(The following information applies to the questions displayed below.) The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $35,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash Accounts receivable Office equipment (net) Building (net) $ 31, 000 61, 000 51, 000 115, 000 105, 000 $ 363, 000 $ 171, 000 31, 000 55, 000 31, 000 75, 000 $ 363, 000 Liabilities Butler, loan Butler, capital (25%) Osman, capital (25%) Ward, capital (50%) Land Total assets Total liabilities and capital following transactions transpire in chronological order during the liquidation of the partnership: Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible. sold the office equipment for $20,500, the building for $82,000, and the land for $124,000. Distributed safe payments of cash. aid all liabilities in full. Paid actual liquidation expenses of $30,500 only. Made final cash distributions to the partners. pare journal entries to record these liquidation transactions. (If no entry is required for a transaction/event, select "No journal -y required" in the first account field.)

(The following information applies to the questions displayed below.) The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $35,000 are expected. The partnership balance sheet at the start of liquidation is as follows: Cash Accounts receivable Office equipment (net) Building (net) $ 31, 000 61, 000 51, 000 115, 000 105, 000 $ 363, 000 $ 171, 000 31, 000 55, 000 31, 000 75, 000 $ 363, 000 Liabilities Butler, loan Butler, capital (25%) Osman, capital (25%) Ward, capital (50%) Land Total assets Total liabilities and capital following transactions transpire in chronological order during the liquidation of the partnership: Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible. sold the office equipment for $20,500, the building for $82,000, and the land for $124,000. Distributed safe payments of cash. aid all liabilities in full. Paid actual liquidation expenses of $30,500 only. Made final cash distributions to the partners. pare journal entries to record these liquidation transactions. (If no entry is required for a transaction/event, select "No journal -y required" in the first account field.)

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 27P

Related questions

Question

Please explain it properly

Transcribed Image Text:[The following information applies to the questions displayed below.)

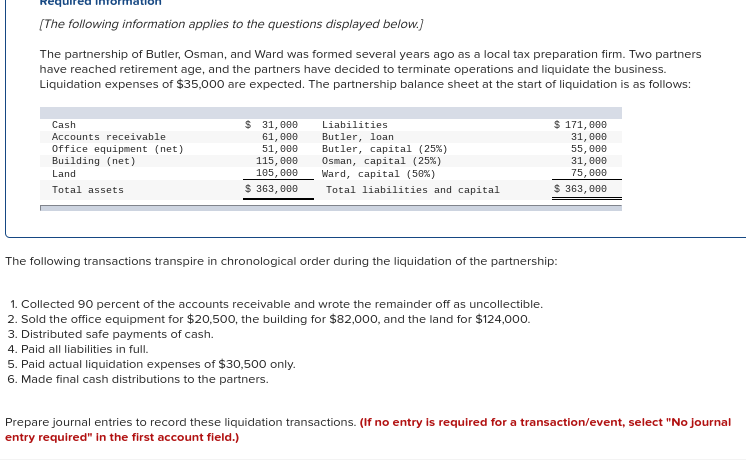

The partnership of Butler, Osman, and Ward was formed several years ago as a local tax preparation firm. Two partners

have reached retirement age, and the partners have decided to terminate operations and liquidate the business.

Liquidation expenses of $35,000 are expected. The partnership balance sheet at the start of liquidation is as follows:

$ 171, 000

$ 31, 000

61, 000

51, 000

115, 000

105, 000

$ 363, 000

Cash

Liabilities

Butler, loan

Butler, capital (25%)

Osman, capital (25%)

Ward, capital (50%)

Total liabilities and capital

Accounts receivable

Office equipment (net)

Building (net)

31, 000

55, 000

31, 000

75, 000

Land

Total assets

$ 363, 000

The following transactions transpire in chronological order during the liquidation of the partnership:

1. Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible.

2. Sold the office equipment for $20,500, the building for $82,000, and the land for $124,000.

3. Distributed safe payments of cash.

4. Paid all liabilities in full.

5. Paid actual liquidation expenses of $30,500 only.

6. Made final cash distributions to the partners.

Prepare journal entries to record these liquidation transactions. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning