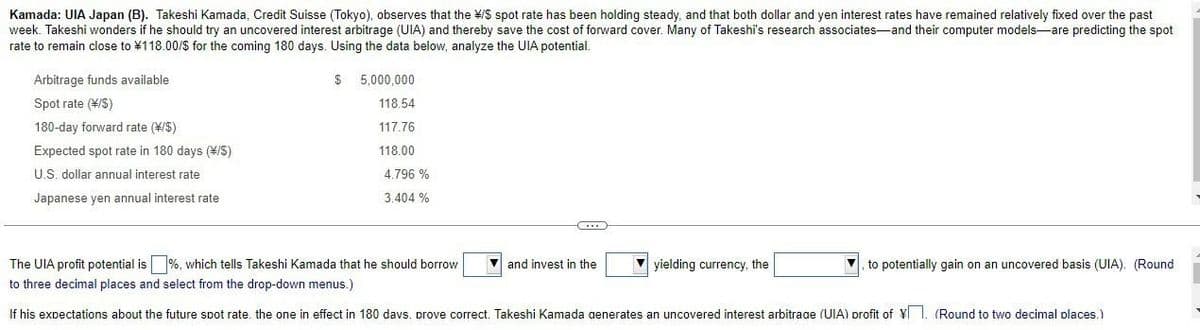

Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the */S spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associates and their computer models-are predicting the spot rate to remain close to 118.00/$ for the coming 180 days. Using the data below, analyze the UIA potential. Arbitrage funds available Spot rate (/S) 180-day forward rate (*/$) Expected spot rate in 180 days (*/S) U.S. dollar annual interest rate Japanese yen annual interest rate $ 5,000,000 118.54 117.76 118.00 4.796 % 3.404 % CITS The UIA profit potential is%, which tells Takeshi Kamada that he should borrow to three decimal places and select from the drop-down menus.) If his expectations about the future spot rate, the one in effect in 180 days, prove correct. Takeshi Kamada generates an uncovered interest arbitrage (UIA) profit of Y. (Round to two decimal places.) and invest in the yielding currency, the to potentially gain on an uncovered basis (UIA). (Round

Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the */S spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associates and their computer models-are predicting the spot rate to remain close to 118.00/$ for the coming 180 days. Using the data below, analyze the UIA potential. Arbitrage funds available Spot rate (/S) 180-day forward rate (*/$) Expected spot rate in 180 days (*/S) U.S. dollar annual interest rate Japanese yen annual interest rate $ 5,000,000 118.54 117.76 118.00 4.796 % 3.404 % CITS The UIA profit potential is%, which tells Takeshi Kamada that he should borrow to three decimal places and select from the drop-down menus.) If his expectations about the future spot rate, the one in effect in 180 days, prove correct. Takeshi Kamada generates an uncovered interest arbitrage (UIA) profit of Y. (Round to two decimal places.) and invest in the yielding currency, the to potentially gain on an uncovered basis (UIA). (Round

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 3SBD

Related questions

Question

Transcribed Image Text:Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the */$ spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past

week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associates and their computer models are predicting the spot

rate to remain close to ¥118.00/$ for the coming 180 days. Using the data below, analyze the UIA potential.

Arbitrage funds available

Spot rate (*/S)

180-day forward rate (\/$)

Expected spot rate in 180 days (\/S)

U.S. dollar annual interest rate

Japanese yen annual interest rate

$ 5,000,000

118.54

117.76

118.00

4.796 %

3.404 %

C

and invest in the

The UIA profit potential is %, which tells Takeshi Kamada that he should borrow

to three decimal places and select from the drop-down menus.)

If his expectations about the future spot rate, the one in effect in 180 days. prove correct. Takeshi Kamada generates an uncovered interest arbitrage (UIA) profit of ¥. (Round to two decimal places.)

yielding currency, the

to potentially gain on an uncovered basis (UIA). (Round

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage