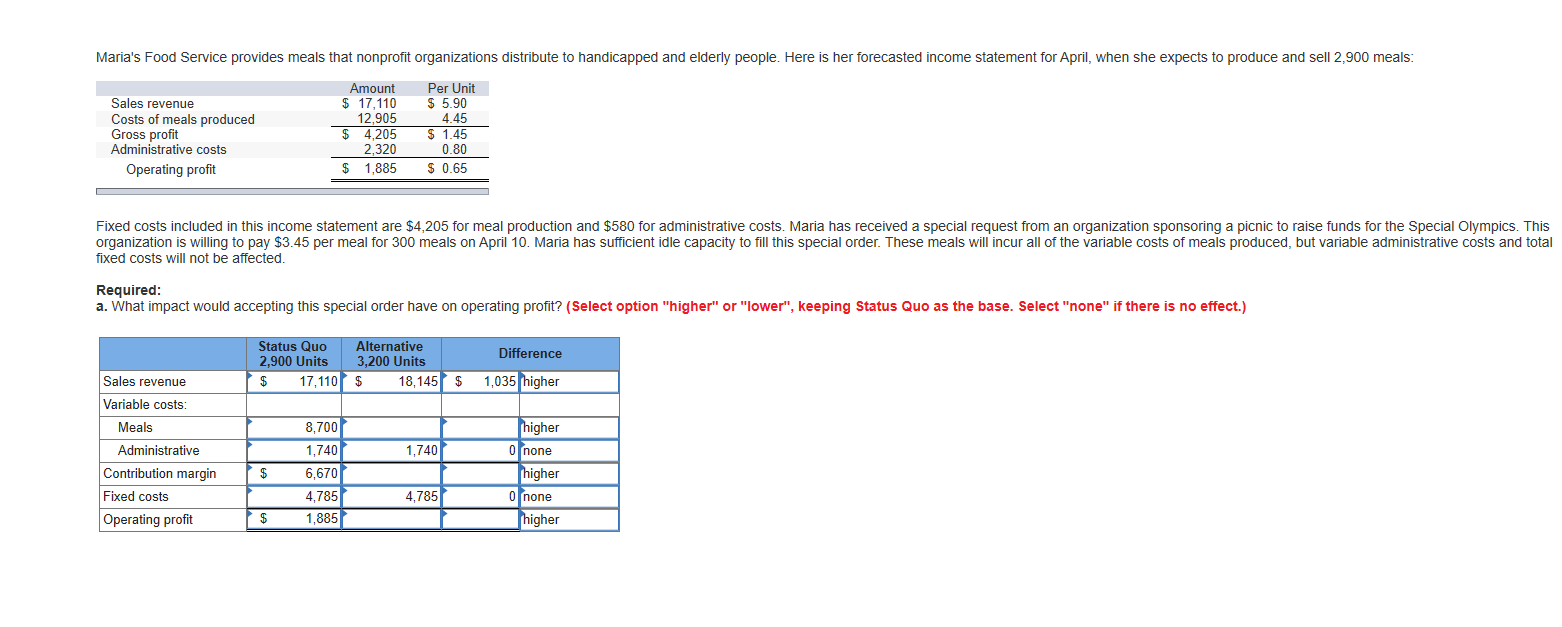

Maria's Food Service provides meals that nonprofit organizations distribute to handicapped and elderly people. Here is her forecasted income statement for April, when she expects to produce and sell 2,900 meals: Amount $ 17,110 12,905 $ 4,205 Per Unit $ 5.90 4.45 $ 1.45 0.80 Sales revenue Costs of meals produced Gross profit Administrative costs 2,320 $ 0.65 $ 1,885 Operating profit Fixed costs included in this income statement are $4,205 for meal production and $580 for administrative costs. Maria has received a special request from an organization sponsoring a picnic to raise funds for the Special Olympics. This organization is willing to pay $3.45 per meal for 300 meals on April 10. Maria has sufficient idle capacity to fill this special order. These meals will incur all of the variable costs of meals produced, but variable administrative costs and total fixed costs will not be affected. Required: a. What impact would accepting this special order have on operating profit? (Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) Status Quo 2.900 Units Alternative 3,200 Units Difference 1,035 higher 17,110 $ 18,145 $ Sales revenue Variable costs: higher Meals 8,700 O none Administrative 1,740 1,740 higher Contribution margin 2$ 6,670 4,785 O none Fixed costs 4,785 1,885 higher Operating profit

Maria's Food Service provides meals that nonprofit organizations distribute to handicapped and elderly people. Here is her forecasted income statement for April, when she expects to produce and sell 2,900 meals: Amount $ 17,110 12,905 $ 4,205 Per Unit $ 5.90 4.45 $ 1.45 0.80 Sales revenue Costs of meals produced Gross profit Administrative costs 2,320 $ 0.65 $ 1,885 Operating profit Fixed costs included in this income statement are $4,205 for meal production and $580 for administrative costs. Maria has received a special request from an organization sponsoring a picnic to raise funds for the Special Olympics. This organization is willing to pay $3.45 per meal for 300 meals on April 10. Maria has sufficient idle capacity to fill this special order. These meals will incur all of the variable costs of meals produced, but variable administrative costs and total fixed costs will not be affected. Required: a. What impact would accepting this special order have on operating profit? (Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) Status Quo 2.900 Units Alternative 3,200 Units Difference 1,035 higher 17,110 $ 18,145 $ Sales revenue Variable costs: higher Meals 8,700 O none Administrative 1,740 1,740 higher Contribution margin 2$ 6,670 4,785 O none Fixed costs 4,785 1,885 higher Operating profit

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 18E: Lakeesha Barnett owns and operates a package mailing store in a college town. Her store, Send It...

Related questions

Question

Alternative 3,200 units meals

Transcribed Image Text:Maria's Food Service provides meals that nonprofit organizations distribute to handicapped and elderly people. Here is her forecasted income statement for April, when she expects to produce and sell 2,900 meals:

Amount

$ 17,110

12,905

$ 4,205

Per Unit

$ 5.90

4.45

$ 1.45

0.80

Sales revenue

Costs of meals produced

Gross profit

Administrative costs

2,320

$ 0.65

$ 1,885

Operating profit

Fixed costs included in this income statement are $4,205 for meal production and $580 for administrative costs. Maria has received a special request from an organization sponsoring a picnic to raise funds for the Special Olympics. This

organization is willing to pay $3.45 per meal for 300 meals on April 10. Maria has sufficient idle capacity to fill this special order. These meals will incur all of the variable costs of meals produced, but variable administrative costs and total

fixed costs will not be affected.

Required:

a. What impact would accepting this special order have on operating profit? (Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.)

Status Quo

2.900 Units

Alternative

3,200 Units

Difference

1,035 higher

17,110 $

18,145 $

Sales revenue

Variable costs:

higher

Meals

8,700

O none

Administrative

1,740

1,740

higher

Contribution margin

2$

6,670

4,785

O none

Fixed costs

4,785

1,885

higher

Operating profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College