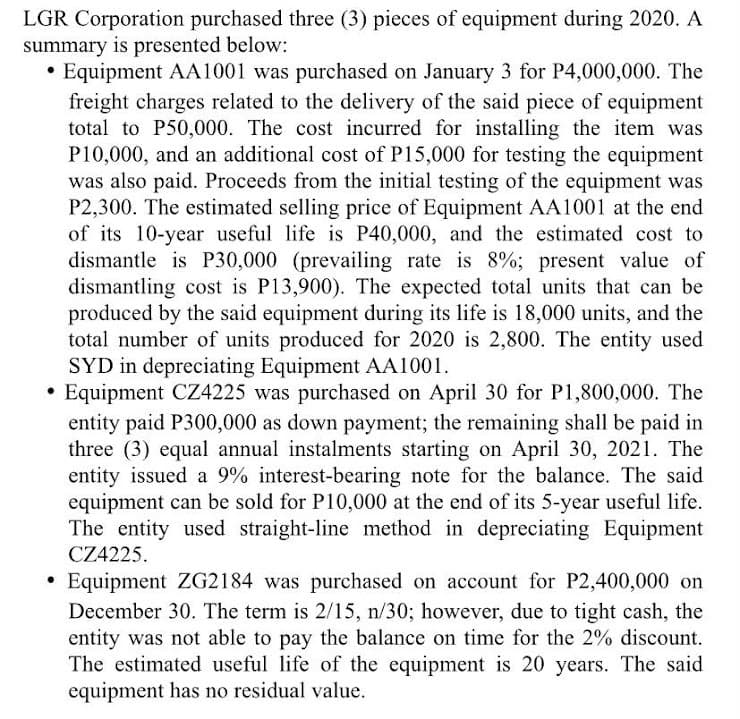

LGR Corporation purchased three (3) pieces of equipment during 2020. A summary is presented below: Equipment AA1001 was purchased on January 3 for P4,000,000. The freight charges related to the delivery of the said piece of equipment total to P50,000. The cost incurred for installing the item was P10,000, and an additional cost of P15,000 for testing the equipment was also paid. Proceeds from the initial testing of the equipment was P2,300. The estimated selling price of Equipment AA1001 at the end of its 10-year useful life is P40,000, and the estimated cost to dismantle is P30,000 (prevailing rate is 8%; present value of dismantling cost is P13,900). The expected total units that can be produced by the said equipment during its life is 18,000 units, and the total number of units produced for 2020 is 2,800. The entity used SYD in depreciating Equipment AA1001. Equipment CZ4225 was purchased on April 30 for P1,800,000. The entity paid P300,000 as down payment; the remaining shall be paid in three (3) equal annual instalments starting on April 30, 2021. The entity issued a 9% interest-bearing note for the balance. The said equipment can be sold for P10,000 at the end of its 5-year useful life. The entity used straight-line method in depreciating Equipment CZ4225. • Equipment ZG2184 was purchased on account for P2,400,000 on December 30. The term is 2/15, n/30; however, due to tight cash, the entity was not able to pay the balance on time for the 2% discount. The estimated useful life of the equipment is 20 years. The said equipment has no residual value.

LGR Corporation purchased three (3) pieces of equipment during 2020. A summary is presented below: Equipment AA1001 was purchased on January 3 for P4,000,000. The freight charges related to the delivery of the said piece of equipment total to P50,000. The cost incurred for installing the item was P10,000, and an additional cost of P15,000 for testing the equipment was also paid. Proceeds from the initial testing of the equipment was P2,300. The estimated selling price of Equipment AA1001 at the end of its 10-year useful life is P40,000, and the estimated cost to dismantle is P30,000 (prevailing rate is 8%; present value of dismantling cost is P13,900). The expected total units that can be produced by the said equipment during its life is 18,000 units, and the total number of units produced for 2020 is 2,800. The entity used SYD in depreciating Equipment AA1001. Equipment CZ4225 was purchased on April 30 for P1,800,000. The entity paid P300,000 as down payment; the remaining shall be paid in three (3) equal annual instalments starting on April 30, 2021. The entity issued a 9% interest-bearing note for the balance. The said equipment can be sold for P10,000 at the end of its 5-year useful life. The entity used straight-line method in depreciating Equipment CZ4225. • Equipment ZG2184 was purchased on account for P2,400,000 on December 30. The term is 2/15, n/30; however, due to tight cash, the entity was not able to pay the balance on time for the 2% discount. The estimated useful life of the equipment is 20 years. The said equipment has no residual value.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6RE

Related questions

Question

How much is the total cost of the three (3) pieces of equipment?

Transcribed Image Text:LGR Corporation purchased three (3) pieces of equipment during 2020. A

summary is presented below:

Equipment AA1001 was purchased on January 3 for P4,000,000. The

freight charges related to the delivery of the said piece of equipment

total to P50,000. The cost incurred for installing the item was

P10,000, and an additional cost of P15,000 for testing the equipment

was also paid. Proceeds from the initial testing of the equipment was

P2,300. The estimated selling price of Equipment AA1001 at the end

of its 10-year useful life is P40,000, and the estimated cost to

dismantle is P30,000 (prevailing rate is 8%; present value of

dismantling cost is P13,900). The expected total units that can be

produced by the said equipment during its life is 18,000 units, and the

total number of units produced for 2020 is 2,800. The entity used

SYD in depreciating Equipment AA1001.

Equipment CZ4225 was purchased on April 30 for P1,800,000. The

entity paid P300,000 as down payment; the remaining shall be paid in

three (3) equal annual instalments starting on April 30, 2021. The

entity issued a 9% interest-bearing note for the balance. The said

equipment can be sold for P10,000 at the end of its 5-year useful life.

The entity used straight-line method in depreciating Equipment

CZ4225.

• Equipment ZG2184 was purchased on account for P2,400,000 on

December 30. The term is 2/15, n/30; however, due to tight cash, the

entity was not able to pay the balance on time for the 2% discount.

The estimated useful life of the equipment is 20 years. The said

equipment has no residual value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT