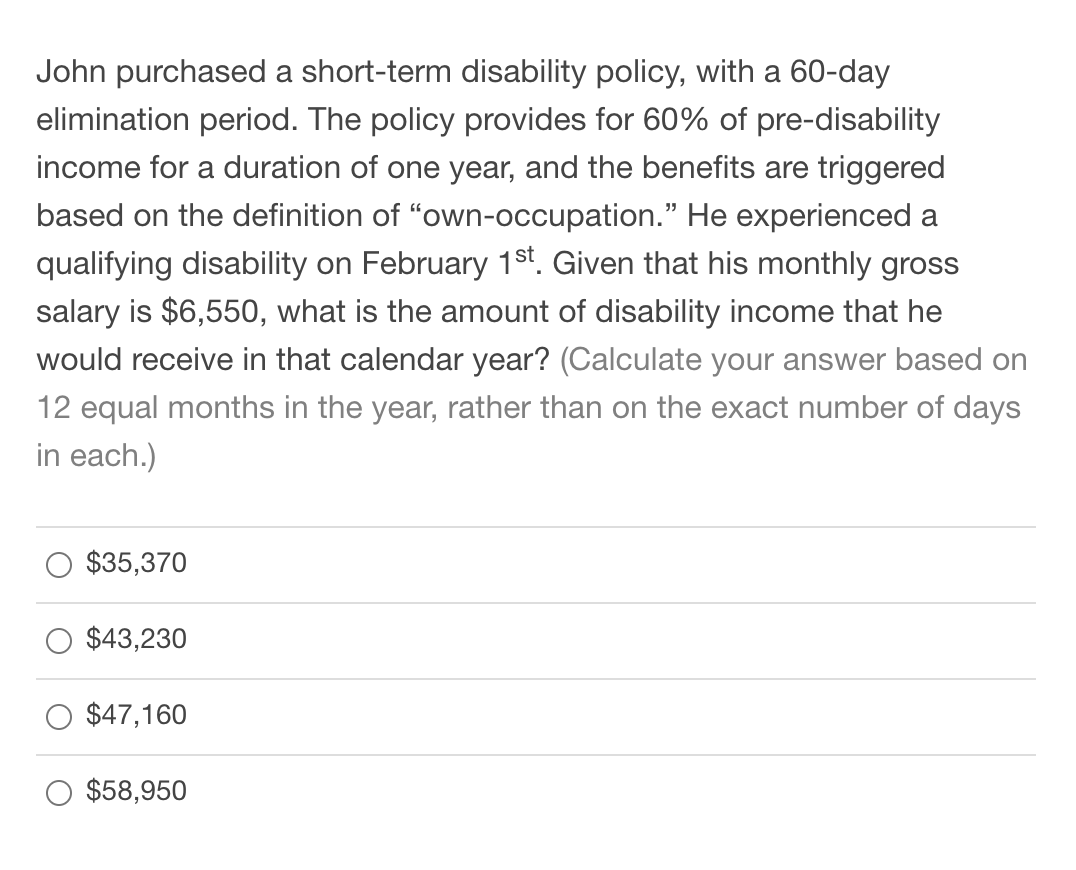

lohn purchased a short-term disability policy, with a 60-day elimination period. The policy provides for 60% of pre-disability ncome for a duration of one year, and the benefits are triggered pased on the definition of "own-occupation." He experienced a qualifying disability on February 1st. Given that his monthly gross alary is $6,550, what is the amount of disability income that he vould receive in that calendar year? (Calculate your answer based on 2 equal months in the year, rather than on the exact number of days

lohn purchased a short-term disability policy, with a 60-day elimination period. The policy provides for 60% of pre-disability ncome for a duration of one year, and the benefits are triggered pased on the definition of "own-occupation." He experienced a qualifying disability on February 1st. Given that his monthly gross alary is $6,550, what is the amount of disability income that he vould receive in that calendar year? (Calculate your answer based on 2 equal months in the year, rather than on the exact number of days

Chapter3: Income Sources

Section: Chapter Questions

Problem 84P

Related questions

Question

Transcribed Image Text:John purchased a short-term disability policy, with a 60-day

elimination period. The policy provides for 60% of pre-disability

income for a duration of one year, and the benefits are triggered

based on the definition of "own-occupation." He experienced a

qualifying disability on February 1st. Given that his monthly gross

salary is $6,550, what is the amount of disability income that he

would receive in that calendar year? (Calculate your answer based on

12 equal months in the year, rather than on the exact number of days

in each.)

$35,370

$43,230

$47,160

$58,950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT