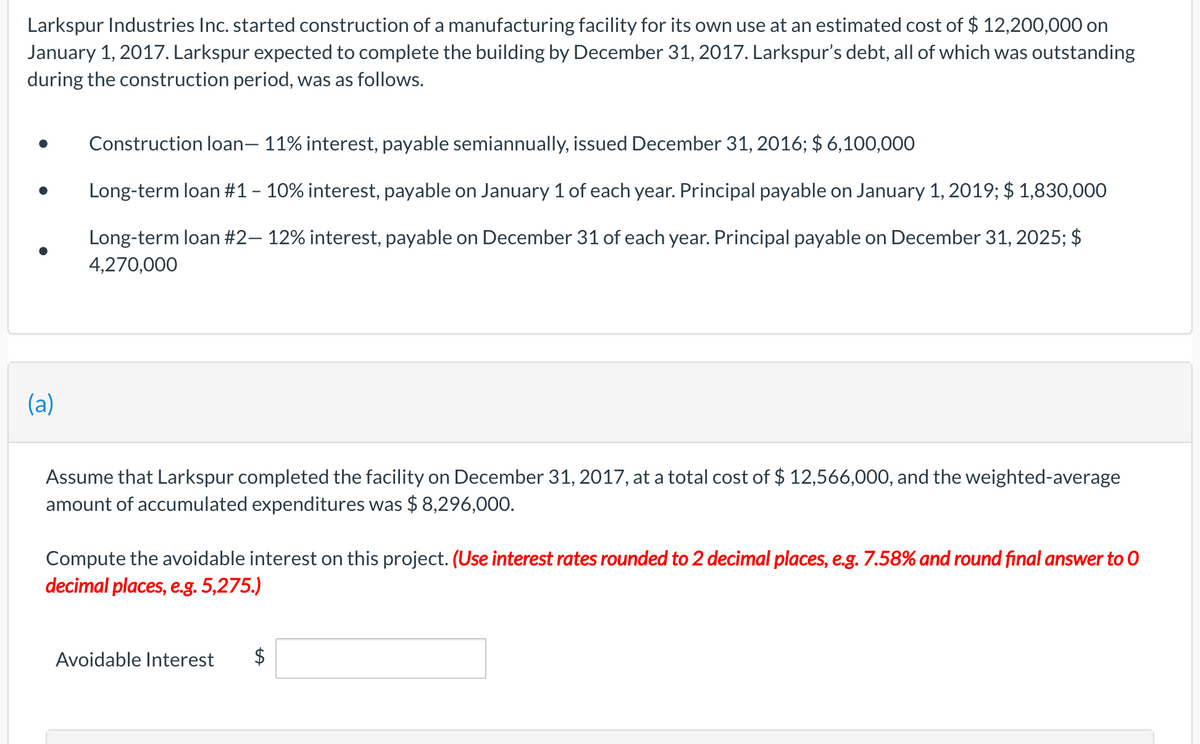

Larkspur Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $ 12,200,000 on January 1, 2017. Larkspur expected to complete the building by December 31, 2017. Larkspur's debt, all of which was outstanding during the construction period, was as follows. Construction loan- 11% interest, payable semiannually, issued December 31, 2016; $ 6,100,000 Long-term loan #1 – 10% interest, payable on January 1 of each year. Principal payable on January 1, 2019; $ 1,830,000 Long-term loan #2– 12% interest, payable on December 31 of each year. Principal payable on December 31, 2025; $ 4,270,000 (a) Assume that Larkspur completed the facility on December 31, 2017, at a total cost of $ 12,566,000, and the weighted-average amount of accumulated expenditures was $ 8,296,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% and round final answer to 0 decimal places, e.g. 5,275.) Avoidable Interest

Larkspur Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $ 12,200,000 on January 1, 2017. Larkspur expected to complete the building by December 31, 2017. Larkspur's debt, all of which was outstanding during the construction period, was as follows. Construction loan- 11% interest, payable semiannually, issued December 31, 2016; $ 6,100,000 Long-term loan #1 – 10% interest, payable on January 1 of each year. Principal payable on January 1, 2019; $ 1,830,000 Long-term loan #2– 12% interest, payable on December 31 of each year. Principal payable on December 31, 2025; $ 4,270,000 (a) Assume that Larkspur completed the facility on December 31, 2017, at a total cost of $ 12,566,000, and the weighted-average amount of accumulated expenditures was $ 8,296,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% and round final answer to 0 decimal places, e.g. 5,275.) Avoidable Interest

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:Larkspur Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $ 12,200,000 on

January 1, 2017. Larkspur expected to complete the building by December 31, 2017. Larkspur's debt, all of which was outstanding

during the construction period, was as follows.

Construction loan- 11% interest, payable semiannually, issued December 31, 2016; $ 6,100,000

Long-term loan #1 - 10% interest, payable on January 1 of each year. Principal payable on January 1, 2019; $ 1,830,000

Long-term loan #2– 12% interest, payable on December 31 of each year. Principal payable on December 31, 2025; $

4,270,000

(a)

Assume that Larkspur completed the facility on December 31, 2017, at a total cost of $ 12,566,000, and the weighted-average

amount of accumulated expenditures was $ 8,296,000.

Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% and round final answer to 0

decimal places, e.g. 5,275.)

Avoidable Interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning