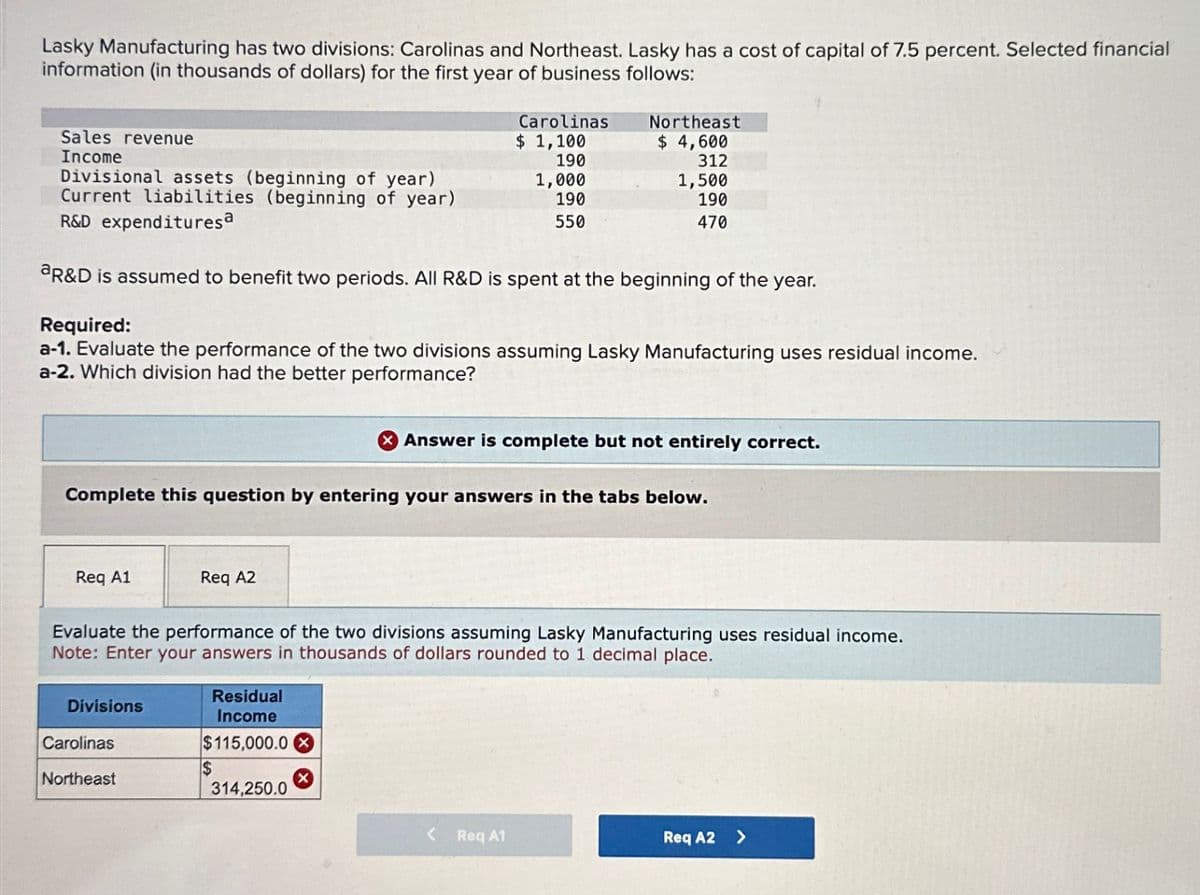

Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expenditures a Carolinas $ 1,100 190 Northeast $ 4,600 312 1,000 190 1,500 190 550 470 aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses residual income. a-2. Which division had the better performance? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Evaluate the performance of the two divisions assuming Lasky Manufacturing uses residual income. Note: Enter your answers in thousands of dollars rounded to 1 decimal place. Divisions Residual Income Carolinas $115,000.0 $ Northeast 314,250.0 Req A1 Req A2 >

Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expenditures a Carolinas $ 1,100 190 Northeast $ 4,600 312 1,000 190 1,500 190 550 470 aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses residual income. a-2. Which division had the better performance? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Evaluate the performance of the two divisions assuming Lasky Manufacturing uses residual income. Note: Enter your answers in thousands of dollars rounded to 1 decimal place. Divisions Residual Income Carolinas $115,000.0 $ Northeast 314,250.0 Req A1 Req A2 >

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter11: Performance Evaluation And Decentralization

Section: Chapter Questions

Problem 21BEB

Related questions

Question

Hansaben

Transcribed Image Text:Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial

information (in thousands of dollars) for the first year of business follows:

Sales revenue

Income

Divisional assets (beginning of year)

Current liabilities (beginning of year)

R&D expenditures a

Carolinas

$ 1,100

190

Northeast

$ 4,600

312

1,000

190

1,500

190

550

470

aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year.

Required:

a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses residual income.

a-2. Which division had the better performance?

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Evaluate the performance of the two divisions assuming Lasky Manufacturing uses residual income.

Note: Enter your answers in thousands of dollars rounded to 1 decimal place.

Divisions

Residual

Income

Carolinas

$115,000.0

$

Northeast

314,250.0

Req A1

Req A2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning