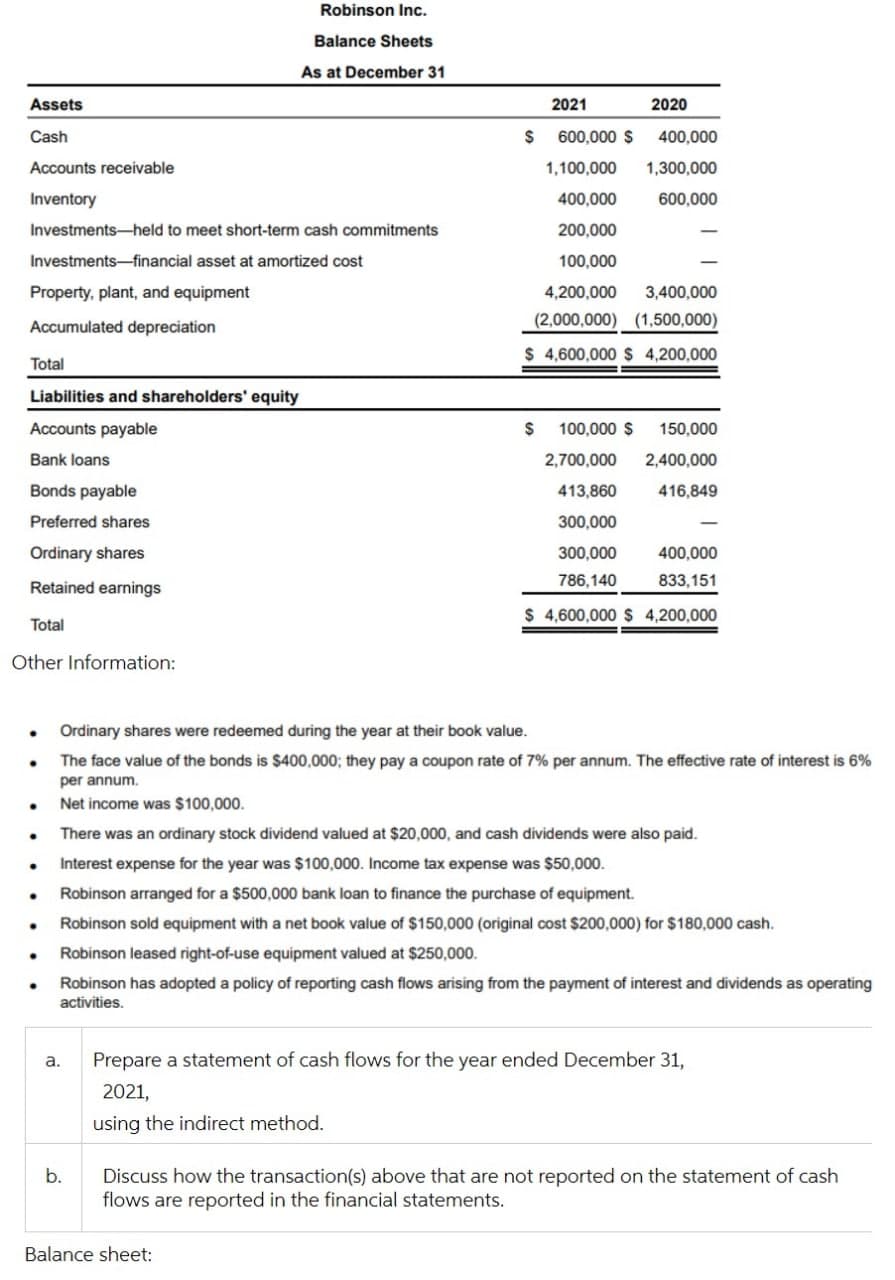

Robinson Inc. Balance Sheets As at December 31 Assets 2021 2020 Cash 600,000 $ 400,000 Accounts receivable 1,100,000 1,300,000 Inventory 400,000 600,000 Investments-held to meet short-term cash commitments 200,000 Investments-financial asset at amortized cost 100,000 Property, plant, and equipment 4,200,000 3,400,000 Accumulated depreciation (2,000,000) (1,500,000) $ 4,600,000 $ 4,200,000 Total Liabilities and shareholders' equity Accounts payable 100,000 $ 150,000 Bank loans 2,700,000 2,400,000 Bonds payable 413,860 416,849 Preferred shares 300,000 Ordinary shares 300,000 400,000 Retained earnings 786,140 833,151 $ 4,600,000 $ 4,200,000 Total other Information: Ordinary shares were redeemed during the year at their book value. The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6% per annum. Net income was $100,000. There was an ordinary stock dividend valued at $20,000, and cash dividends were also paid. Interest expense for the year was $100,000. Income tax expense was $50,000. Robinson arranged for a $500,000 bank loan to finance the purchase of equipment. Robinson sold equipment with a net book value of $150,000 (original cost $200,000) for $180,000 cash. Robinson leased right-of-use equipment valued at $250,000. Robinson has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating activities. a. Prepare a statement of cash flows for the year ended December 31, 2021, using the indirect method. b. Discuss how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. Balance sheet:

Robinson Inc. Balance Sheets As at December 31 Assets 2021 2020 Cash 600,000 $ 400,000 Accounts receivable 1,100,000 1,300,000 Inventory 400,000 600,000 Investments-held to meet short-term cash commitments 200,000 Investments-financial asset at amortized cost 100,000 Property, plant, and equipment 4,200,000 3,400,000 Accumulated depreciation (2,000,000) (1,500,000) $ 4,600,000 $ 4,200,000 Total Liabilities and shareholders' equity Accounts payable 100,000 $ 150,000 Bank loans 2,700,000 2,400,000 Bonds payable 413,860 416,849 Preferred shares 300,000 Ordinary shares 300,000 400,000 Retained earnings 786,140 833,151 $ 4,600,000 $ 4,200,000 Total other Information: Ordinary shares were redeemed during the year at their book value. The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6% per annum. Net income was $100,000. There was an ordinary stock dividend valued at $20,000, and cash dividends were also paid. Interest expense for the year was $100,000. Income tax expense was $50,000. Robinson arranged for a $500,000 bank loan to finance the purchase of equipment. Robinson sold equipment with a net book value of $150,000 (original cost $200,000) for $180,000 cash. Robinson leased right-of-use equipment valued at $250,000. Robinson has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating activities. a. Prepare a statement of cash flows for the year ended December 31, 2021, using the indirect method. b. Discuss how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. Balance sheet:

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 8EP

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Robinson Inc.

Balance Sheets

As at December 31

Assets

2021

2020

Cash

600,000 $

400,000

Accounts receivable

1,100,000

1,300,000

Inventory

400,000

600,000

Investments-held to meet short-term cash commitments

200,000

Investments-financial asset at amortized cost

100,000

Property, plant, and equipment

4,200,000

3,400,000

Accumulated depreciation

(2,000,000) (1,500,000)

$ 4,600,000 $ 4,200,000

Total

Liabilities and shareholders' equity

Accounts payable

100,000 $

150,000

Bank loans

2,700,000

2,400,000

Bonds payable

413,860

416,849

Preferred shares

300,000

Ordinary shares

300,000

400,000

786,140

833,151

Retained earnings

$ 4,600,000 $ 4,200,000

Total

Other Information:

Ordinary shares were redeemed during the year at their book value.

The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective rate of interest is 6%

per annum.

Net income was $100,000.

There was an ordinary stock dividend valued at $20,000, and cash dividends were also paid.

Interest expense for the year was $100,000. Income tax expense was $50,000.

Robinson arranged for a $500,000 bank loan to finance the purchase of equipment.

Robinson sold equipment with a net book value of $150,000 (original cost $200,000) for $180,000 cash.

Robinson leased right-of-use equipment valued at $250,000.

Robinson has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating

activities.

a.

Prepare a statement of cash flows for the year ended December 31,

2021,

using the indirect method.

Discuss how the transaction(s) above that are not reported on the statement of cash

flows are reported in the financial statements.

b.

Balance sheet:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning