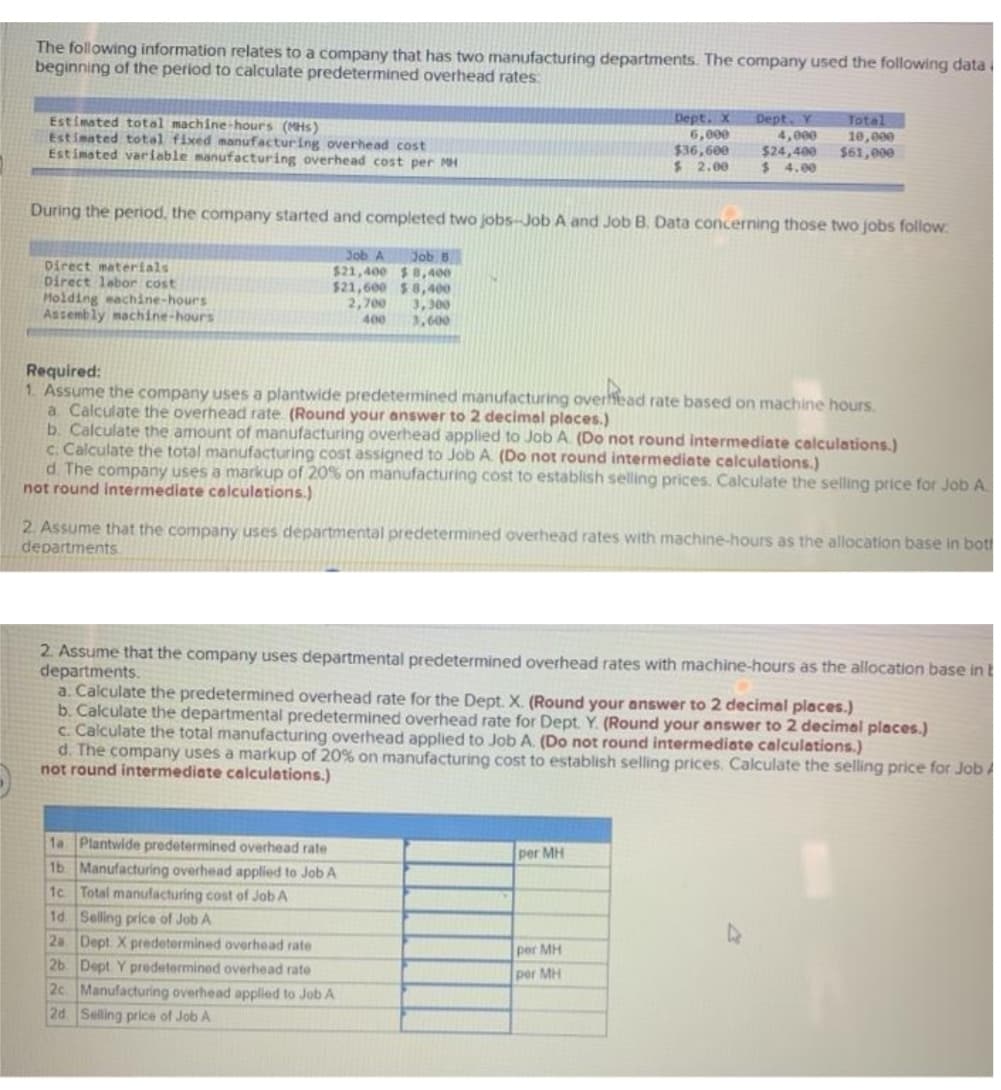

The following information relates to a company that has two manufacturing departments. The company used the following dat. beginning of the period to calculate predetermined overhead rates: Estimated total machine-hours (MHs) Estimated total fixed manufacturing overhead cost Estimsted variable manufacturing overhead cost per MH Dept. x 6,000 $36,600 $ 2.00 Dept. 4,000 $24,400 $ 4.00 Total 10,000 $61,000 During the period, the company started and completed two jobs-Job A and Job B. Data concerning those two jobs follow. Job A Direct materials Direct labor cost Molding machine-hours Assembly machine-hours Job B $21,400 $8,400 $21,600 $8,400 3,300 3,600 2,700 400 Required: 1. Assume the company uses a plantwide predetermined manufacturing overead rate based on machine hours

The following information relates to a company that has two manufacturing departments. The company used the following dat. beginning of the period to calculate predetermined overhead rates: Estimated total machine-hours (MHs) Estimated total fixed manufacturing overhead cost Estimsted variable manufacturing overhead cost per MH Dept. x 6,000 $36,600 $ 2.00 Dept. 4,000 $24,400 $ 4.00 Total 10,000 $61,000 During the period, the company started and completed two jobs-Job A and Job B. Data concerning those two jobs follow. Job A Direct materials Direct labor cost Molding machine-hours Assembly machine-hours Job B $21,400 $8,400 $21,600 $8,400 3,300 3,600 2,700 400 Required: 1. Assume the company uses a plantwide predetermined manufacturing overead rate based on machine hours

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 5SEA: PREDETERMINED FACTORY OVERHEAD RATE Millerlile Enterprises calculates a predetermined factory...

Related questions

Question

Transcribed Image Text:The following information relates to a company that has two manufacturing departments. The company used the following data

beginning of the period to calculate predetermined overhead rates:

Estimated total machine-hours (MHs)

Estimated total fixed manufacturing overhead cost

Estimated variable manufacturing overhead cost per MH

Dept. X

6,000

$36,600

$ 2.00

Dept. Y

4,000

$24,400

$ 4.00

Total

10,000

$61,000

During the period, the company started and completed two jobs-Job A and Job B. Data concerning those two jobs follow

Job B

$21,400 $ 8,400

$21,600 $8,400

3,300

3,600

Job A

Direct materials

Direct lebor cost

Molding machine-hours

Assembly machine-hours

2,700

400

Required:

1. Assume the company uses a plantwide predetemined manufacturing overfead rate based on machine hours.

a. Calculate the overhead rate (Round your answer to 2 decimal places.)

b. Calculate the amount of manufacturing overhead applied to Job A. (Do not round intermediate calculations.)

c. Calculate the total manufacturing cost assigned to Job A (Do not round intermediate calculations.)

d. The company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job A.

not round intermediate calculations.)

2. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in bot

departments

2. Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in t

departments.

a. Calculate the predetermined overhead rate for the Dept. X. (Round your answer to 2 decimal places.)

b. Calculate the departmental predetermined overhead rate for Dept. Y. (Round your answer to 2 decimal places.)

c. Calculate the total manufacturing overhead applied to Job A. (Do not round intermediate calculations.)

d. The company uses a markup of 20% on manufacturing cost to establish selling prices. Calculate the selling price for Job

not round intermediate calculations.)

1a Plantwide predetermined overhead rate

1b Manufacturing overhead applied to Job A

1c Total manufacturing cost of Job A

1d. Selling price of Job A

2a Dept X predetermined overhead rate

2b. Dept Y predetermined overhead rate

2c Manufacturing overhead applied to Job A

2d. Selling price of Job A

per MH

per MH

per MH

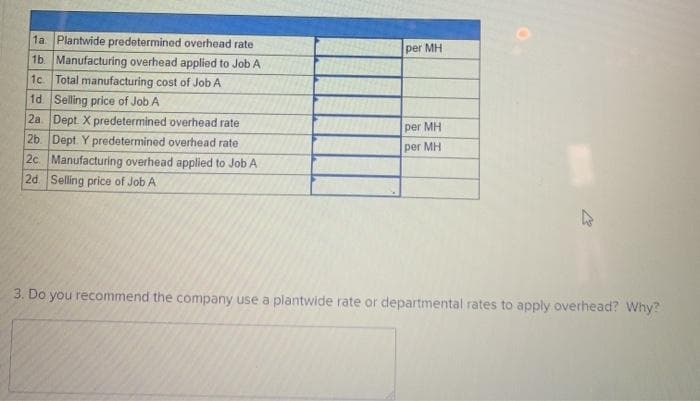

Transcribed Image Text:1a Plantwide predetermined overhead rate

per MH

1b. Manufacturing overhead applied to Job A

1c Total manufacturing cost of Job A

1d. Selling price of Job A

2a Dept. X predetermined overhead rate

2b. Dept. Y predetermined overhead rate

2c Manufacturing overhead applied to Job A

2d. Selling price of Job A

per MH

per MH

3. Do you recommend the company use a plantwide rate or departmental rates to apply overhead? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning