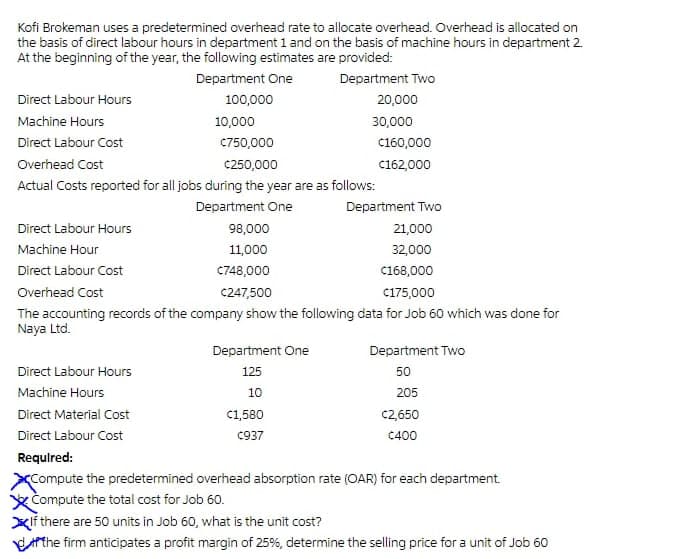

Kofi Brokeman uses a predetermined overhead rate to allocate overhead. Overhead is allocated on the basis of direct labour hours in department 1 and on the basis of machine hours in department 2 At the beginning of the year, the following estimates are provided: Department One Department Two Direct Labour Hours 100,000 20,000 Machine Hours 10,000 30,000 Direct Labour Cost C750,000 c160,000 Overhead Cost c250,000 C162,000 Actual Costs reported for all jobs during the year are as follows: Department One Department Two Direct Labour Hours 98,000 21,000 Machine Hour 11,000 32,000 Direct Labour Cost C748,000 168,000 Overhead Cost C247,500 C175,000 The accounting records of the company show the following data for Job 60 which was done for Naya Ltd. Department One Department Two Direct Labour Hours 125 50 Machine Hours 10 205 Direct Material Cost C1,580 c2,650 Direct Labour Cost C937 C400 Required: XCompute the predetermined overhead absorption rate (OAR) for each department XCompute the total cost for Job 60. Xif there are 50 units in Job 60, what is the unit cost? the firm anticipates a profit margin of 25%, determine the selling price for a unit of Job 60

Kofi Brokeman uses a predetermined overhead rate to allocate overhead. Overhead is allocated on the basis of direct labour hours in department 1 and on the basis of machine hours in department 2 At the beginning of the year, the following estimates are provided: Department One Department Two Direct Labour Hours 100,000 20,000 Machine Hours 10,000 30,000 Direct Labour Cost C750,000 c160,000 Overhead Cost c250,000 C162,000 Actual Costs reported for all jobs during the year are as follows: Department One Department Two Direct Labour Hours 98,000 21,000 Machine Hour 11,000 32,000 Direct Labour Cost C748,000 168,000 Overhead Cost C247,500 C175,000 The accounting records of the company show the following data for Job 60 which was done for Naya Ltd. Department One Department Two Direct Labour Hours 125 50 Machine Hours 10 205 Direct Material Cost C1,580 c2,650 Direct Labour Cost C937 C400 Required: XCompute the predetermined overhead absorption rate (OAR) for each department XCompute the total cost for Job 60. Xif there are 50 units in Job 60, what is the unit cost? the firm anticipates a profit margin of 25%, determine the selling price for a unit of Job 60

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 30P: Primera Company produces two products and uses a predetermined overhead rate to apply overhead....

Related questions

Question

answer quickly

Transcribed Image Text:Kofi Brokeman uses a predetermined overhead rate to allocate overhead. Overhead is allocated on

the basis of direct labour hours in department 1 and on the basis of machine hours in department 2.

At the beginning of the year, the following estimates are provided:

Department One

Department Two

Direct Labour Hours

100,000

20,000

Machine Hours

10,000

30,000

Direct Labour Cost

C750,000

C160,000

Overhead Cost

C250,000

C162,000

Actual Costs reported for all jobs during the year are as follows:

Department One

Department Two

Direct Labour Hours

98,000

21,000

Machine Hour

11,000

32,000

Direct Labour Cost

C748,000

c168,000

Overhead Cost

C247,500

C175,000

The accounting records of the company show the following data for Job 60 which was done for

Naya Ltd.

Department One

Department Two

Direct Labour Hours

125

50

Machine Hours

10

205

Direct Material Cost

C1,580

c2,650

Direct Labour Cost

C937

C400

Requlred:

XCompute the predetermined overhead absorption rate (OAR) for each department.

X Compute the total cost for Job 60.

Xif there are 50 units in Job 60, what is the unit cost?

Athe firm anticipates a profit margin of 25%, determine the selling price for a unit of Job 60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,