Ledger Account balances (prior to any Balance Day Adjustments) as of 30 June 2018: Insurance $ Rent Interest Income Plant 2,400.00 $ 1,800.00 $ 1,400.00 $ 10,000.00 $ 6,000.00 $ 5,550.00 200.00 Accumulated Depreciation Accounts Receivable Allowance for Doubtful Debts $ Additional Information - On 1 December 2017 a one-year insurance premium was paid for $2,400 plus GST. Insurance cover starts on 1 December - Rent paid in advance $150 on 30 June 2018 - Interest earned but not received $350 on 30 June 2018 Depreciation to be provided $1,000 on 30 June 2018 - - Bad Debts to be written off $500 plus $50 GST on 30 June 2018 - Allowance for Doubtful Debts to be adjusted to 5.5% of Accounts Receivable - Physical count on 30 June 2018 reveals inventory value of $68,000 and the perpetual records show inventory value $70,000. Milo Ltd uses a perpetual inventory system.

Ledger Account balances (prior to any Balance Day Adjustments) as of 30 June 2018: Insurance $ Rent Interest Income Plant 2,400.00 $ 1,800.00 $ 1,400.00 $ 10,000.00 $ 6,000.00 $ 5,550.00 200.00 Accumulated Depreciation Accounts Receivable Allowance for Doubtful Debts $ Additional Information - On 1 December 2017 a one-year insurance premium was paid for $2,400 plus GST. Insurance cover starts on 1 December - Rent paid in advance $150 on 30 June 2018 - Interest earned but not received $350 on 30 June 2018 Depreciation to be provided $1,000 on 30 June 2018 - - Bad Debts to be written off $500 plus $50 GST on 30 June 2018 - Allowance for Doubtful Debts to be adjusted to 5.5% of Accounts Receivable - Physical count on 30 June 2018 reveals inventory value of $68,000 and the perpetual records show inventory value $70,000. Milo Ltd uses a perpetual inventory system.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 8E: Considering the following events, determine which month the revenue or expenses would be recorded...

Related questions

Question

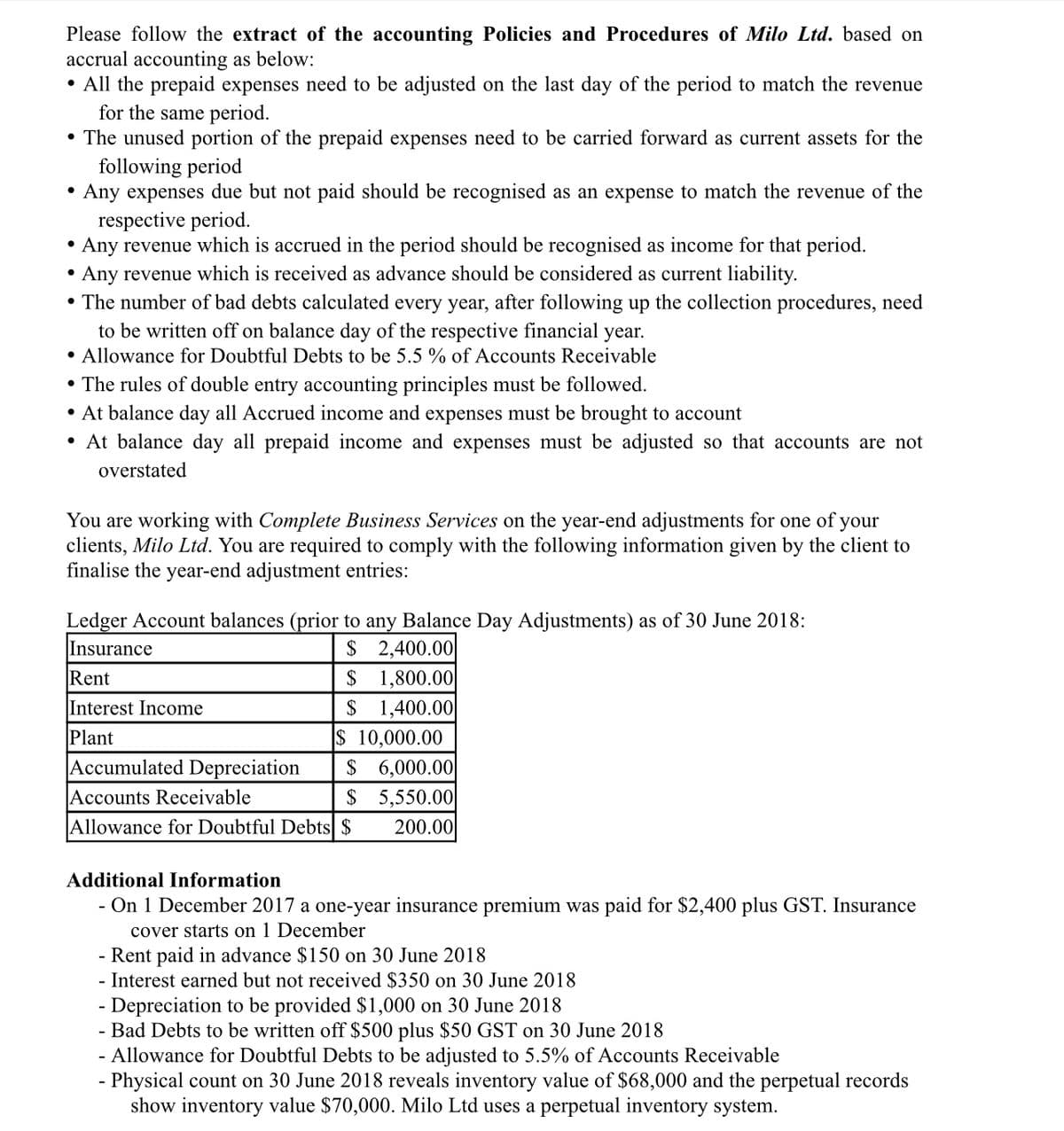

Transcribed Image Text:Please follow the extract of the accounting Policies and Procedures of Milo Ltd. based on

accrual accounting as below:

• All the prepaid expenses need to be adjusted on the last day of the period to match the revenue

for the same period.

• The unused portion of the prepaid expenses need to be carried forward as current assets for the

following period

Any expenses due but not paid should be recognised as an expense to match the revenue of the

respective period.

Any revenue which is accrued in the period should be recognised as income for that period.

Any revenue which is received as advance should be considered as current liability.

●

• The number of bad debts calculated every year, after following up the collection procedures, need

to be written off on balance day of the respective financial year.

• Allowance for Doubtful Debts to be 5.5 % of Accounts Receivable

The rules of double entry accounting principles must be followed.

• At balance day all Accrued income and expenses must be brought to account

• At balance day all prepaid income and expenses must be adjusted so that accounts are not

overstated

You are working with Complete Business Services on the year-end adjustments for one of your

clients, Milo Ltd. You are required to comply with the following information given by the client to

finalise the year-end adjustment entries:

Ledger Account balances (prior to any Balance Day Adjustments) as of 30 June 2018:

Insurance

$ 2,400.00

$ 1,800.00

$ 1,400.00

$ 10,000.00

$ 6,000.00

$ 5,550.00

200.00

Rent

Interest Income

Plant

Accumulated Depreciation

Accounts Receivable

Allowance for Doubtful Debts $

Additional Information

- On 1 December 2017 a one-year insurance premium was paid for $2,400 plus GST. Insurance

cover starts on 1 December

- Rent paid in advance $150 on 30 June 2018

Interest earned but not received $350 on 30 June 2018

- Depreciation to be provided $1,000 on 30 June 2018

- Bad Debts to be written off $500 plus $50 GST on 30 June 2018

- Allowance for Doubtful Debts to be adjusted to 5.5% of Accounts Receivable

- Physical count on 30 June 2018 reveals inventory value of $68,000 and the perpetual records

show inventory value $70,000. Milo Ltd uses a perpetual inventory system.

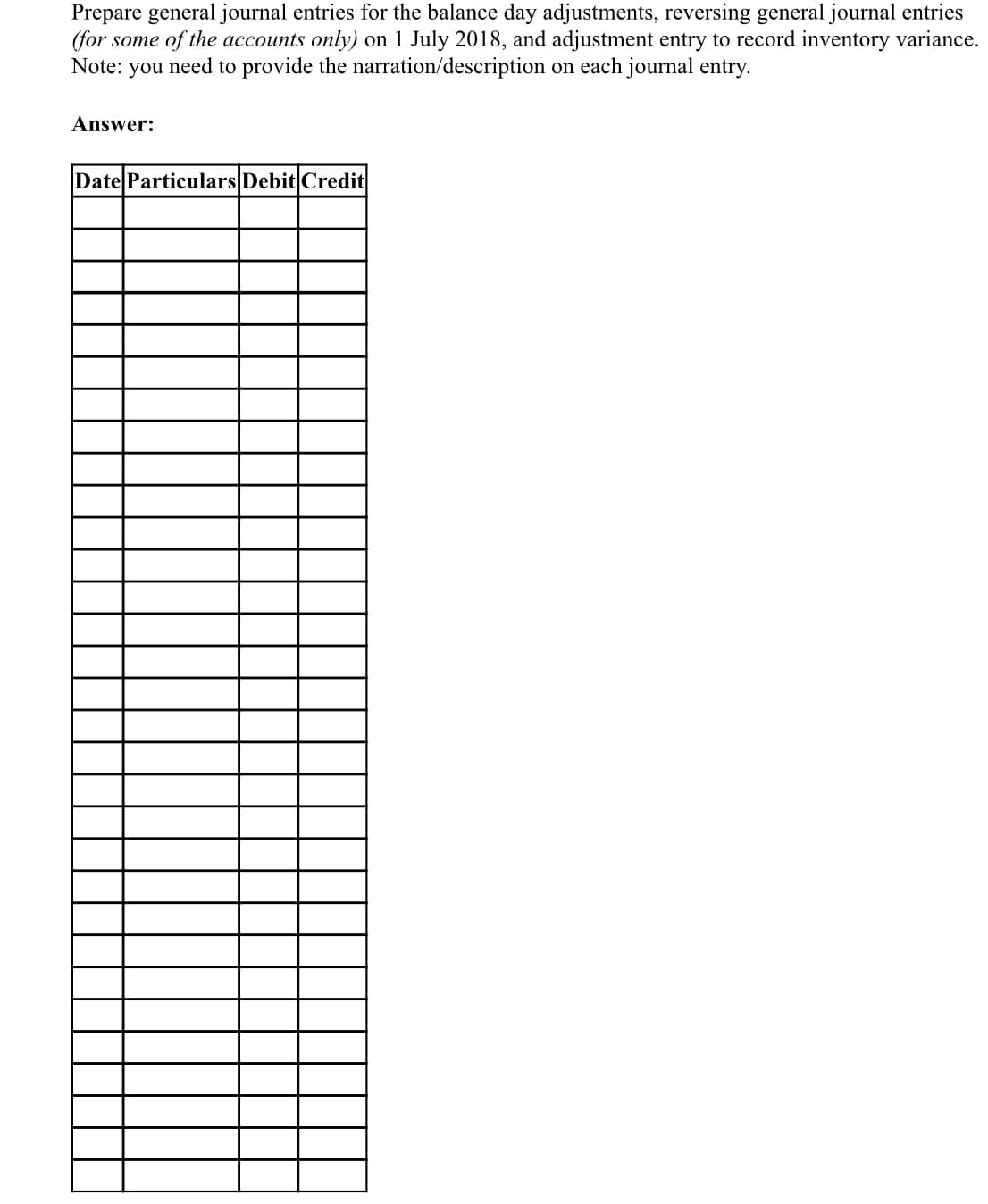

Transcribed Image Text:Prepare general journal entries for the balance day adjustments, reversing general journal entries

(for some of the accounts only) on 1 July 2018, and adjustment entry to record inventory variance.

Note: you need to provide the narration/description on each journal entry.

Answer:

Date Particulars Debit Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,