The results of your audit of Heave Company for 2 consecutive years are shown below: a. Net income for 2018 and 2019 are P46, 520 and P51, 230 respectively. b. Equipment worth P6, o00 purchased on 2018 was charged to expense. The equipment has a useful life of 10 years. c. In 2017, merchandise inventory was understated by P5, o00 and was overstated by P3, 000 in 2019. d. Inventory purchased on account was not recorded in 2018 and included as inventory only on 2019. e. P4, 000 worth of accrued taxes were not recorded in 2018. Unearned rent received was taken up as income amounted to P2, 000. f. Requirement: a. The adjusted net income for 2018 and 2019.

The results of your audit of Heave Company for 2 consecutive years are shown below: a. Net income for 2018 and 2019 are P46, 520 and P51, 230 respectively. b. Equipment worth P6, o00 purchased on 2018 was charged to expense. The equipment has a useful life of 10 years. c. In 2017, merchandise inventory was understated by P5, o00 and was overstated by P3, 000 in 2019. d. Inventory purchased on account was not recorded in 2018 and included as inventory only on 2019. e. P4, 000 worth of accrued taxes were not recorded in 2018. Unearned rent received was taken up as income amounted to P2, 000. f. Requirement: a. The adjusted net income for 2018 and 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

CASH TO ACCRUAL, SINGLE ENTRY AND CORRECTION OF ERRORS

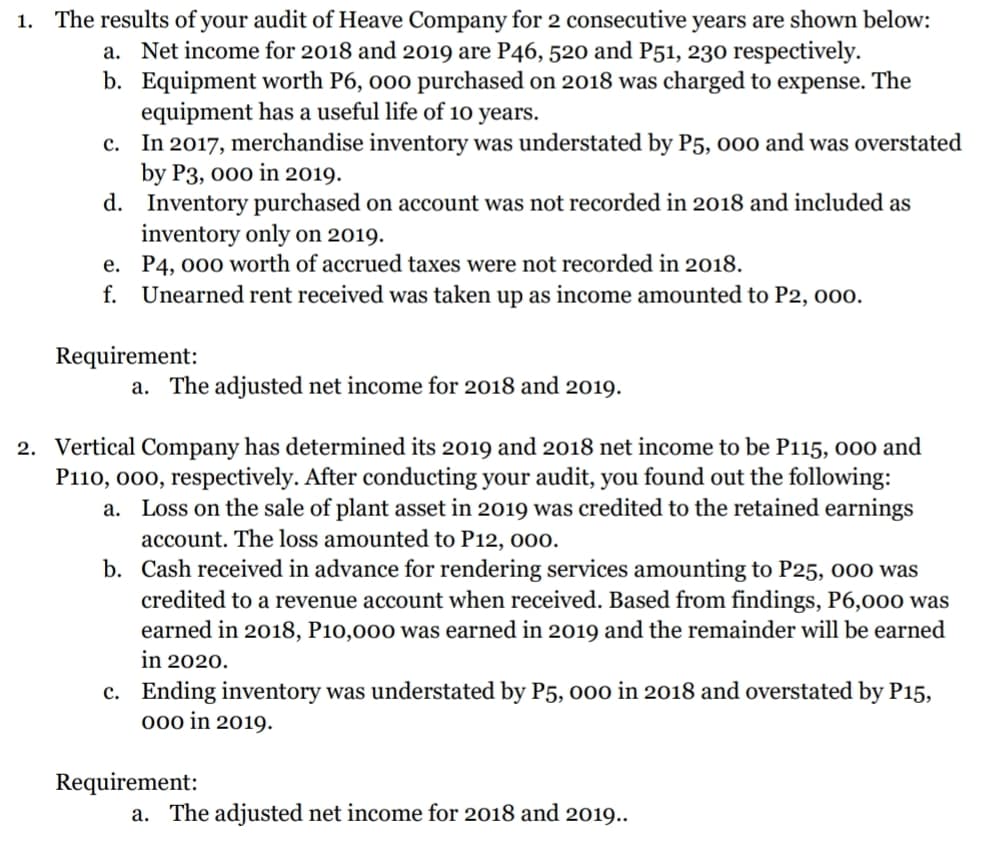

Transcribed Image Text:1. The results of your audit of Heave Company for 2 consecutive years are shown below:

a. Net income for 2018 and 2019 are P46, 520 and P51, 230 respectively.

b. Equipment worth P6, o00 purchased on 2018 was charged to expense. The

equipment has a useful life of 10 years.

c. In 2017, merchandise inventory was understated by P5, o00 and was overstated

by P3, 000 in 2019.

d. Inventory purchased on account was not recorded in 2018 and included as

inventory only on 2019.

e. P4, 000 worth of accrued taxes were not recorded in 2018.

f. Unearned rent received was taken up as income amounted to P2, o00.

Requirement:

a. The adjusted net income for 2018 and 2019.

2. Vertical Company has determined its 2019 and 2018 net income to be P115, 000 and

P110, 000, respectively. After conducting your audit, you found out the following:

a. Loss on the sale of plant asset in 2019 was credited to the retained earnings

account. The loss amounted to P12, 000.

b. Cash received in advance for rendering services amounting to P25, o0o was

credited to a revenue account when received. Based from findings, P6,000 was

earned in 2018, P10,000 was earned in 2019 and the remainder will be earned

in 2020.

c. Ending inventory was understated by P5, 000 in 2018 and overstated by P15,

000 in 2019.

Requirement:

a. The adjusted net income for 2018 and 2019..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College