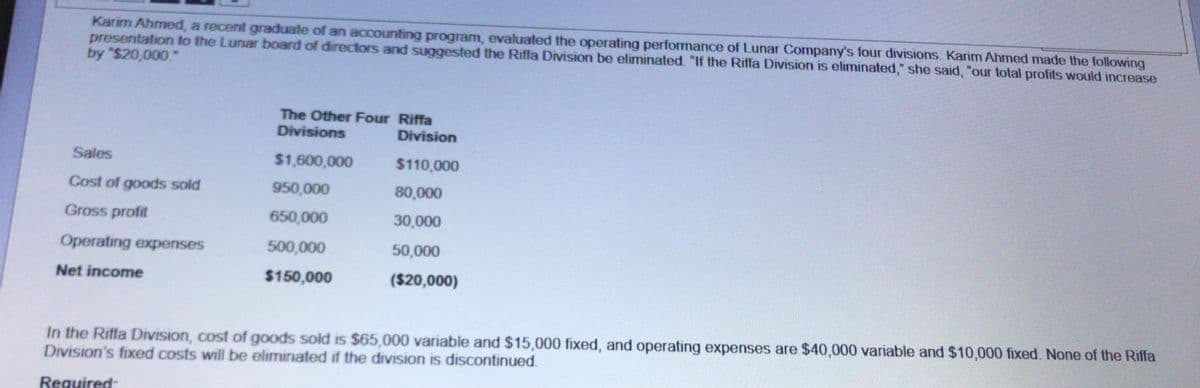

Karim Ahmed, a recent graduate of an accounting program, evaluated the operating performance of Lunar Company's four divisions. Karim Ahmed made the following presentation to the Lunar board of directors and suggested the Riffa Division be eliminated. "If the Riffa Division is eliminated," she said, "our total profits would increase by "$20,000. The Other Four Riffa Divisions Division Sales $1,600,000 $110,000 Cost of goods sold 950,000 80,000 Gross profit 650,000 30,000 Operating expenses 500,000 50,000 Net income $150,000 ($20,000) In the Riffa Division, cost of goods sold is $65.000 varis

Q: 1. The budgeted expected cash collections from customers for May. 2. The budgeted expected cash…

A: Budgets are the estimates or forecasts that are made for future period of time. Some budgets that…

Q: A corporation is a business that is legally separate and distinct from its owners

A: TRUE

Q: Arabian Gulf Corporation reports the following stockholders' equity section on December 31, 2020 -…

A: The journal entries are prepared to record day to day transactions on regular basis. The dividend is…

Q: During the month of May, Bennett Manufacturing Company purchases $43,000 of raw materials. The…

A: Cost of goods manufactured: Cost of goods manufactured means total manufacturing costs; including…

Q: 2) The capital investment required in a certain project is $ 5000. The project production profile is…

A: Dear student as u have asked 4 multiple subparts and as per guideline we will solve first three…

Q: On November 10, JumpStart Co. provides $1,820 in services to clients. At the time of service, the…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Illustration. The balance sheet of Mateo Roa on Oct. 1, 2021, before accepting Martin Penaco as his…

A: To record the investment by the partners in the partnership firm, the assets contributed by the…

Q: Learning Task 3: Prepare Adjusting Entries in a two-column journal: 1. On June 30, 2018, Mr. De…

A:

Q: immediately

A: Introduction: Revenue recognition conditions are the criteria under which a company can recognize…

Q: BRS 1. Cash balance according to the company's records at August 31, $17,100. 2. Cash balance…

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: Q2. The comparative historical-cost balance sheets of Maiikstan Enterprises for 2010 and 2011 are…

A: Net monetary assets or liabilities is the difference between the sum total of the following and the…

Q: Learning Task 2: Journalize the entries for the following adjustments on December 31, the ed of the…

A: The journal entries are prepared to keep the record of day to day transactions of the business. The…

Q: Finance professionals rely more on cash than accounting earnings for decision making purpose because…

A: The Accounting are calculated as per the financial reporting framework and prepare by the accountant…

Q: logs

A:

Q: Illustration. The balance sheet of Mateo Roa on Oct. 1, 2021, before accepting Martin Penaco as his…

A:

Q: Calculate the owner's equity for 2019 and prepare a comparative balance sheet with horizontal…

A: Comparitive statements are prepared to compare the Balance Sheets figures of the current year with…

Q: If the beginning balance of retained earnings is $180,000, revenue is $85,000, expenses total…

A: Introduction: Retained earnings is the total cumulative earnings of the organization over the period…

Q: A savings account at your local credit union holds a balance of $5,894 for the entire month of…

A: Simple interest is the amount of interest received on a deposit based on a flat rate. Formula:…

Q: Balance sheet? Sales 46,828 Purchases 32,222 Capital 80,000

A: Introduction: Balance sheet: All Assets and liabilities are to be shown in Balance sheet. It tells…

Q: Which investment method did Patrick use to compute the $286,570 income from O'Brien? Determine the…

A: 1.computation of income from O'Brien.

Q: Gaddy Company has 50,000 ordinary shares authorized with P10 par value. The following transactions…

A: Contributed capital includes the total value of the capital of the company, by issuing common stock…

Q: Gizmo Inc. purchased a one-year insurance policy on October 1 for $4,320. The adjusting entry on…

A: Dec.31 Insurance Exp $1080.00 Prepaid Insurance…

Q: 14 15 16 and decided to liquidate their partnership Prior to the final distribution of cash to the…

A:

Q: Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book…

A: Introduction: If an investor company acquires a controlling interest (more than 50% stake) in the…

Q: Sweet Corporation makes a product with the following standard costs: Standard Quantity or…

A: Lets understand the basics. Variable overhead efficiency variance is a variance between the actual…

Q: A contributes P1M, B contributed P1M, and C contributed services. There was no agreement as to…

A: Several forms of organisation of business structure are in use. These are Partnership, Sole…

Q: A business has beginning capital of $56,000. The owner makes no contribution but does withdraw…

A: Ending capital = Beginning capital + Additional capital + Net income - Drawings

Q: Journal Entries for Sale, Return, and Remittance-Perpetual System On October 14, the Patrick Company…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: The following revenue and expense account balances were taken from the Income Statement columns of…

A: Income statement: The income statement shows the company's revenues and expenses earned during the…

Q: Account Cash A/R Rent Exp DR $40,000 20,000 12,000 CR

A: Introduction: Income statement: All revenues and expenses are to be shown in income statement. It…

Q: Transactions for CCA Class 8 assets. Date Item Activity Amount Purchase $50,000 March 11, 2002…

A: By the given information from the table, Transaction for CCA class 8 asset. Also, Product claim for…

Q: Prepare the adjusting entries for the following independent cases on December 31, 2021, unless the…

A: Normally for all the businesses, accounting period ends either on Dec 31 or Mar 31. At the end of…

Q: Even though abel donated P100,000 and Carr supplied P84,000 in recognised assets, Johney and Carr…

A: Attributes are goods that may be separated from the company and disposed of, such as machinery,…

Q: On September 1, a corporation had 100,000 shares of $2 par value common stock, and $1,000,000 of…

A: When an organization increases the number of its stocks to enhance the stock's liquidity is known as…

Q: Question 8 One of the characteristics of a general partnership is voluntary association. O True O…

A: The answer for the true or false question and relevant explanation are presented hereunder :…

Q: Payable is a batch level activities Static Budget 1000000 S $2,90 $100000 Activities Number of…

A: Production volume variance is a metric utilized by organisations to compare the cost of…

Q: In one month, a c credit accounts a recorded in the s OA. $250, OB. $320, OC. $180, OD. $70,0

A: Cash Flow Statement- A cash flow statement is an important component of the company's financial…

Q: How much is the expense to be recognized by ABC in 2021?

A: For every P200 spent - 1 point is granted For every P1 spent - 1/200 i.e.0.005 point is granted…

Q: Income statement? Accounts Debit Credit (OMR) (OMR) Cash 120,000 Capital 100,000 Prepaid insurance…

A: An income statement is one of the financial statements prepared at the end of the reporting period…

Q: Apple Corporation produces a single product. The standard costs for one unit of its product are as…

A: Variable Overhead Spending Variance = (SR - AR) x AH

Q: epaid insurance expired, P 6,000. erest revenue Accrued, P 41,000. Learned service revenue earned,…

A: Adjusting entries are recorded at the end of the year to ensure the correct revenue and expenses are…

Q: What would you be ready to spend now for a P1,250 annual return over the following ten years,…

A: The term "discount charge" refers to the interest rate levied by the Treasury Department on…

Q: On 31 July the Pass book of BAC LLC reported balance of RO 8750. Cheques deposited in bank awaiting…

A: Introduction: BRS: BRS stands for Bank Reconciliation statement. To reconcile the differences…

Q: A manufacturing company applies factory overhead based on direct labor hours. At the beginning of…

A: Factory overhead means all type of indirect costs being incurred on production and manufacturing of…

Q: a) Income Statement / Profit & Loss Statement b) Statement of changes in Equity c) Balance Sheet /…

A: As per our protocol we provide solution to the one question or to the first three sub-parts only but…

Q: What effect do you think this inflation adjusted rate has on the price of an I-bond in comparison…

A: I-Bonds also known as inflation link saving bonds are the bonds with minimal risk category…

Q: Learning Task #3: Complete the accounting cycle using the adjusted trial balance below. JM…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: As of the end of its accounting period, December 31, Year 1, Great Plains Company has assets of…

A: The accounting equation states that assets equal to sum of liabilities and equity. Assets =…

Q: Both are estimated liabilities, but customer loyalty programs are different from warranties because…

A: As per IFRS 115 "Revenue from contracts wih customer" Customer loyalty programs includes the…

Q: January 1, 2013 2-year-old Cattle 12,000 New Born Cattle 4,000 December 31, 2013 2-year old cattle…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

(1) Prepare an incremental analysis to eliminate or keep a division decision

(2) Is Karim Ahmed right about eliminating the Riffa Division? Why or why not

Step by step

Solved in 2 steps with 1 images

- Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.Dantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).

- Costco is the largest chain of membership warehouse clubs in the world, based on sales volume, and it is the fifth largest general retailer in the United States. Costco focuses on selling products at low prices, often at a very high volume. These goods are usually bulk-packaged and marketed primarily to large families and businesses. Costco became the first company to grow from zero to 3 billion in sales in less than six years. In a recent fiscal year, Costcos sales totaled 116 billion, a 2 percent increase from 2015, and its net income reached 2.35 billion, an 1 percent decrease from 2015. This information, and much more, can be derived from the financial statements that merchandising firms such as Costco prepare on a regular basis to provide shareholders and other interested parties information about the companys activities and financial performance. 1. What type of information would a classified income statement provide to shareholders and other interested parties? 2. What type of information would a classified balance sheet provide to shareholders and other interested parties? Why would this information be important for calculating the working capital and the current ratio, for example?At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.Costco is the largest chain of membership warehouse clubs in the world based on sales volume, and it is the fifth largest general retailer in the United States. Costco focuses on selling products at low prices, often at a very high volume. These goods are usually bulk-packaged and marketed primarily to large families and businesses. Costco became the first company to grow from zero to 3 billion in sales in less than six years. In a recent fiscal year, Costcos sales totaled 76.3 billion, a 29.3 percent increase from 2006, and its net income reached 1.30 billion, an 18.1 percent increase from 2006. This information, and much more, can be derived from the financial statements that merchandising firms such as Costco prepare on a regular basis to provide shareholders and other interested parties information about the companys activities and financial performance. 1. What type of information would a classified income statement provide to shareholders and other interested parties? 2. What type of information would a classified balance sheet provide to shareholders and other interested parties? Why would this information be important for calculating the working capital and the current ratio, for example?

- Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net income of $40 million. Included in the income was interest expense of $2,800,000. The companys tax rate was 40%. Total assets were $470 million, current liabilities were $104,000,000, and $72,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon?Each of the following scenarios requires the use of accounting information to carry out one or more of the following managerial activities: (1) planning, (2) control and evaluation, (3) continuous improvement, or (4) decision making. a. MANAGER: At the last board meeting, we established an objective of earning an after-tax profit equal to 20 percent of sales. I need to know the revenue that we need to earn in order to meet this objective, given that we have 250,000 to spend on the promotional campaign. Once I have estimated sales in units, we then need to outline a promotional campaign that conforms to our budget and that will take us where we want to be. However, to compute the targeted sales revenue, I need to know the unit sales price, the unit variable cost, and the associated fixed production and support costs. I also need to know the tax rate. b. MANAGER: We have problems with our procurement process. Our accounts payable department is spending 80 percent of its time resolving discrepancies between the purchase order, receiving order, and suppliers invoice. Incorrect part numbers on the purchase orders, incorrect quantities ordered, and wrong parts sent (or the incorrect quantity) are just a few examples of sources of discrepancies. A complete redesign of the process has been suggested, which will allow us to eliminate virtually all of the errors and, at the same time, significantly reduce the number of clerks needed in purchasing, receiving, and accounts payable. This redesign promises to significantly reduce costs, decrease lead time, and increase customer satisfaction. c. MANAGER: This overhead cost report indicates that we have spent significantly more on inspection, purchasing, and production than was budgeted. An investigation has revealed that the source of the problem is faulty components from suppliers. A supplier evaluation has revealed that by selecting five suppliers with the best quality records (out of 15 currently used), the number of defective components will be dramatically reduced, thus producing significant overhead savings by reducing the demand for inspections, reordering, and rework. d. MANAGER: A large local firm has approached me and has offered to sell us one of the components used in our small enginesa component that we are currently producing internally. I need to know costs that we would avoid if this component is purchased so that I can assess the economic merits of this offer. e. MANAGER: Currently, our deluxe lawn mower is losing money. We need to increase profits. I would like to know how much our profits would be if we reduce our variable costs by 50 per mower while maintaining our current sales volume. Also, marketing claims that if we increase advertising expenditures by 1,000,000 and cut prices by 15 percent, we can increase the number of mowers sold by 25 percent. I would like to know which approach offers the most profit, or if a combination of the approaches may be best. f. MANAGER: We are implementing a major quality improvement program. We will be increasing the investment in prevention and detection activities with the expectation of driving down both internal and external failure costs. I expect to see trend reports for all categories of quality costs. I want to see if improving quality really does reduce costs and improve profitability. g. MANAGER: Our engineering design department has proposed a new design for our product. The new design promises to reduce post-purchase costs and, as a consequence, increase market share. I need to know the cost of producing this new design because it uses some new components and requires some different manufacturing processes. I would then like to have a projected income statement based on the new market share and new production costs. The planned selling price will be the same, or maybe even 10 percent lower. Projections based on the two price scenarios would be needed. h. MANAGER: My engineers have said that by redesigning our two main production processes, we can reduce move time by 90 percent and wait time by 85 percent. This would decrease cycle time and virtually eliminate the need to carry finished goods inventories. On-time deliveries would also increase dramatically. This would produce cost savings of nearly 20,000,000 per year. Market share and revenues would also increase. Required: 1. Describe each of the four managerial responsibilities. 2. Identify the managerial activity or activities applicable for each scenario, and indicate the role of accounting information in the activity.A recent accounting graduate from Divine Word University evaluated the operating performance of Boswell Company's four divisions. The following presentation was made to Boswell's Board of Directors. During the presentation, the accountant made the recommendation to eliminate the Southern Division stating that total net income would increase by P40,000. (See analysis below.) Other Three Divisions Southern Division Total Sales P2,000,000 P480,000 P2,480,000 Cost of Goods Sold 950,000 400,000 1,350,000 Gross Profit…

- Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance of Dunn Company’s six divisions. Veronica made the following presentation to Dunn’s board of directors and suggested the Percy Division be eliminated. “If the Percy Division is eliminated,” she said, “our total profits would increase by $27,000.” The OtherFive Divisions PercyDivision Total Sales $1,665,000 $100,000 $1,765,000 Cost of goods sold 978,300 76,600 1,054,900 Gross profit 686,700 23,400 710,100 Operating expenses 528,100 50,400 578,500 Net income $158,600 $ (27,000 ) $131,600 In the Percy Division, cost of goods sold is $60,100 variable and $16,500 fixed, and operating expenses are $29,200 variable and $21,200 fixed. None of the Percy Division’s fixed costs will be eliminated if the division is discontinued.Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your…Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance of Dunn Company’s six divisions. Veronica made the following presentation to Dunn’s board of directors and suggested the Percy Division be eliminated. “If the Percy Division is eliminated,” she said, “our total profits would increase by $25,700.” The OtherFive Divisions PercyDivision Total Sales $1,663,000 $100,900 $1,763,900 Cost of goods sold 977,800 76,100 1,053,900 Gross profit 685,200 24,800 710,000 Operating expenses 526,900 50,500 577,400 Net income $158,300 $ (25,700 ) $132,600 In the Percy Division, cost of goods sold is $59,300 variable and $16,800 fixed, and operating expenses are $30,400 variable and $20,100 fixed. None of the Percy Division’s fixed costs will be eliminated if the division is discontinued.Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your…Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance of Dunn Company’s six divisions. Veronica made the following presentation to Dunn’s board of directors and suggested the Percy Division be eliminated. “If the Percy Division is eliminated,” she said, “our total profits would increase by $26,200.” The OtherFive Divisions PercyDivision Total Sales $1,663,000 $100,100 $1,763,100 Cost of goods sold 978,600 76,800 1,055,400 Gross profit 684,400 23,300 707,700 Operating expenses 526,000 49,500 575,500 Net income $158,400 $ (26,200 ) $132,200 In the Percy Division, cost of goods sold is $59,300 variable and $17,500 fixed, and operating expenses are $31,400 variable and $18,100 fixed. None of the Percy Division’s fixed costs will be eliminated if the division is discontinued.Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your…