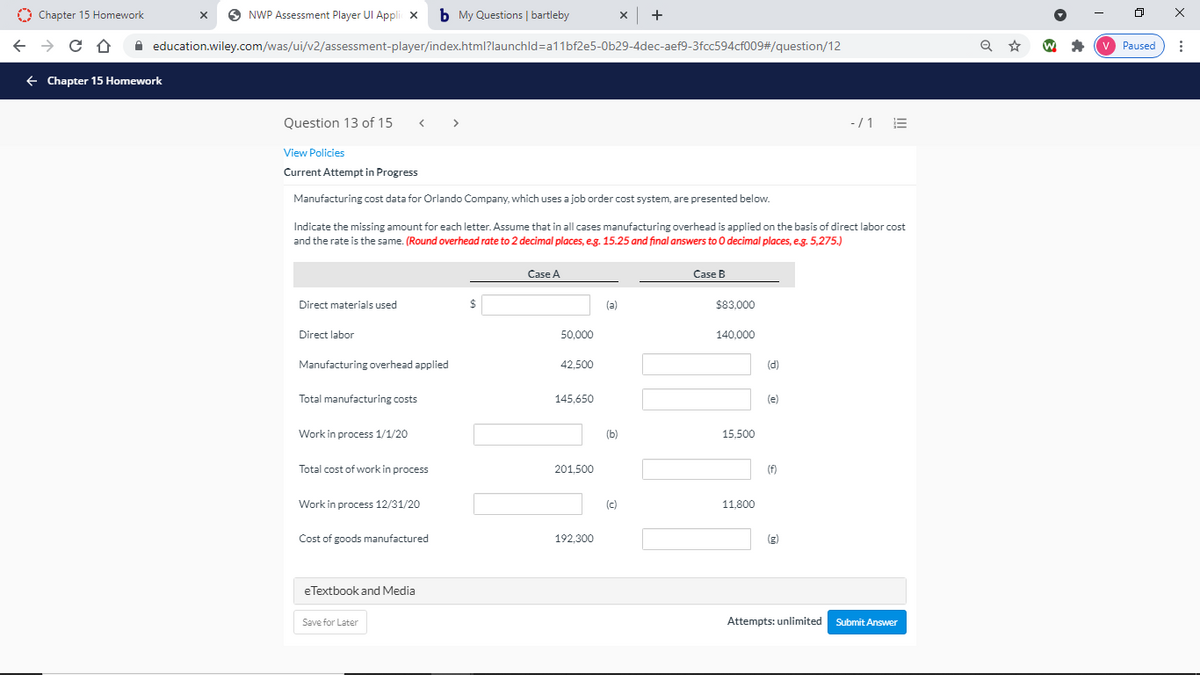

Manufacturing cost data for Orlando Company, which uses a job order cost system, are presented below. Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost and the rate is the same. (Round overhead rate to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 5,275.) Case A Case B Direct materials used $enter a dollar amount rounded to 0 decimal places (a) $83,000 Direct labor 50,000 140,000 Manufacturing overhead applied 42,500 enter a dollar amount rounded to 0 decimal places (d) Total manufacturing costs 145,650 enter a dollar amount rounded to 0 decimal places (e) Work in process 1/1/20 enter a dollar amount rounded to 0 decimal places (b) 15,500 Total cost of work in process 201,500 enter a dollar amount rounded to 0 decimal places (f) Work in process 12/31/20 enter a dollar amount rounded to 0 decimal places (c) 11,800 Cost of goods manufactured 192,300 enter a dollar amount rounded to 0 decimal places

Manufacturing cost data for Orlando Company, which uses a job order cost system, are presented below. Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost and the rate is the same. (Round overhead rate to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 5,275.) Case A Case B Direct materials used $enter a dollar amount rounded to 0 decimal places (a) $83,000 Direct labor 50,000 140,000 Manufacturing overhead applied 42,500 enter a dollar amount rounded to 0 decimal places (d) Total manufacturing costs 145,650 enter a dollar amount rounded to 0 decimal places (e) Work in process 1/1/20 enter a dollar amount rounded to 0 decimal places (b) 15,500 Total cost of work in process 201,500 enter a dollar amount rounded to 0 decimal places (f) Work in process 12/31/20 enter a dollar amount rounded to 0 decimal places (c) 11,800 Cost of goods manufactured 192,300 enter a dollar amount rounded to 0 decimal places

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 3RP

Related questions

Question

Manufacturing cost data for Orlando Company, which uses a

Indicate the missing amount for each letter. Assume that in all cases manufacturing

|

Case A

|

Case B

|

||||||

|---|---|---|---|---|---|---|---|

|

Direct materials used

|

$enter a dollar amount rounded to 0 decimal places

|

(a) | $83,000 | ||||

|

Direct labor

|

50,000 | 140,000 | |||||

|

Manufacturing overhead applied

|

42,500 |

enter a dollar amount rounded to 0 decimal places

|

(d) | ||||

|

Total

|

145,650 |

enter a dollar amount rounded to 0 decimal places

|

(e) | ||||

|

Work in process 1/1/20

|

enter a dollar amount rounded to 0 decimal places

|

(b) | 15,500 | ||||

|

Total cost of work in process

|

201,500 |

enter a dollar amount rounded to 0 decimal places

|

(f) | ||||

|

Work in process 12/31/20

|

enter a dollar amount rounded to 0 decimal places

|

(c) | 11,800 | ||||

|

Cost of goods manufactured

|

192,300 |

enter a dollar amount rounded to 0 decimal places

|

(g) |

Transcribed Image Text:O Chapter 15 Homework

O NWP Assessment Player UI Appli x

b My Questions | bartleby

x +

A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=a11bf2e5-0b29-4dec-aef9-3fcc594cf009#/question/12

v Paused

+ Chapter 15 Homework

Question 13 of 15

< >

-/1 E

View Policies

Current Attempt in Progress

Manufacturing cost data for Orlando Company, which uses a job order cost system, are presented below.

Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost

and the rate is the same. (Round overhead rate to 2 decimal places, eg. 15.25 and final answers to O decimal places, e.g. 5,275.)

Case A

Case B

Direct materials used

24

(a)

$83,000

Direct labor

50,000

140,000

Manufacturing overhead applied

42,500

(d)

Total manufacturing costs

145,650

(e)

Work in process 1/1/20

(b)

15,500

Total cost of work in process

201,500

(f)

Work in process 12/31/20

(c)

11.800

Cost of goods manufactured

192,300

(g)

eTextbook and Media

Attempts: unlimited Submit Answer

Save for Later

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you