted the dollar-value retail LIFO method on January 1, 2018. The following data apply to the 4 subsequent years:

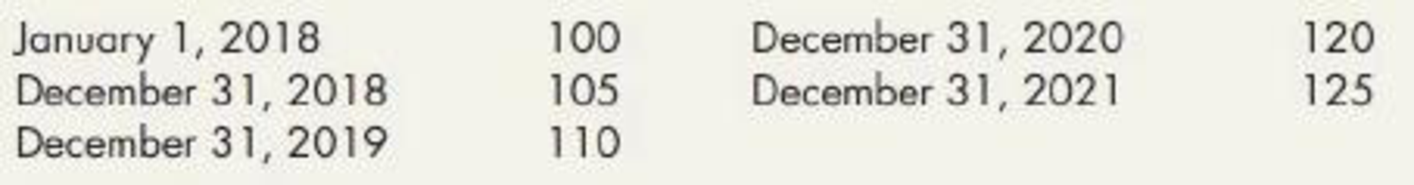

In addition, the following price indexes are available:

Required:

Compute the inventory at the end of each of the 4 years. Round the cost-to-retail ratio to 3 decimal places.

Calculate the cost of ending inventory for 2018, 2019, 2020, and 2021 years by using dollar-value LIFO retail method.

Explanation of Solution

Dollar-Value-LIFO: This method shows all the inventory figures at dollar price rather than units. Under this inventory method, the units that are purchased last are sold first. Thus, it starts from the selling of the units recently purchased and ending with the beginning inventory.

Calculate the cost of ending inventory for 2018, 2019, 2020, and 2021 years by using dollar-value LIFO retail method:

For the year 2018:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2018 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 40,000 | 80,000 |

| Add: Net purchase | 85,500 | 190,000 |

| Goods available for sale – Excluding beginning inventory | 85,500 | 190,000 |

| Goods available for sale – Including beginning inventory | 125,500 | 270,000 |

| Less: Net sales | (200,000) | |

| Estimated ending inventory at retail for 2018 | $70,000 | |

Table (1)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2018 is $33,333.

Working note 1:

Calculate cost-to-retail ratio.

Working note 2:

Calculate cost-to-retail ratio.

For the year 2019:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2019 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 33,333 | 70,000 |

| Add: Net purchase | 92,000 | 230,000 |

| Goods available for sale – Excluding beginning inventory | 92,000 | 230,000 |

| Goods available for sale – Including beginning inventory | 125,333 | 300,000 |

| Less: Net sales | (210,000) | |

| Estimated ending inventory at retail for 2019 | $90,000 | |

Table (1)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2019 is $39,999.

Working note 1:

Calculate cost-to-retail ratio.

For the year 2020:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2020 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 39,999 | 90,000 |

| Add: Net purchase | 117,600 | 280,000 |

| Goods available for sale – Excluding beginning inventory | 117,600 | 280,000 |

| Goods available for sale – Including beginning inventory | 157,599 | 370,000 |

| Less: Net sales | (260,000) | |

| Estimated ending inventory at retail for 2020 | $110,000 | |

Table (3)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2020 is $44,963.

Working note 1:

Calculate cost-to-retail ratio.

For the year 2021:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2021 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 44,963 | 110,000 |

| Add: Net purchase | 147,200 | 320,000 |

| Goods available for sale – Excluding beginning inventory | 147,200 | 320,000 |

| Goods available for sale – Including beginning inventory | 192,163 | 430,000 |

| Less: Net sales | (300,000) | |

| Estimated ending inventory at retail for 2021 | $130,000 | |

Table (4)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2021 is $52,054.

Working note 1:

Calculate cost-to-retail ratio.

Want to see more full solutions like this?

Chapter 8 Solutions

Intermediate Accounting: Reporting And Analysis

- Dollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015. The following information about the inventory at the end of each year is available from Kwestels records: Required: Calculate the dollar-value LIFO inventory at the end of each year. Round to the nearest dollar.arrow_forwardFinancial statement data for years ending December 31 for Tango Company follow: a. Determine the inventory turnover for 20Y7 and 20Y6. b. Determine the days sales in inventory for 20Y7 and 20Y6. Use 365 days and round to one decimal place. c. Does the change in inventory turnover and the days sales in inventory from 20Y6 to 20Y7 indicate a favorable or an unfavorable trend?arrow_forwardFinancial statement data for years ending December 31 for Holland Company follow: a. Determine the inventory turnover for 20Y4 and 20Y3. b. Determine the days sales in inventory for 20Y4 and 20Y3. Use 365 days and round to one decimal place. c. Does the change in inventory turnover and the days sales in inventory from 20Y3 to 20Y4 indicate a favorable or an unfavorable trend?arrow_forward

- At December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600arrow_forwardInventory Pools Stone Shoe Company adopted dollar-value LIFO on January 1, 2019. The company produces four products and uses a single inventory pool. The companys beginning inventory consists of the following: During 2019, the company has the following purchases and sales: Required: 1. Compute the dollar-value LIFO cost of the ending inventory. Round the cost index to 4 decimal places and all other amounts to the nearest dollar. 2. Next Level By how much would the companys gross profit differ if it had used four pools instead of a single pool?arrow_forwardInventory Analysis Singleton Inc. reported the following information for the current year: Required: Compute Singletons (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Note: Round all answers to two decimal places.)arrow_forward

- Habicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows: Required: 1. Determine the gross profit for each year under each of the following periodic inventory methods: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places.) 2. Next Level Explain whether the companys return on assets (net income divided by average total assets) would be higher under FIFO or LIFO.arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forwardBeginning inventory, purchases, and sales for 30xT are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the May 23 purchase, (b) the cost of the merchandise sold on May 26, and (c) the inventory on May 31.arrow_forward

- Alternative Inventory Methods Park Companys perpetual inventory records indicate the following transactions in the month of June: Required: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: a. FIFO b. LIFO c. Average cost (Round unit costs to 3 decimal places and other amounts to the nearest dollar.) 2. Next Level Why are the cost of goods sold and ending inventory amounts different for each of the three methods? What do these amounts tell us about the purchase price of inventory during the year? 3. Next Level Which method produces the most realistic amount for net income? For inventory? Explain your answer. 4. Next Level If Park uses IFRS, which of the previous alternatives would be acceptable and why?arrow_forwardJohnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year, it made net purchases of 180,000 at cost and 322,000 at retail. Johnson nude sales of 300,000. Assuming a price index of 100 at the beginning of the year and 110 at the end of the year, compute Johnsons ending inventory at cost using the dollar-value LIFO retail method.arrow_forwardComprehensive The following information for 2019 is available for Marino Company: 1. The beginning inventory is 100,000. 2. Purchases returns of 4,000 were made. 3. Purchases of 300,000 were made on terms of 2/10, n/30. Eighty percent of the discounts were taken. 4. At December 31, purchases of 20,000 were in transit, FOB destination, on terms of 2/10, n/30. 5. The company made sales of 640,000. The gross selling price per unit is twice the net cost of each unit sold. 6. Sales allowances of 6,000 were made. 7. The company uses the LIFO periodic method and the gross method for purchase discounts. Required: 1. Compute the cost of the ending inventory before the physical inventory is taken. 2. Compute the amount of the cost of goods sold that came from the purchases of the period and the amount that came from the beginning inventory.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning