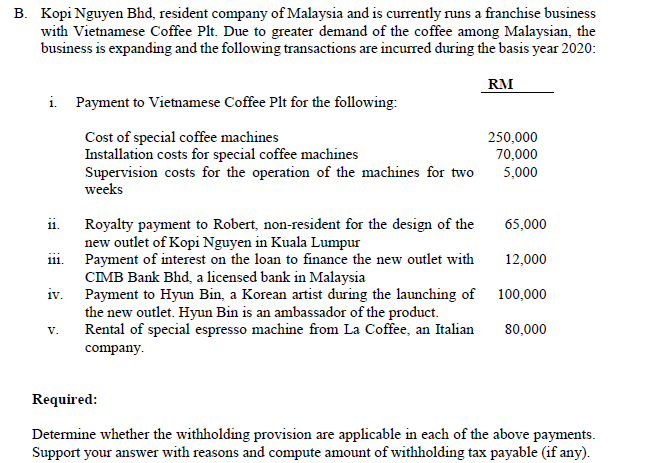

Kopi Nguyen Bhd, resident company of Malaysia and is currently runs a franchise business

Q: ABC Company granted 100 share options to each of its 200 employees on January 1,2019. The option pla...

A: Number of employees expected to exercise share option as on December 31,2019 = 200 - 10 - 10 = 180 ...

Q: Miracles Manufacturing Co. manufactures a lifting equipment. One order from Heaven Company for 3,000...

A: Cost of goods manufactured means that the cost which has been allocated on the goods or units which ...

Q: A , B and C bind themselves to pay D P30,000. Only A received the money as per agreement between A, ...

A: Contract refers to those legally enforceable obligations in which two or more parties either individ...

Q: Cullumber Corporation had the following 2020 income statement. Sales revenue $213,000 Cost of go...

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the so...

Q: Record the above transactions. (List all debit entries before credit entries. Credit account titles ...

A: Journal entries is a tool for recording business transactions into accounting records.

Q: years; find n (number of months) and i (rate per month). Write i in decimal form.

A: Given r = R/100, so 12/100 = 0.12 t = Time Involved in years, 0.5 years is calculated as 6 months...

Q: You were asked to answer the following question: Consider a small photography studio with 8 workers ...

A: Cost refers to the amount that is spent to obtain a final product from the manufacturing unit or by ...

Q: resented below are data taken from the records of Shamrock Company. December 31, 2020 ...

A: The question is based on the concept of Cash flow statement. Cash flow statement is the statement th...

Q: War Room Company manufactures fire extinguisher per the design and specification of its customers, a...

A: Gross profit rate = Gross profit / Sales Selling price per unit = Cost per unit + Gross profit per u...

Q: Cari Furniture has the following information in respect of Coffee tables for 2021: Production specif...

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-part...

Q: Condensed financial data of Novak Company for 2020 and 2019 are presented below. NOVAK COMPANY COM...

A: NOVAK COMPANY Cash Flow Statement (Indirect Method) For the year ended December 31, 2020 Cash ...

Q: How much will I invest in a fund that will amount P1 500 000 in 12 years if money is worth 5% compou...

A: Future value (FV) = P1,500,000 Period = 12 Years Quarterly period (n) = 12*4 = 48 Interest rate = 5%...

Q: The income statement of Headland Company is shown below. HEADLAND COMPANY INCOME STATEMENT FOR THE...

A: The statement of cash flows can be prepared using two methods, i.e. Direct Method and Indirect Metho...

Q: Staley Co. manufactures computer monitors. The following is a summary of its basic cost and revenue ...

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods...

Q: the design and specification of its customers, and accordingly uses the job order costing system. I...

A: in managerial accounting , the job costing is very popular. job costing methods it is used when a co...

Q: ABC Company granted 100 share options to each of its 200 employees on January 1,2019. The option pla...

A: Compensation Expense means all expenses and costs associated with compensation and benefits provided...

Q: Problem 1 On Jan. 1, 2020, Aldama Company has a note payable to bank in the amount of Transactions d...

A: Notes payable refers to a written promise to pay a certain amount of money in the future to the lend...

Q: Sophie Lopez is a 72-year-old widow who has recently been diagnosed with Alzheimer’s disease. She ha...

A: Life insurance refers to a contract or agreement between the parties where one is the ‘insured’ and ...

Q: Retained Earnings Statement Pressure Pumps Corporation, a manufacturer of industrial pumps, reports ...

A: The income statement (retained earnings statement) is a financial statement that summarizes a compan...

Q: Piit Company currently sells 1,0 ariable costs are P1.50. A discou COL anits of product M. The manag...

A: Variable Cost - The total cost of production of a good comprises of the total fixed cost of producti...

Q: he deposit in transit balance for the previous and current months are P200,000 and P100,000, respect...

A: Total Book deposits = Deposit in transit for current month + Total deposits acknowledged by Bank - D...

Q: WINDSOR INC. COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Ca...

A: The cash flow statement is an essential part of the financial statements of the organization. It is ...

Q: What would be the selling price per unit if the spoilage loss is common to Job AAA and the company m...

A: in managerial accounting, the method of job costing allows for customise product and to charge the a...

Q: age of time B. Completion of percentage of a project C. Performan

A: Revenue refers to the sum value of money gained by a business by selling its goods or services in th...

Q: homeowner has been paying a monthly mortgage payment of $716.40 on a 40-year loan at a fixed annual ...

A: Solution Given Monthly mortgage payment 716.40 Number of year 40 years Annual rate o...

Q: What is the rate of interest if P40000 earned interest of P1200 in 140 days? (А) 2% (в) 7.82% c) 7.7...

A: Principal amount = P40000 Interest amount = P1200 Period = 140 days = 140/365 = 0.383561643835616

Q: Alain company prepared draft financial statements that showe income before tax for the year ended De...

A: Profit before tax is the term of accounts that measure the profits of business before business has t...

Q: Determine the total service department costs (S1 + S2) allocated to P1?

A: Calculation of Cost of S2 allocated to P1: Cost of S2 allocated to P2 = P37500 Proportion of Cost of...

Q: Advertising Materials drew up the following trial balance for the year ending 31 December 2010 Draw ...

A: solution concept statement of comprehensive income (income statement) is prepared to present the in...

Q: iger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhe...

A: Tiger Equipment Inc. Factory Overhead Cost Variance Report—Welding Department For the Month Ended Ma...

Q: Morrissey Technologies Inc.’s 2015 financial statements are shown here. Suppose that in 2016, sales ...

A: Pro-forma Balance Sheet- A pro-forma balance sheet is a tabulation of upcoming projections and can h...

Q: freight out/transportation out included in the calculation of cost of goods manufactured?

A: Solution Concept Freight out Freight out is the cost that is incurred in selling the goods . it is b...

Q: [ CLO 3] In accounting analysis, the following is NOT among the criteria for recognizing assets. O R...

A: Recognition of assets and liabilities is essential to preparation and presentation of financial stat...

Q: Department started production of 75,000 chairs. During the month, the firm completed 80,000 chairs ...

A: Solution.. Beginning inventory = 15,000 units Units started in = 75,000 Units completed and tr...

Q: Larkspur Limited is a private company that follows ASPE. It is authorized to issue an unlimited numb...

A: Return on Equity - Return on Equity shows how much the company earned from the amount owed to stockh...

Q: Feal-Goode Inc. purchased a patent on a new drug. The patent cost $12,000. The patent has a life of ...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Jan 2 Additional money was introduced by Dada in a form cash GH¢50,000.00 and cash at bank GHe70,00c...

A: Journal entry is the entry which the business has to record at the time when ever the business trans...

Q: Silver on MCX - Multi Commodity Exchange of India Ltd.

A: Multi Commodity Exchange of India Ltd: The Multi Commodity Exchange of India Ltd (MCX) is a commodit...

Q: On March 1, 2022, Purrchezza bought 500 pieces of hirts from Sellenaur at a cost of P100 each with t...

A: The FOB shipping point means that buyer becomes the owner of the goods as soon as goods are reached ...

Q: Voiture Company manufactures compact, energy-efficient cars. On April 1, it purchased a machine for ...

A: Financial statements that describe the operations and financial performance of a company. Financial ...

Q: BE5.4 (LO 3), AP Prepare the journal entries to record the following transactions on Borst Company's...

A: 2/10,n/30 means 2% discount will be given on invoice price if payment is made with in 10 days (That ...

Q: Relevant of differential cost analysis takes all variable and fixed costs into account to analyze de...

A: Differential cost analysis is the difference in cost for every alternative which helps in making the...

Q: ABC Company has only one job in process on January 1, 2022, Job No. 97 for 75 units, carried at a co...

A: Job order costing is the system of costing where the work is performed as per the specific job. The...

Q: Inč. iš čomplêting the preparation of the draft finančiål štatement för thể year ended December 31, ...

A: In the above question Financial loss of P2,500,000 will be an adjusting event P2,500,000 Cust...

Q: A company has traditionally allocated its overhead based on machine hours but had collected this inf...

A: Overheads are the costs that are expensed on more than one product. Thus, these are not directly all...

Q: LABAN Company provided the following shareholders’ equity on December 31, 2020: Preference share cap...

A: Solution Working note Dividend get accumulated = (1000000*12%*2year) = 240000 / 10000 shares = P24 ...

Q: Using the attached information, the simple journal entries to record the partners’ contributions i

A: Working Notes :- The partners agreed to...

Q: Work in process of Faithful Corporation on July 1, 2022 (per general ledger) is P23,900. Job 102 P 8...

A: The cost of goods manufactured includes the cost of goods that are manufactured and finished during ...

Q: Prepare the operating activities section of the statement of cash flows for the year ended December ...

A: Please see step 2 for answer

Q: What tax strategies are available to a company seeking to make an acquisition

A: Some tax strategies are discussed below

Step by step

Solved in 2 steps

- Selasih Company manufactures aluminium containers for restaurants. The owner of Selasih, Puan Atiqah, believes that an aggressive campaign is needed next year due to the Malaysian local market’s uncertain conditions. Presented below is the data for the current year 2021, for use in next year’s campaign. (see the photo) Puan Atiqah has set the sales target for the year 2022 at a level of RM550,000 (22,000 units of containers), or ten percent more than the sales in the year 2021. The selling price of the container is RM25 each, for both years. Required: “Break-even analysis is of limited use to management because a company cannot survive by just breaking even.” Do you agree with the statement? Explain.One of your Taiwanese suppliers has bid on a new line of molded plastic parts that iscurrently being assembled at your plant. The supplier has bid $0.10 per part, given a forecastyou provided of 200,000 parts in year 1; 300,000 in year 2; and 500,000 in year 3.Shipping and handling of parts from the supplier’s factory is estimated at $0.01 per unit.Additional inventory handling charges should amount to $0.005 per unit. Finally, administrativecosts are estimated at $20 per month.Although your plant is able to continue producing the part, the plant would need toinvest in another molding machine, which would cost $10,000. Direct materials can bepurchased for $0.05 per unit. Direct labor is estimated at $0.03 per unit plus a 50 percentsurcharge for benei ts; indirect labor is estimated at $0.011 per unit plus 50 percent benei ts. Up-front engineering and design costs will amount to $30,000. Finally, management has insisted that overhead be allocated if the parts are made in-house at a rate…National Restaurant Supply, Inc., sells restaurant equipment and supplies throughout most of the United States. Management is considering adding a machine that makes sorbet to its line of ice cream making machines. Management will negotiate the purchase price of the sorbet machine with its Swedish manufacturer. Management of National Restaurant Supply believes the sorbet machine can be sold to its customers in the United States for $4,950. At that price, annual sales of the sorbet machine should be 100 units. If the sorbet machine is added to National Restaurant Supply’s product lines, the company will have to invest $600,000 in inventories and special warehouse fixtures. The variable cost of selling the sorbet machines would be $650 per machine. Required: 1. If National Restaurant Supply requires a 15% return on investment (ROI), what is the maximum amount the company would be willing to pay the Swedish manufacturer for the sorbet machines? 2. The manager who is flying to Sweden…

- DIY Sdn Bhd is a Malaysian tax resident company. DIY is involved in manufacturing bricks. DIY needs to know regarding sales tax implications in the manufacturing business. The company plans to import special high-grade stones and carry out a change in the nature and quality of the materials by glazing them before sale. DIY’s current sales is RM350,000 and is projected to be around RM400,000 for the next few years a(i) Explain whether DIY Sdn Bhd activities will fall within the scope of manufacturing activities for sales tax purposes. a(ii) Discuss on the sales tax registration requirement and advice whether DIY need to be registered.Hans Brinker is assistant vice-president for marketing for Skagen Ice Skate Company (SIS). SIS does all of its own manufacturing in Denmark and then distributes worldwide through its sales office. World prices for foreign sales offices are set by the home office. Brinker is now setting the price list for all U.S. sales offices, and needs prices set for the coming year. The current spot rate is ?? = ???? $ = 5.6050, with a one-year forward rate of ?? = ???? $ = 5.5685. The one-year deposit rates for Danish krone and U.S. dollars are 1.5% and 1.35%, respectively. SIS’s best-selling professional figure skate, the Royal Silver Blade, is currently priced at $450 to U.S. retailers. Current inflation estimates for Denmark and the United States are both about 3%. SIS’s policy is to try to absorb about 50% of all exchange rate-induced price increases, but pass along 100% of all exchange rate price decreases if possible. The world skate business is competitive. Brinker phones you and explains…God is King Ltd has been printing all its magazines from Dubai due to the comparative cost advantage. The company is considering establishing its own printing department, and the R&D team have identified a printing machine which will meet the quality and cost specifications of God is King Ltd. The machine also has the capacity to print to meet the market needs of the company. The machine, which has a useful life of 5 years, will cost GHȼ800,000 and immediate installation cost will be GH¢ 50,000. Fixed cost for maintaining the machine will be GH¢170,000 per annum over the machine’s useful life and additional working capital of GH¢ 30,000 will be introduced in year 2. The use of this machine will generate a contribution of GH¢ 500,000 per annum for five (5) years. Corporate income tax rate, payable in areas, is 25% and the companies after tax cost of capital is 20%. No capital allowance is permitted. Required: Calculate the NPV for the project and advise management on whether to…

- Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Answer: 221,500 Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? Answer: 307.5You have taken over the family business, making custom furniture for sale in South Africa and forexport to neighbouring African countries. Your long‐term strategic objective is “To increase exportsales of bespoke furniture to Africa over the next four years”.You have designed a new outdoor dining set that will sell for R7 500. Your variable costs to producethe product amount to R2 500 per set and the fixed costs you estimate at R25 000. In 2021, yourassets amounted to R525 000 (current assets) and R1.5 million (non‐current assets) Liabilities for2021 amounted to R260 000 (current liabilities) and R1.1 million (non‐current liabilities).Q.3.1 Evaluate your long‐term goal with suggestions on how to improve it. Q.3.2 Conduct a breakeven analysis to determine the number of dining sets the companymust sell to break even.Q.3.3 Calculate your debt ratio based on the figures provided. Explain your findingsDD Limited, South Africa, is a specialist manufacturer of electronic scooters. In seeking to expand its operations, it could acquire a French subsidiary company, AAA Limited, or set up a new division in its home market. The relevant figures for these two options are:Set up new division at home R andCost of setting up premises 2 2 440 000Cost of machinery 8 7 00 000Annual sales 33 000 000Annual variable cost 1 4 050 000Additional head office expenses 1 300 000Existing head office expenses 3 220 000Depreciation: machinery 10% on cost annually 8 7 0 000Acquisition EuroAcquire shares from existing shareholders 28 000 000Redundancy costs 5 000 000Annual Sales 39 000 000Annual variable costs 18 000 000Annual fixed costs 10 000 000Consultants fees 750 000Additional information:- The project is expected to last for 7 years.- DD Limited, current cost of capital is 10%.- The French inflation is expected to be below the South African inflation by 1% per year, throughout the life of…

- A piece of labour-saving equipment has just come onto the market, which Kaisen Electronics Ltd. could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow (currency is in thousands of yen, denoted by ¥): Purchase cost of the equipment ¥ 283,500 Annual cost savings that will be provided by the equipment ¥ 63,000 Life of the equipment 10 years Required: 1-a. Compute the payback period for the equipment. (Round your answer to 1 decimal place.) 1-b. If the company requires a payback period of five years or less, would the equipment be purchased? multiple choice 1 No Yes 2-a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment’s useful life. (Round your answer to 1 decimal place. (i.e., 0.123 should be considered as 12.3%).) 2-b. Will the equipment be purchased if the company requires a rate of return of at least 17%?Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the…Due to rising labor costs in Malaysia, Domain Computer, based in Singapore, is considering shifting part of its production facilities from Malaysia to an emerging market, Vietnam, to better integrate its supply chain in the South east Asia region. John Lawson, the CFO of the company, estimates that Domain Computer needs to invest USD735,000 to acquire an existing factory in Vietnam and another USD285,000 in renovations and installation of new machineries. The cost of training new workers is estimated to be USD310,000. He believes that the new factory will lead to an estimated USD928,000 savings in labor costs and another USD417,000 savings in logistics expenses. Required: Use cost-benefit analysis to recommend whether Domain Computer should shift parts of its production facilities from Malaysia to Vietnam. Explain your answer. You are required to write 500 to 800 words. ( Currently I have completed my Cost-benefit analysis; but I am confused as to how to use PESTLE's analysis with…