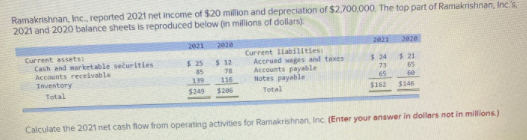

Ramakrishnan, Inc, reported 2021 net income of $20 million and depreciation of $2,700,000. The top part of Ramakrishnan, Inc.s 2021 and 2020 balance sheets is reproduced below (in millions of dollars): 2021 202 2023 2020 Current assets: Cash and market able seturities Accounts recelvable Inventory Current liabilities Accrued weges and taxes Accounts payable Notes payable Total $ 25 85 $ 12 $ 24 $ 21 65 78 116 $206 73 199 65 Total $249 $162 $146 Calculate the 2021 net cash flow from operating activities for Ramakrishnan, Inc. (Enter your answer in dollars not in millions)

Ramakrishnan, Inc, reported 2021 net income of $20 million and depreciation of $2,700,000. The top part of Ramakrishnan, Inc.s 2021 and 2020 balance sheets is reproduced below (in millions of dollars): 2021 202 2023 2020 Current assets: Cash and market able seturities Accounts recelvable Inventory Current liabilities Accrued weges and taxes Accounts payable Notes payable Total $ 25 85 $ 12 $ 24 $ 21 65 78 116 $206 73 199 65 Total $249 $162 $146 Calculate the 2021 net cash flow from operating activities for Ramakrishnan, Inc. (Enter your answer in dollars not in millions)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 7MC

Related questions

Question

Transcribed Image Text:Ramakrishnan, Inc, reported 2021 net income of $20 million and depreciation of $2,700,000. The top part of Ramakrishnan, Inc.s

2021 and 2020 balance sheets is reproduced below (in millions of dollars):

2021 202

2023

2020

Current assets:

Cash and market able seturities

Accounts recelvable

Inventory

Current liabilities

Accrued weges and taxes

Accounts payable

Notes payable

Total

$ 25

85

$ 12

$ 24

$ 21

65

78

116

$206

73

199

65

Total

$249

$162

$146

Calculate the 2021 net cash flow from operating activities for Ramakrishnan, Inc. (Enter your answer in dollars not in millions)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning