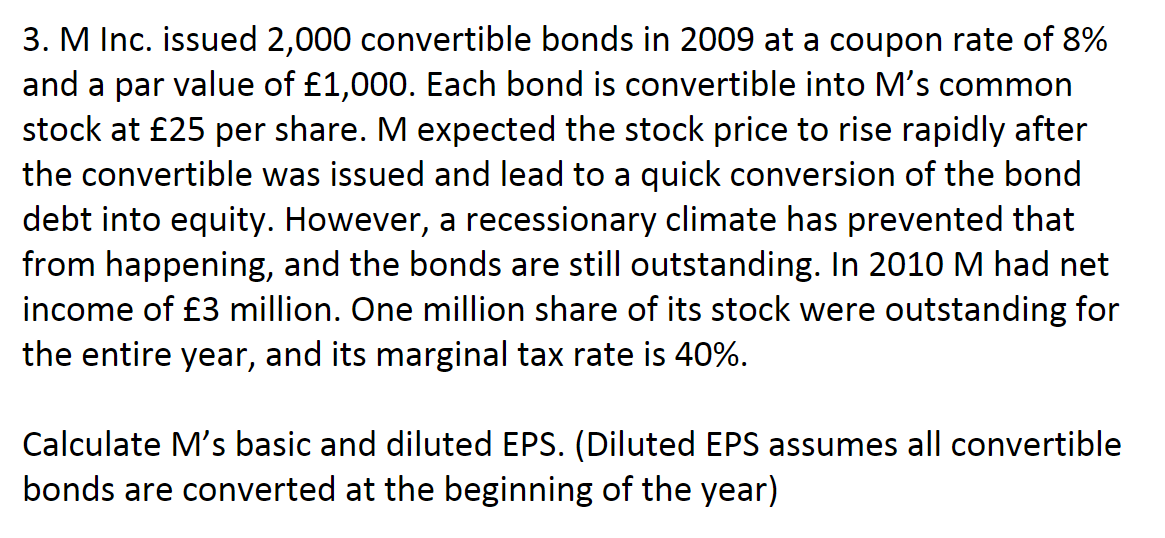

M Inc. issued 2,000 convertible bonds in 2009 at a coupol nd a par value of £1,000. Each bond is convertible into M's ock at £25 per share. M expected the stock price to rise ra e convertible was issued and lead to a quick conversion o ebt into equity. However, a recessionary climate has preve om happening, and the bonds are still outstanding. In 2010 come of £3 million. One million share of its stock were out e entire year, and its marginal tax rate is 40%.

Q: 10. In a liquidating distribution Ann receives cash of $3,000, inventory in which the partnership's…

A: Introduction: A corporation is liquidated by selling its assets and utilizing the revenues to pay…

Q: A company owed P2,000,000 plus P180,000 of accrued interest to Bank of Philippines which was due to…

A: Bank agreed to accept an old machine Machine Cost :- P3,900,000 Accumulated depreciation :- P…

Q: company is experiencing financial difficulty and is negotiating a trouble debt restructuring with…

A: debt restructuring is a process that is used by the company , individual, or even countries in…

Q: In 2021, a company issued 1,000,000 no-par value ordinary shares for P1.15 per share. The stated…

A: In case of shares with no-par value, whole of the consideration received shall not be available to…

Q: Assembly Department at the end of the year just ended

A: Nafth Company has an Equipment Services Department that performs all needed maintenance work on the…

Q: Dream Big Pillow Co., pays 65% of its purchases in the month of purchase, 30% the month after the…

A: The cash payment to suppliers is recorded in the cash disbursement schedule.

Q: Income Statement ($M) 2019 Revenue 372 Depreciation Other Operating Expense Income Before Taxes 12…

A: Formula: Net profit margin ratio = ( Net income / revenues ) x 100

Q: The Express Company is preparing its cash budget for the month of June. The following information is…

A: Lets understand the basics. Management prepares cash collection and cash disbursement schedule to…

Q: On December 31, 2021, the company presented the following information: Ordinary share capital, P50…

A: Cost Value of Property, plant and equipment: P8,000,000 Book Value of Property, plant and equipment:…

Q: Identify types of costs and explain their accounting. E2.20 (LO 1) Wu-Li Corporation incurred the…

A: Direct material, direct labor and manufacturing overhead are the part of product costs which are…

Q: Ogag company issued 1,000 shares of its P5 par value ordinary shares as payment for 1,000 hours of…

A: Par. value of Ordinary Shares :- P5 No. Of Equity Shares issued :- 1000 shares Market Value of…

Q: Which is TRUE in Barangay Micro Business Enterprise (BMBE)? S1: Corporations cannot register as…

A: As Per Barangay Micro Business Enterprise Any Natural Person or Judicial ,…

Q: Jaime Ltd manufactures and sells a small electric product to order for the computer industry. The…

A: The income statement should be prepared to record revenue and expenses for the period and find the…

Q: Boa City had the following fixed assets: Fixed Assets used in proprietary fund activities Fixed…

A: Government wide statement of net position is overall net fixed invested by government in different…

Q: The stockholders' equity of A Company at the end of 2023 and 2022 are as follows: 2023 2022…

A: Price per share of stock is the par value plus any paid in capital in excess of par for the stock.…

Q: A company has suffered operating losses for some time but is now operating profitably and expects to…

A: Quasi reorganization means where assets and liabilities are restated at fair value and profit is…

Q: Perfect Stampers makes and sells aftermarket hubcaps. The variable cost for each hubcap is $4.75,…

A: Contribution margin per unit = Selling price per unit - Variable Cost per unit

Q: In the course of your audit of the financial statements of Apayao Corp. for the period ended…

A: A Total Deposit in Transit on December 31 Total Deposits in Bank =637220 + 356080…

Q: One of the criticisms of the NLRB is that they are too powerful and are constantly fining companies…

A: Here discuss about the activities of the National Labor Relation Board (NLRB) and it primary aims to…

Q: Explain briefly how with examples

A:

Q: A, B, C and D are known robbers in their community. They created a Jewelry-on-hand Partnership so…

A: In any partnership, there are two or more partners who are responsible for running the business…

Q: A capitalist partner is not allowed to enter into a new partnership if it is a competing business.…

A: Diligence – The obligation of the partner is to act diligently in her decisions on behalf of the…

Q: ute is $9.50 per direct labor-hour. The production budget calls for producing 2,200 units in June…

A: Meaning of Direct labor Budget : The direct labor budget is useful the number of laborers who will…

Q: Knights Technologies is considering changing its credit terms from 2/15, n/30 to 3/10, n/30 to speed…

A: Outstanding sales days is a measure that shows how long it takes for a company to get money for a…

Q: ne Atlantic Company sells a product with a break-even point of 4,247 sales units. The variable cost…

A: Break even point in units= fixed cost/ contribution per unit 4247 = $110,422/contribution margin per…

Q: Which of the following is a connector account? O Retained Earnings O Prepaid Rent O Common Stock O…

A: Connector accounts are those accounts which connects or joins two particular financial statements.

Q: s $1,800, and land in whic as $25,000. s on the distribution?

A: Given as, Received amount= $3,000, Inventory Partnership basis= $1,800, Land partnership basis=…

Q: Negotiations on a new contract have started. The contractor has 500 employees, the contract is 2.5%…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: USE THE NUMBERS 1-10 TO PLACE THE FOLLOWING STEPS OF THE ACCOUNTING CYCLE IN THEIR PROPER ORDER, 1…

A: Accounting cycle includes the step by step procedure of recording and finalizing the business…

Q: Draft a concise introduction, some background, and essential information of the cash flow statements…

A:

Q: Contrast activity-based costing (ABC) with activity-based management (ABM). Question…

A: ABC system of cost accounting is based on activities , which are considered any event, unit of work…

Q: What is the carrying amount of the bonds as of December 31, 2022?

A: Compound financial Instrument: A Compound Financial Instrument is an instrument which exhibits the…

Q: Please answer the number 2 problem. Thank you!

A: There are two type of cash balances that is being maintained in business. One is cash balance as per…

Q: How much is the income tax applicable on the transactions?

A: taxable AMOUNT = 15,000,000

Q: January 1, 2019,

A: ET Mags Inc. should record the lease payments in the leasee's accounts. The current lease is a…

Q: ackage upgrade and

A: Given as, Units in process, April 1, 60% complete 60,000Units completed and transferred out…

Q: What's the cash balance at the end of the month?

A: Budgets are the mainly called the estimates made for future period of time. Cash budget is one of…

Q: When the equity shares are issued for noncash consideration, the share capital is recorded at an…

A: Solution: When the equity shares are issued for noncash consideration, following are priority to…

Q: Task 2: Rustaq company has sold goods on credit RO 55,000 on 31“ December 2020 and received RO…

A: A bad debt expense is reported when a receivable is no longer recoverable due to a customer's…

Q: A company reported the following information on December 31, 2021: Preference share, P100 par…

A: Total shareholders' equity is the amount of funds of the shareholders outstanding in the statement…

Q: What is the proper treatment for noncash asset received from a non-stockholder? Group of answer…

A: Accounting entry to be made for noncash asset received from a non-stockholder: Debit Noncash Assets…

Q: What is the classification of shares that has privileges over any of the other classes of shares in…

A: Par value shares: These are those shares that have a face value per share also known as par value.…

Q: Arthoney Ircis trial balance cortairs the fallowing balances: Cash $535 Accounts Payable $344…

A: Introduction: Trial Balance: All the final ledger accounts balances are posted in Trial balance to…

Q: What is the difference between book value accounting and market value accounting? How do interest…

A: Here discuss about the details of the book value of accounting and the market value of accounting.…

Q: ficient Securiti

A: Stakeholders are those who are interested in the company and can influence or be influenced by the…

Q: A project has a NPV of 15,000 when the cutoff rate is 10%. The annual cash flows are 20,505 on an…

A: Profitability index is used to see the attractiveness of investment or a project. It is also written…

Q: EXERCISE 14A-6 Basic Present Value Concepts The Caldwell Herald newspaper reported the following…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Donahue Oil has an account titled Oil and Gas Properties. Donahue paid $6,700,000 for oil reserves…

A: Journal entry is the primary step to record the transaction in the books of account. The debit and…

Q: How would non-financial performance indicators help to improve the performance of the company?…

A: Introduction: In its most basic form, non-financial performance metrics give information on a…

Q: The following data are provided by Coach Sarah Company: Assets at book value P750,000 Assets at…

A: Introduction:- According to accounting Deficiency denotes negative or loss of money. Estimated…

Step by step

Solved in 4 steps

- On February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. 1. What was the nominal yield on this bond on February 9, 2015?On February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Qusetion: What was the risk premium for this bond on February 9, 2022? [To 2 decimal places.]On February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Question: What was the current yield on this bond on February 9, 2022? [To 2 decimal place.]

- On February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Question: What was the current yield on this bond on February 9, 2015?On February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Question: What was the nominal yield on this bond on February 9, 2022? [To 1 decimal place.]On February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Question: It is now February 9, 2022, and suddenly the Federal Reserve announces a massive program to buy more bonds. Instantly, the market rate of interest for a riskless corporate bond that would apply to this bond rises from 2.05% to 2.3%. If there…

- Apel Investment Company has GH¢1,800,000 of interest-bearing bond outstanding. The outstanding bonds have a 11% coupon and a 14% yield to maturity. Management believes they could issue new bonds at a premium of 105% that would provide a similar yield to maturity. Also, the company’s prepared stock currently stands at GH¢1,200,000 and trades at GH¢60.00 per share. The company pays a dividend of GH¢3.00 per share. Furthermore, the company’s common stock sells for GH¢15.00 per share with 200,000 shares in issue. The company has a beta of 1.2, whiles the government’s T-Bill has an interest rate of 12%, with a 18% average return on the market. The company’s marginal tax rate is 40%.Management is considering investing in a new project, the details of which are as follows:GH¢ Project cost 2,000,000.00Estimated net profit: Year 1 (22,000.00) Year 2 192,000.00 Year 3 300,000.00Year 4 270,000.00Year 5 180,000.00Additional information; Depreciation is based on the straight line method. The…Apel Investment Company has GH¢1,800,000 of interest-bearing bond outstanding. The outstanding bonds have a 11% coupon and a 14% yield to maturity. Management believes they could issue new bonds at a premium of 105% that would provide a similar yield to maturity. Also, the company’s prepared stock currently stands at GH¢1,200,000 and trades at GH¢60.00 per share. The company pays a dividend of GH¢3.00 per share. Furthermore, the company’s common stock sells for GH¢15.00 per share with 200,000 shares in issue. The company has a beta of 1.2, whiles the government’s T-Bill has an interest rate of 12%, with a 18% average return on the market. The company’s marginal tax rate is 40%.Management is considering investing in a new project, the details of which are as follows:GH¢ Project cost 2,000,000.00Estimated net profit: Year 1 (22,000.00) Year 2 192,000.00 Year 3 300,000.00Year 4 270,000.00Year 5 180,000.00Additional information; Depreciation is based on the straight line method. The…Apel Investment Company has GH¢1,800,000 of interest-bearing bond outstanding. The outstanding bonds have a 11% coupon and a 14% yield to maturity. Management believes they could issue new bonds at a premium of 105% that would provide a similar yield to maturity. Also, the company’s prepared stock currently stands at GH¢1,200,000 and trades at GH¢60.00 per share. The company pays a dividend of GH¢3.00 per share. Furthermore, the company’s common stock sells for GH¢15.00 per share with 200,000 shares in issue. The company has a beta of 1.2, whiles the government’s T-Bill has an interest rate of 12%, with a 18% average return on the market. The company’s marginal tax rate is 40%.Management is considering investing in a new project, the details of which are as follows:GH¢ Project cost 2,000,000.00Estimated net profit: Year 1 (22,000.00) Year 2 192,000.00 Year 3 300,000.00Year 4 270,000.00Year 5 180,000.00Additional information; Depreciation is based on the straight line method. The…

- Several years ago, Castles in the Sand Inc. issued bonds at face value of $1,000 at a yield to maturity of 7.4%. Now, with 8 years left until the maturity of the bonds, the company has run into hard times and the yield to maturity on the bonds has increased to 12%. What is the price of the bond now? (Assume semiannual coupon payments.)A. Morin Company's bonds mature in 8 years, have a par value of $1,000, and make an annual coupon interest payment of $65. The market requires an interest rate of 6.7% on these bonds. What is the bond's price? a. $1,215.14 b. $1,155.86 c. $1,047.19 d. $770.58 e. $987.92 B. Which of the following statements is CORRECT? a. IPO prices are generally established by the market, and buyers of the new stock must pay the price that prevails at the close of trading on the day the stock is offered to the public. b. It is possible that the price set in an IPO is so low that investors will want to buy more shares than the company wants to sell. In that case, the company will have to issue more shares than it wants to sell. c. The term "IPO" stands for Introductory Price Offered, and it is the price at which shares of a new company are offered to the public. d. In a "Dutch auction," investors who want to buy shares in an IPO submit bids…Voyager, Inc. has issued bonds with a ten-year maturity that are paying a coupon of 8%. Rates have decreased since this issuing, so the bond is selling at a premium of $1,050. What is the Yield to Maturity? 6.80% 3.64% 7.29% 3.40%