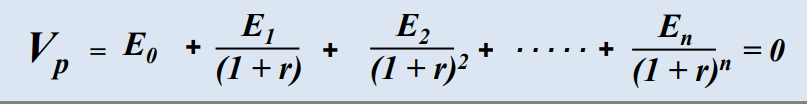

Khairy is deciding if he should pursue a professional course for one year, from January to December 2022. The direct costs of the course is $3000 and the opportunity cost involved, given that Khairy is unable to work for a year, is $6000. Khairy plans to work from the year 2023 to 2025 upon completion of the course and subsequently withdraw from the labour force. The incremental earnings Khairy expects to earn after obtaining this professional qualification is $2000 in the year 2023, $2500 in the year 2024 and $3000 in the year 2025. Assume the interest rate is 10%. i) Apply the method of net present value to decide whether Khairy should pursue this course. (by using the given formula) ii) Explain the effect of the following factors on the net present value of human capital investment. a) Increase in fees due to privatization of institutions of higher education b) Increase in retirement age

Khairy is deciding if he should pursue a professional course for one year, from January to December 2022. The direct costs of the course is $3000 and the

qualification is $2000 in the year 2023, $2500 in the year 2024 and $3000 in the year 2025. Assume the interest rate is 10%.

i) Apply the method of

ii) Explain the effect of the following factors on the net present value of human capital investment.

a) Increase in fees due to privatization of institutions of higher education

b) Increase in retirement age

Step by step

Solved in 2 steps with 1 images