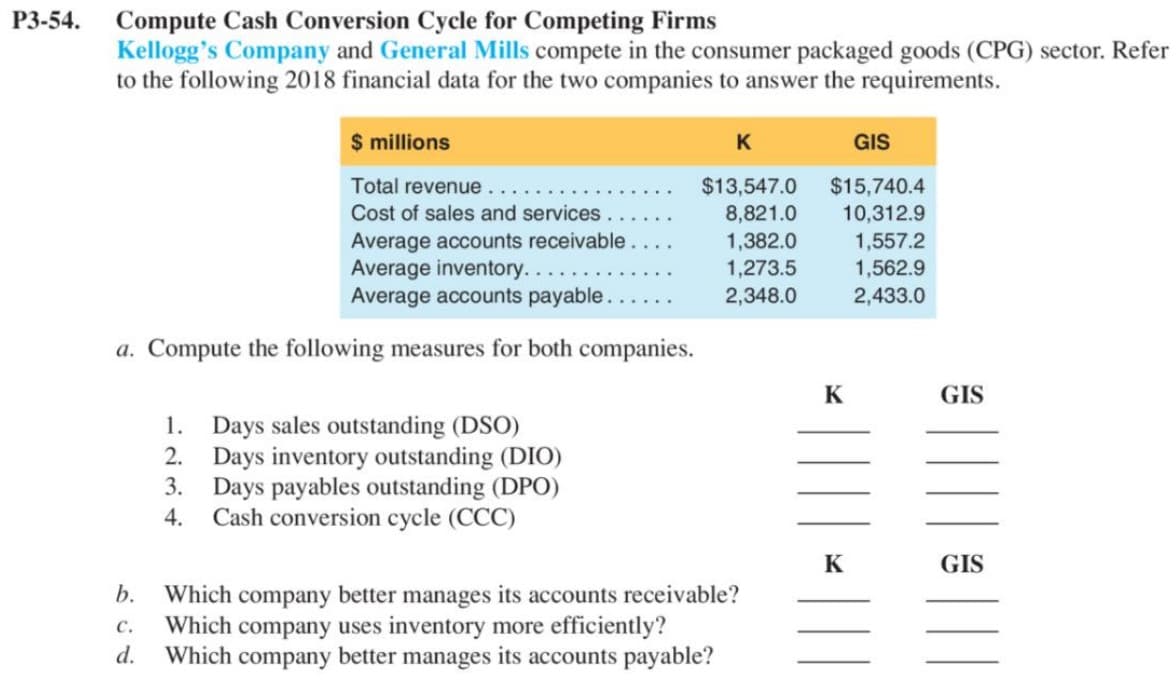

Kellogg's Company and General Mills compete in the consumer packaged goods (CPG) sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions K GIS Total revenue $13,547.0 $15,740.4 Cost of sales and services 8,821.0 10,312.9 1,382.0 Average accounts receivable. Average inventory.... Average accounts payable. 1,557.2 1,562.9 2,433.0 1,273.5 2,348.0 a. Compute the following measures for both companies. K GIS 1. Days sales outstanding (DSO) 2. Days inventory outstanding (DIO) 3. Days payables outstanding (DPO) Cash conversion cycle (CCC) 4. K GIS b. Which company better manages its accounts receivable? Which company uses inventory more efficiently? Which company better manages its accounts payable? с. d.

Kellogg's Company and General Mills compete in the consumer packaged goods (CPG) sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions K GIS Total revenue $13,547.0 $15,740.4 Cost of sales and services 8,821.0 10,312.9 1,382.0 Average accounts receivable. Average inventory.... Average accounts payable. 1,557.2 1,562.9 2,433.0 1,273.5 2,348.0 a. Compute the following measures for both companies. K GIS 1. Days sales outstanding (DSO) 2. Days inventory outstanding (DIO) 3. Days payables outstanding (DPO) Cash conversion cycle (CCC) 4. K GIS b. Which company better manages its accounts receivable? Which company uses inventory more efficiently? Which company better manages its accounts payable? с. d.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 8MCQ: Which item is added to net income when computing cash flows from operating activities? a. Gain on...

Related questions

Question

Transcribed Image Text:P3-54.

Compute Cash Conversion Cycle for Competing Firms

Kellogg's Company and General Mills compete in the consumer packaged goods (CPG) sector. Refer

to the following 2018 financial data for the two companies to answer the requirements.

$ millions

K

GIS

Total revenue

$13,547.0

$15,740.4

Cost of sales and services.

8,821.0

1,382.0

1,273.5

10,312.9

Average accounts receivable

Average inventory...

Average accounts payable..

1,557.2

1,562.9

2,348.0

2,433.0

a. Compute the following measures for both companies.

K

GIS

1. Days sales outstanding (DSO)

2. Days inventory outstanding (DIO)

3. Days payables outstanding (DPO)

Cash conversion cycle (CCC)

4.

GIS

Which company better manages its accounts receivable?

Which company uses inventory more efficiently?

d.

b.

с.

Which company better manages its accounts payable?

||

|||| - ||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning