Juan operates a grocery in Baguio City as sole proprietor. An adjoining lot is used as parking area of his customers. In 2017, due to a business reversal, Juan disallowed the use of the lot as parking space for customers and contemplated on selling it. It was only recently, in June 2021, that Juan was able to sell the lot at a gain. a. The gain is subject to capital gains tax. b. The gain is subject to regular income tax. c. The gain is subject to final withholding tax on passive income. d. The gain is tax exempt.

Juan operates a grocery in Baguio City as sole proprietor. An adjoining lot is used as parking area of his customers. In 2017, due to a business reversal, Juan disallowed the use of the lot as parking space for customers and contemplated on selling it. It was only recently, in June 2021, that Juan was able to sell the lot at a gain. a. The gain is subject to capital gains tax. b. The gain is subject to regular income tax. c. The gain is subject to final withholding tax on passive income. d. The gain is tax exempt.

Chapter9: Taxation Of International Transactions

Section: Chapter Questions

Problem 21P

Related questions

Question

Juan operates a grocery in Baguio City as sole proprietor. An adjoining lot is used as parking area of his customers. In 2017, due to a business reversal, Juan disallowed the use of the lot as parking space for customers and contemplated on selling it. It was only recently, in June 2021, that Juan was able to sell the lot at a gain.

a. The gain is subject to

b. The gain is subject to regular income tax.

c. The gain is subject to final withholding tax on passive income.

d. The gain is tax exempt.

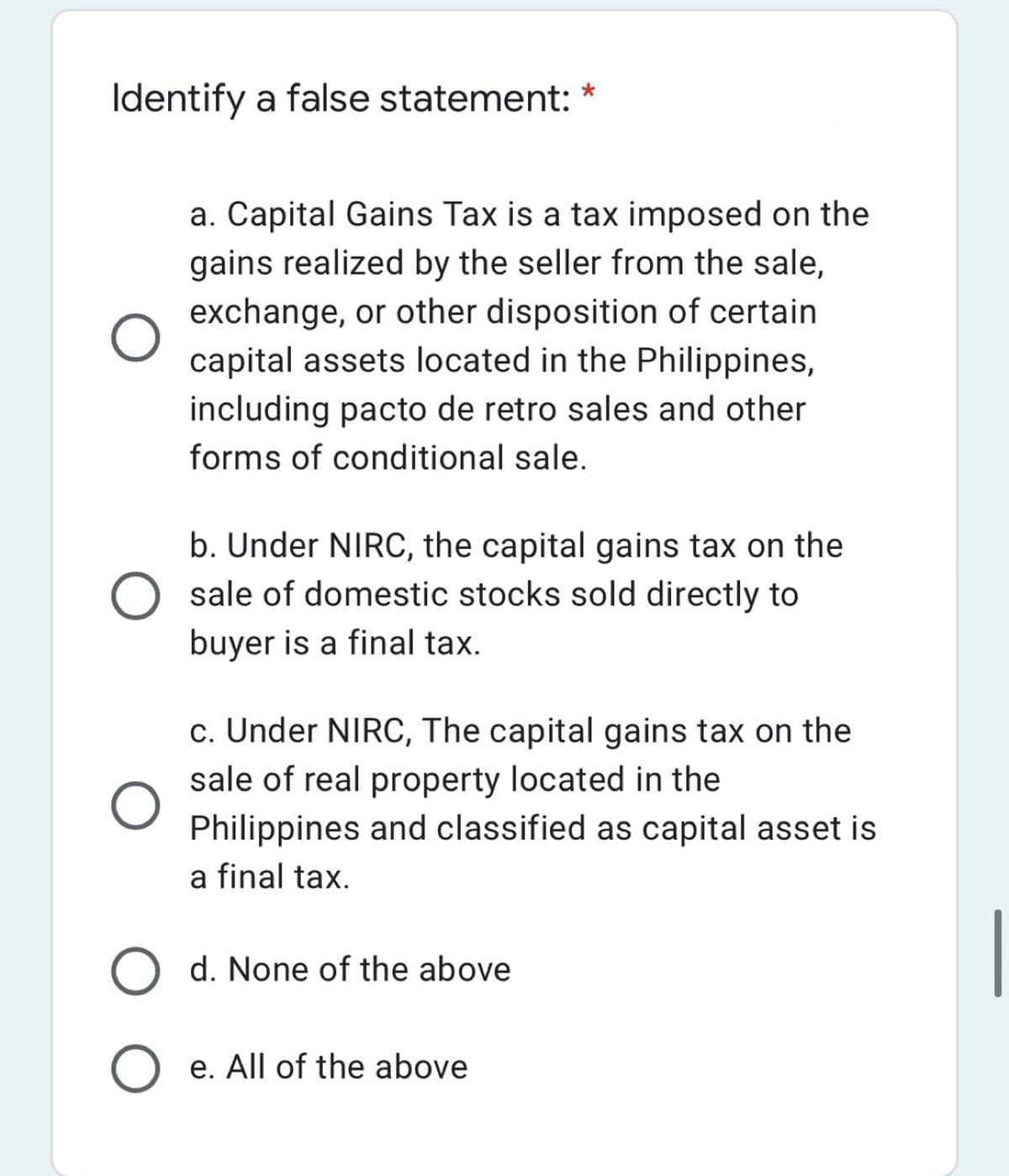

Transcribed Image Text:Identify a false statement:

a. Capital Gains Tax is a tax imposed on the

gains realized by the seller from the sale,

exchange, or other disposition of certain

capital assets located in the Philippines,

including pacto de retro sales and other

forms of conditional sale.

b. Under NIRC, the capital gains tax on the

sale of domestic stocks sold directly to

buyer is a final tax.

c. Under NIRC, The capital gains tax on the

sale of real property located in the

Philippines and classified as capital asset is

a final tax.

O d. None of the above

O e. All of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you