Llungby AB spent 1,000,000 krone in 2020 on the development of a new product. The company determined that 25 percent of this amount was incurred after the criteria in IAS 36 for capitalization as an intangible asset had been met. The newly developed product is brought to market in January 2021 and is expected to generate sales revenue for five years. Assume that Llungby AB is a foreign company using IFRS and is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: Prepare journal entries for development costs for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2) U.S. GAAP. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAP.

Llungby AB spent 1,000,000 krone in 2020 on the development of a new product. The company determined that 25 percent of this amount was incurred after the criteria in IAS 36 for capitalization as an intangible asset had been met. The newly developed product is brought to market in January 2021 and is expected to generate sales revenue for five years. Assume that Llungby AB is a foreign company using IFRS and is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: Prepare journal entries for development costs for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2) U.S. GAAP. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAP.

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 1.8C

Related questions

Question

Llungby AB spent 1,000,000 krone in 2020 on the development of a new product. The company determined that 25 percent of this amount was incurred after the criteria in IAS 36 for capitalization as an intangible asset had been met. The newly developed product is brought to market in January 2021 and is expected to generate sales revenue for five years.

Assume that Llungby AB is a foreign company using IFRS and is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes.

Required:

- Prepare

journal entries for development costs for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2) U.S. GAAP. - Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAP.

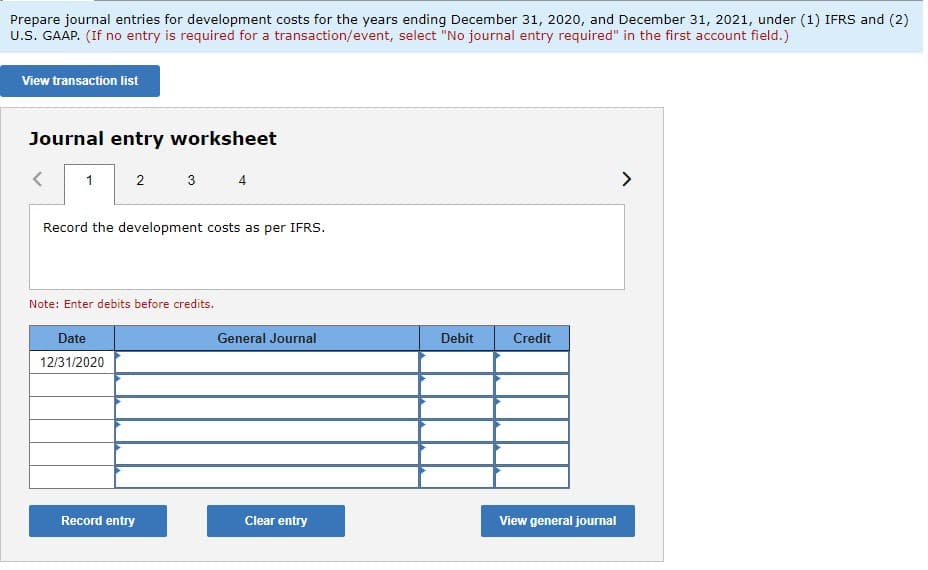

Transcribed Image Text:Prepare journal entries for development costs for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2)

U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

2

Record the development costs as per IFRS.

Date

12/31/2020

3

Note: Enter debits before credits.

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

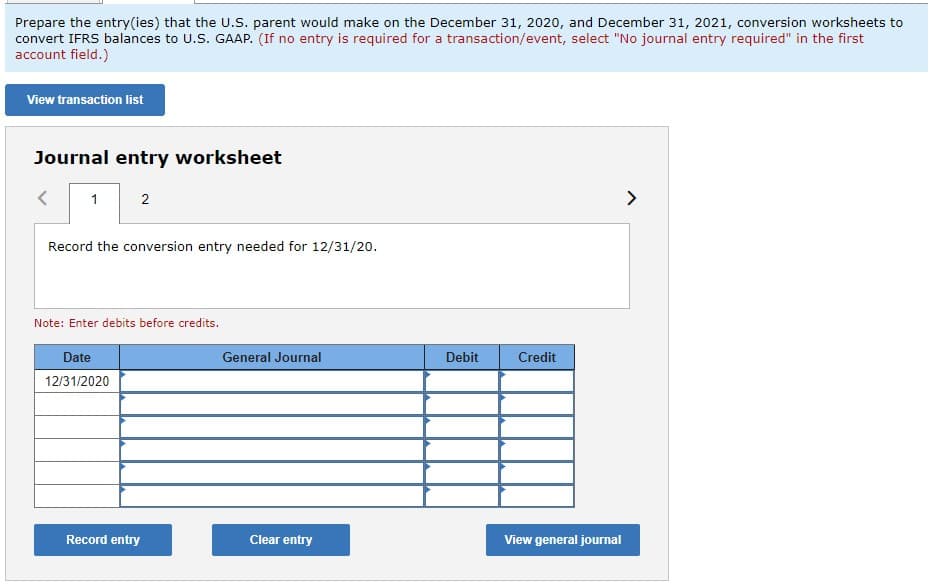

Transcribed Image Text:Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to

convert IFRS balances to U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

View transaction list

Journal entry worksheet

<

1

2

Record the conversion entry needed for 12/31/20.

Note: Enter debits before credits.

Date

12/31/2020

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning