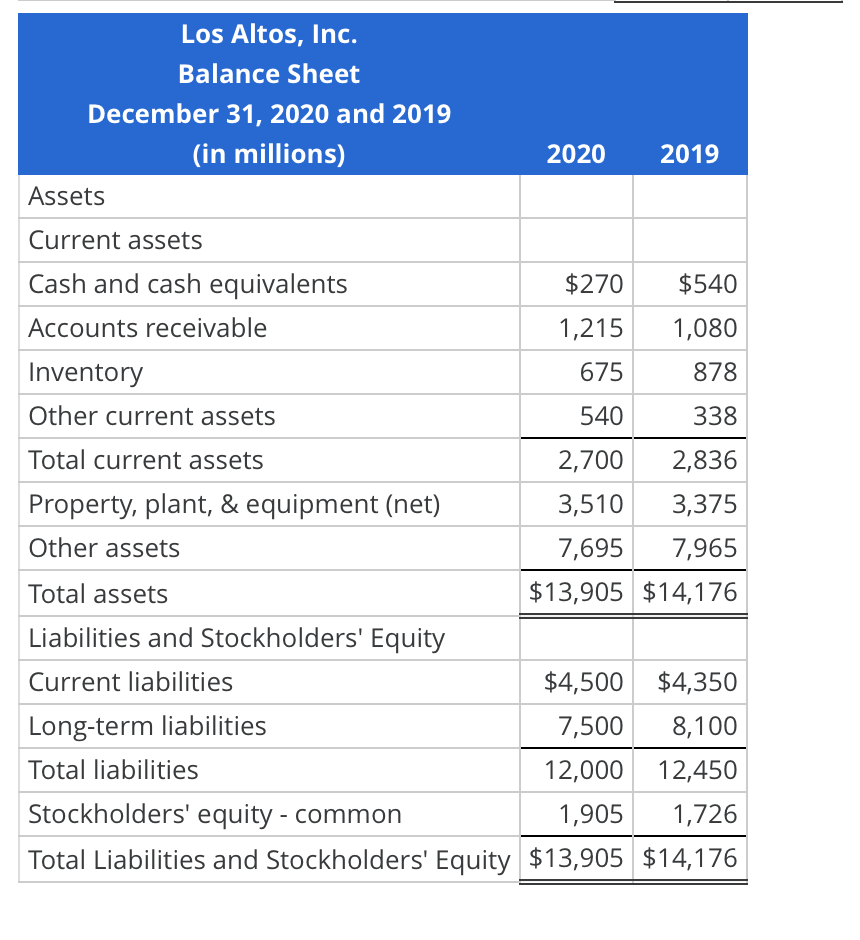

Los Altos, Inc. Balance Sheet December 31, 2020 and 2019 (in millions) 2020 2019 Assets Current assets Cash and cash equivalents $270 $540 Accounts receivable 1,215 1,080 Inventory 675 878 Other current assets 540 338 Total current assets 2,700 2,836 Property, plant, & equipment (net) 3,510 3,375 Other assets 7,695 7,965 Total assets $13,905 $14,176 Liabilities and Stockholders' Equity Current liabilities $4,500 $4,350 Long-term liabilities 7,500 8,100 Total liabilities 12,000 12,450 Stockholders' equity - common 1,905 1,726 Total Liabilities and Stockholders' Equity $13,905 $14,176

Los Altos, Inc. Balance Sheet December 31, 2020 and 2019 (in millions) 2020 2019 Assets Current assets Cash and cash equivalents $270 $540 Accounts receivable 1,215 1,080 Inventory 675 878 Other current assets 540 338 Total current assets 2,700 2,836 Property, plant, & equipment (net) 3,510 3,375 Other assets 7,695 7,965 Total assets $13,905 $14,176 Liabilities and Stockholders' Equity Current liabilities $4,500 $4,350 Long-term liabilities 7,500 8,100 Total liabilities 12,000 12,450 Stockholders' equity - common 1,905 1,726 Total Liabilities and Stockholders' Equity $13,905 $14,176

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 4P: Sales Increase Maggies Muffins Bakery generated 5 million in sales during 2018, and its year-end...

Related questions

Question

Practice Pack

Transcribed Image Text:Los Altos, Inc.

Balance Sheet

December 31, 2020 and 2019

(in millions)

2020

2019

Assets

Current assets

Cash and cash equivalents

$270

$540

Accounts receivable

1,215

1,080

Inventory

675

878

Other current assets

540

338

Total current assets

2,700

2,836

Property, plant, & equipment (net)

3,510

3,375

Other assets

7,695

7,965

Total assetsS

$13,905 $14,176

Liabilities and Stockholders' Equity

Current liabilities

$4,500 $4,350

Long-term liabilities

7,500

8,100

Total liabilities

12,000

12,450

Stockholders' equity - common

1,905

1,726

Total Liabilities and Stockholders' Equity $13,905 $14,176

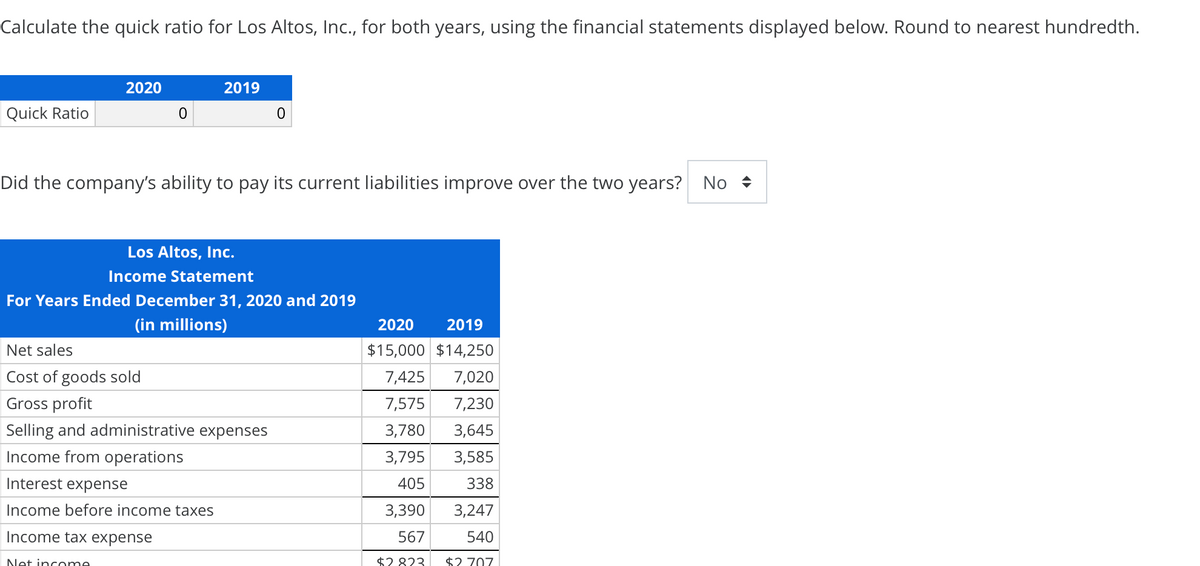

Transcribed Image Text:Calculate the quick ratio for Los Altos, Ic., for both years, using the financial statements displayed below. Round to nearest hundredth.

2020

2019

Quick Ratio

Did the company's ability to pay its current liabilities improve over the two years? No +

Los Altos, Inc.

Income Statement

For Years Ended December 31, 2020 and 2019

(in millions)

2020

2019

Net sales

$15,000 $14,250

Cost of goods sold

7,425

7,020

Gross profit

7,575

7,230

Selling and administrative expenses

3,780

3,645

Income from operations

3,795

3,585

Interest expense

405

338

Income before income taxes

3,390

3,247

Income tax expense

567

540

Net income

$2 823

$2 707

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning