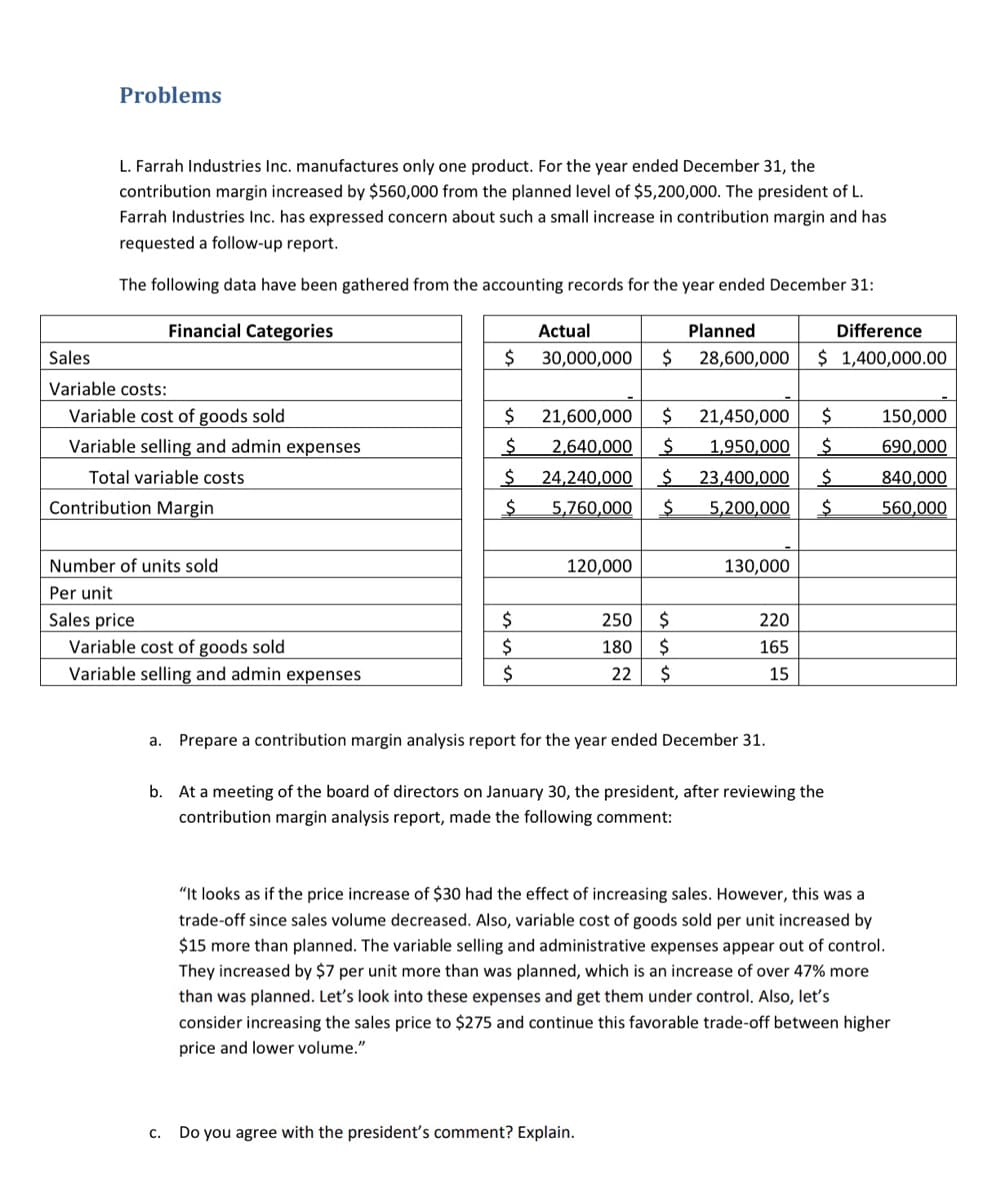

L. Farrah Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $560,000 from the planned level of $5,200,000. The president of L. Farrah Industries Inc. has expressed concern about such a small increase in contribution margin and has requested a follow-up report. The following data have been gathered from the accounting records for the year ended December 31:

L. Farrah Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $560,000 from the planned level of $5,200,000. The president of L. Farrah Industries Inc. has expressed concern about such a small increase in contribution margin and has requested a follow-up report. The following data have been gathered from the accounting records for the year ended December 31:

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

Transcribed Image Text:Problems

L. Farrah Industries Inc. manufactures only one product. For the year ended December 31, the

contribution margin increased by $560,000 from the planned level of $5,200,000. The president of L.

Farrah Industries Inc. has expressed concern about such a small increase in contribution margin and has

requested a follow-up report.

The following data have been gathered from the accounting records for the year ended December 31:

Financial Categories

Actual

Planned

Difference

Sales

30,000,000

$

28,600,000

$ 1,400,000.00

Variable costs:

Variable cost of goods sold

21,600,000

$

21,450,000

$

150,000

Variable selling and admin expenses

2,640,000

1,950,000

690,000

Total variable costs

24,240,000

23,400,000

840,000

Contribution Margin

5,760,000

5,200,000

560,000

Number of units sold

120,000

130,000

Per unit

Sales price

2$

250

220

Variable cost of goods sold

Variable selling and admin expenses

2$

2$

$

2$

180

165

22

15

a. Prepare a contribution margin analysis report for the year ended December 31.

b. At a meeting of the board of directors on January 30, the president, after reviewing the

contribution margin analysis report, made the following comment:

"It looks as if the price increase of $30 had the effect of increasing sales. However, this was a

trade-off since sales volume decreased. Also, variable cost of goods sold per unit increased by

$15 more than planned. The variable selling and administrative expenses appear out of control.

They increased by $7 per unit more than was planned, which is an increase of over 47% more

than was planned. Let's look into these expenses and get them under control. Also, let's

consider increasing the sales price to $275 and continue this favorable trade-off between higher

price and lower volume."

C.

Do you agree with the president's comment? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning