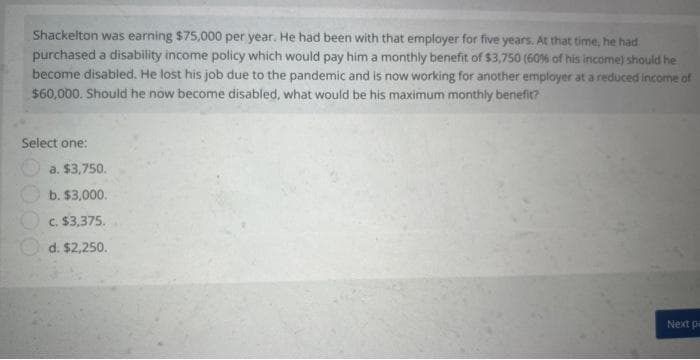

Shackelton was earning $75,000 per year. He had been with that employer for five years. At that time, he had purchased a disability income policy which would pay him a monthly benefit of $3,750 (60% of his income) show become disabled. He lost his job due to the pandemic and is now working for another employer at a reduced in $60,000. Should he now become disabled, what would be his maximum monthly benefit? Select one: a. $3,750. b. $3,000. c. $3,375. d. $2,250.

Shackelton was earning $75,000 per year. He had been with that employer for five years. At that time, he had purchased a disability income policy which would pay him a monthly benefit of $3,750 (60% of his income) show become disabled. He lost his job due to the pandemic and is now working for another employer at a reduced in $60,000. Should he now become disabled, what would be his maximum monthly benefit? Select one: a. $3,750. b. $3,000. c. $3,375. d. $2,250.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 30P

Related questions

Question

Transcribed Image Text:Shackelton was earning $75,000 per year. He had been with that employer for five years. At that time, he had

purchased a disability income policy which would pay him a monthly benefit of $3,750 (60% of his income) should he

become disabled. He lost his job due to the pandemic and is now working for another employer at a reduced income of

$60,000. Should he now become disabled, what would be his maximum monthly benefit?

Select one:

a. $3,750.

b. $3,000.

c. $3,375.

d. $2,250.

Next pa

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you