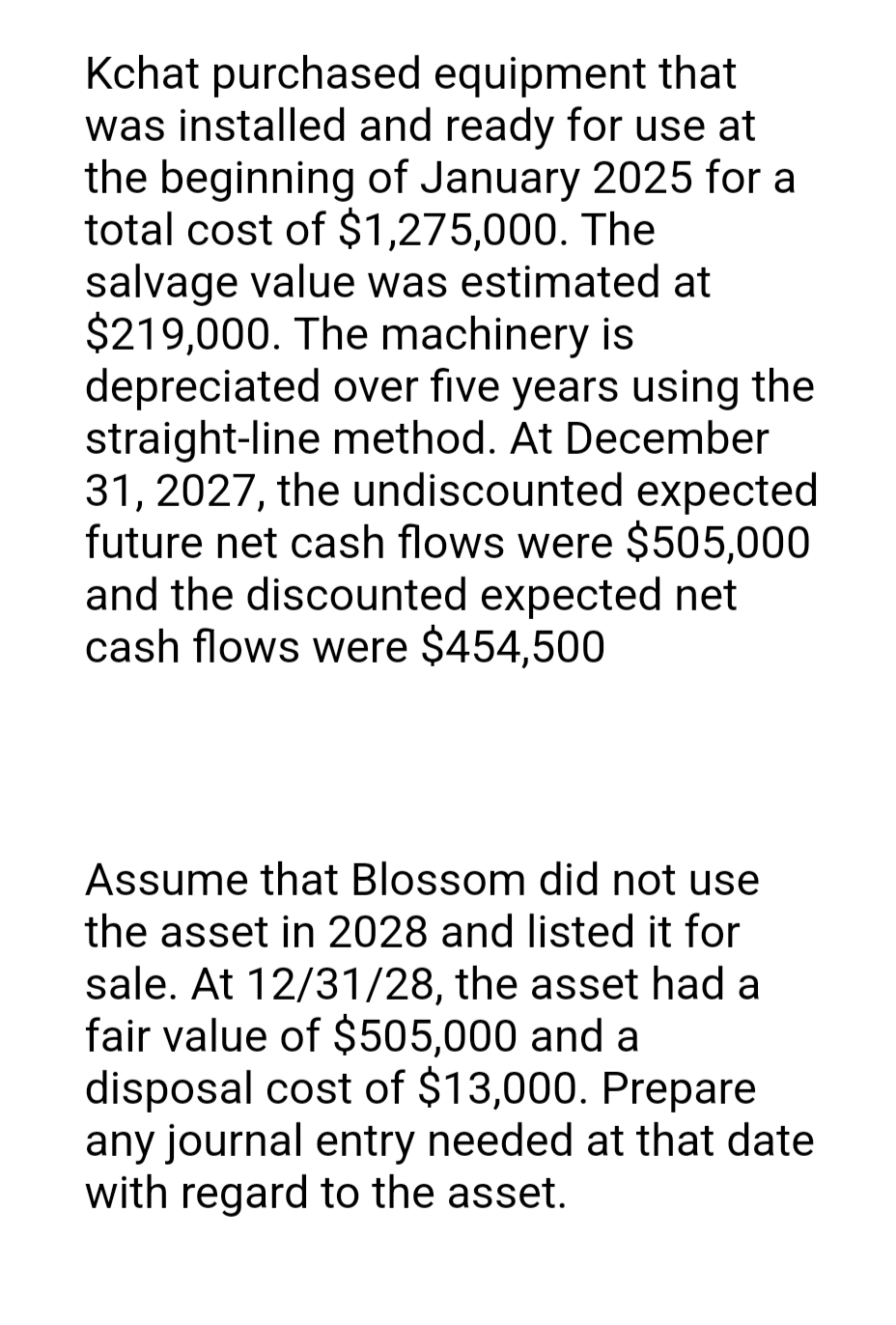

Kchat purchased equipment that was installed and ready for use at the beginning of January 2025 for a total cost of $1,275,000. The salvage value was estimated at $219,000. The machinery is depreciated over five years using the straight-line method. At December 31, 2027, the undiscounted expected future net cash flows were $505,000 and the discounted expected net cash flows were $454,500 Assume that Blossom did not use the asset in 2028 and listed it for sale. At 12/31/28, the asset had a fair value of $505,000 and a disposal cost of $13,000. Prepare any journal entry needed at that date with regard to the asset.

Kchat purchased equipment that was installed and ready for use at the beginning of January 2025 for a total cost of $1,275,000. The salvage value was estimated at $219,000. The machinery is depreciated over five years using the straight-line method. At December 31, 2027, the undiscounted expected future net cash flows were $505,000 and the discounted expected net cash flows were $454,500 Assume that Blossom did not use the asset in 2028 and listed it for sale. At 12/31/28, the asset had a fair value of $505,000 and a disposal cost of $13,000. Prepare any journal entry needed at that date with regard to the asset.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14P: Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used...

Related questions

Question

Transcribed Image Text:Kchat purchased equipment that

was installed and ready for use at

the beginning of January 2025 for a

total cost of $1,275,000. The

salvage value was estimated at

$219,000. The machinery is

depreciated over five years using the

straight-line method. At December

31, 2027, the undiscounted expected

future net cash flows were $505,000

and the discounted expected net

cash flows were $454,500

Assume that Blossom did not use

the asset in 2028 and listed it for

sale. At 12/31/28, the asset had a

fair value of $505,000 and a

disposal cost of $13,000. Prepare

any journal entry needed at that date

with regard to the asset.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning