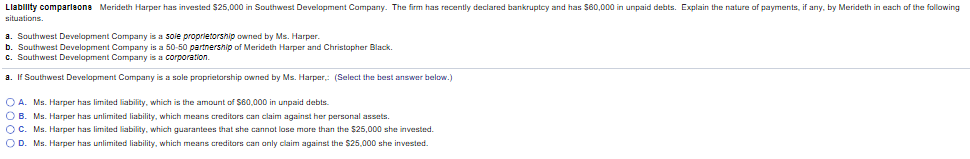

Llabillty comparlsons Merideth Harper has invested $25,000 in Southwest Development Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the follawing situations. a. Sauthwest Develapment Company is a sole proprietorship owned by Ms. Harper. b. Southwest Development Campany is a 50-50 partnership of Merideth Harper and Christapher Black a. If Southwest Develapment Company is a sole praprietarship owned by Ms. Harper: (Select the best answer below.) O A. Ms. Harper has limited iability, which is the amount of $80,000 in unpaid debts. O B. Ms. Harper has unlimited liability, which means creditors can claim against her personal assets. C. O D. Ms. Harper has limited liability, which guarantees that she cannot lose more than the $25,000 she invested. Ms. Harper has unlimited liability, which means creditors can only claim against the S25 000 she invested

Llabillty comparlsons Merideth Harper has invested $25,000 in Southwest Development Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the follawing situations. a. Sauthwest Develapment Company is a sole proprietorship owned by Ms. Harper. b. Southwest Development Campany is a 50-50 partnership of Merideth Harper and Christapher Black a. If Southwest Develapment Company is a sole praprietarship owned by Ms. Harper: (Select the best answer below.) O A. Ms. Harper has limited iability, which is the amount of $80,000 in unpaid debts. O B. Ms. Harper has unlimited liability, which means creditors can claim against her personal assets. C. O D. Ms. Harper has limited liability, which guarantees that she cannot lose more than the $25,000 she invested. Ms. Harper has unlimited liability, which means creditors can only claim against the S25 000 she invested

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 72TA

Related questions

Question

Transcribed Image Text:Llabillty comparlsons Merideth Harper has invested $25,000 in Southwest Development Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the follawing

situations.

a. Sauthwest Develapment Company is a sole proprietorship owned by Ms. Harper.

b. Southwest Development Campany is a 50-50 partnership of Merideth Harper and Christapher Black

a. If Southwest Develapment Company is a sole praprietarship owned by Ms. Harper: (Select the best answer below.)

O A. Ms. Harper has limited iability, which is the amount of $80,000 in unpaid debts.

O B. Ms. Harper has unlimited liability, which means creditors can claim against her personal assets.

C.

O D.

Ms. Harper has limited liability, which guarantees that she cannot lose more than the $25,000 she invested.

Ms. Harper has unlimited liability, which means creditors can only claim against the S25 000 she invested

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT