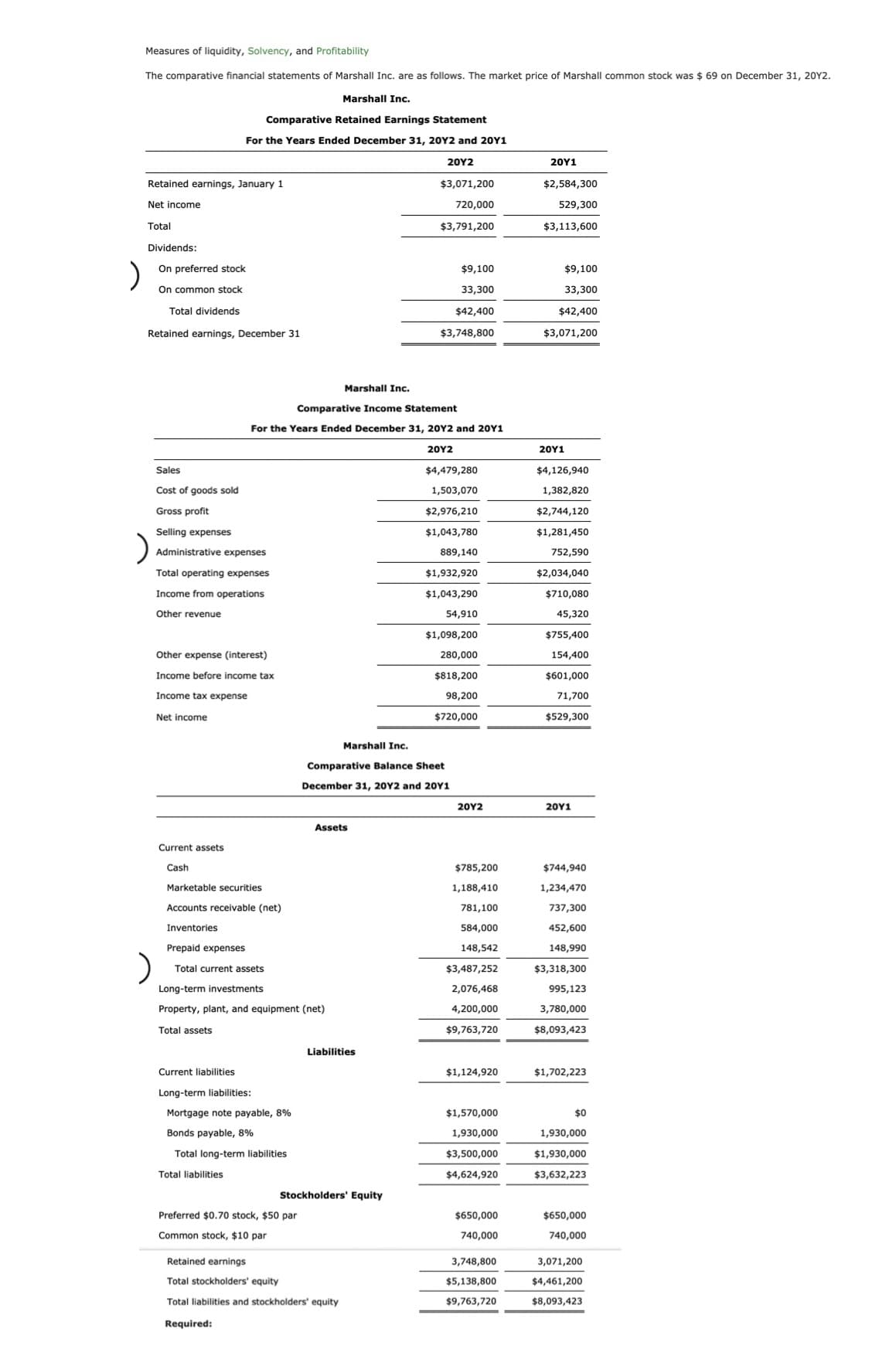

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 69 on December 31, 2 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Retained earnings, January 1 $3,071,200 $2,584,300 Net income 720,000 529,300 Total $3,791,200 $3,113,600 Dividends: On preferred stock $9,100 $9,100 On common stock 33,300 33,300 Total dividends $42,400 $42,400 Retained earnings, December 31 $3,748,800 $3,071,200 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales $4,479,280 $4,126,940 Cost of goods sold 1,503,070 1,382,820 Gross profit $2,976,210 $2,744,120 Selling expenses $1,043,780 $1,281,450 Administrative expenses 889,140 752,590 Total operating expenses $1,932,920 $2,034,040 Income from operations $1,043,290 $710,080 Other revenue 54,910 45,320 $1,098,200 $755,400 Other expense (interest) 280,000 154,400 Income before income tax $818,200 $601,000 Income tax expense 98,200 71,700 $720,000 $529,300 Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Assets Current assets Cash $785,200 $744,940 Marketable securities 1,188,410 1,234,470 Accounts receivable (net) 781,100 737,300 Inventories 584,000 452,600 Prepaid expenses 148,542 148,990 Total current assets $3,487,252 $3,318,300 Long-term investments 2,076,468 995,123 Property, plant, and equipment (net) 4,200,000 3,780,000 Total assets $9,763,720 $8,093,423 Liabilities Current liabilities $1,124,920 $1,702,223 Long-term liabilities: Mortgage note payable, 8% $1,570,000 $0 Bonds payable, 8% 1,930,000 1,930,000 Total long-term liabilities $3,500,000 $1,930,000 Total liabilities $4,624,920 $3,632,223 Stockholders' Equity Preferred $0.70 stock, $50 par $650,000 $650,000 Common stock, $10 par 740,000 740,000 Retained earnings 3,748,800 3,071,200 Total stockholders' equity $5,138,800 $4,461,200 Total liabilities and stockholders' equity $9,763,720 $8,093,423 Required:

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 69 on December 31, 2 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Retained earnings, January 1 $3,071,200 $2,584,300 Net income 720,000 529,300 Total $3,791,200 $3,113,600 Dividends: On preferred stock $9,100 $9,100 On common stock 33,300 33,300 Total dividends $42,400 $42,400 Retained earnings, December 31 $3,748,800 $3,071,200 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales $4,479,280 $4,126,940 Cost of goods sold 1,503,070 1,382,820 Gross profit $2,976,210 $2,744,120 Selling expenses $1,043,780 $1,281,450 Administrative expenses 889,140 752,590 Total operating expenses $1,932,920 $2,034,040 Income from operations $1,043,290 $710,080 Other revenue 54,910 45,320 $1,098,200 $755,400 Other expense (interest) 280,000 154,400 Income before income tax $818,200 $601,000 Income tax expense 98,200 71,700 $720,000 $529,300 Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Assets Current assets Cash $785,200 $744,940 Marketable securities 1,188,410 1,234,470 Accounts receivable (net) 781,100 737,300 Inventories 584,000 452,600 Prepaid expenses 148,542 148,990 Total current assets $3,487,252 $3,318,300 Long-term investments 2,076,468 995,123 Property, plant, and equipment (net) 4,200,000 3,780,000 Total assets $9,763,720 $8,093,423 Liabilities Current liabilities $1,124,920 $1,702,223 Long-term liabilities: Mortgage note payable, 8% $1,570,000 $0 Bonds payable, 8% 1,930,000 1,930,000 Total long-term liabilities $3,500,000 $1,930,000 Total liabilities $4,624,920 $3,632,223 Stockholders' Equity Preferred $0.70 stock, $50 par $650,000 $650,000 Common stock, $10 par 740,000 740,000 Retained earnings 3,748,800 3,071,200 Total stockholders' equity $5,138,800 $4,461,200 Total liabilities and stockholders' equity $9,763,720 $8,093,423 Required:

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.17P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

I need help solving this

Transcribed Image Text:Measures of liquidity, Solvency, and Profitability

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 69 on December 31, 2

Marshall Inc.

Comparative Retained Earnings Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Retained earnings, January 1

$3,071,200

$2,584,300

Net income

720,000

529,300

Total

$3,791,200

$3,113,600

Dividends:

On preferred stock

$9,100

$9,100

On common stock

33,300

33,300

Total dividends

$42,400

$42,400

Retained earnings, December 31

$3,748,800

$3,071,200

Marshall Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Sales

$4,479,280

$4,126,940

Cost of goods sold

1,503,070

1,382,820

Gross profit

$2,976,210

$2,744,120

Selling expenses

$1,043,780

$1,281,450

Administrative expenses

889,140

752,590

Total operating expenses

$1,932,920

$2,034,040

Income from operations

$1,043,290

$710,080

Other revenue

54,910

45,320

$1,098,200

$755,400

Other expense (interest)

280,000

154,400

Income before income tax

$818,200

$601,000

Income tax expense

98,200

71,700

$720,000

$529,300

Marshall Inc.

Comparative Balance Sheet

December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Assets

Current assets

Cash

$785,200

$744,940

Marketable securities

1,188,410

1,234,470

Accounts receivable (net)

781,100

737,300

Inventories

584,000

452,600

Prepaid expenses

148,542

148,990

Total current assets

$3,487,252

$3,318,300

Long-term investments

2,076,468

995,123

Property, plant, and equipment (net)

4,200,000

3,780,000

Total assets

$9,763,720

$8,093,423

Liabilities

Current liabilities

$1,124,920

$1,702,223

Long-term liabilities:

Mortgage note payable, 8%

$1,570,000

$0

Bonds payable, 8%

1,930,000

1,930,000

Total long-term liabilities

$3,500,000

$1,930,000

Total liabilities

$4,624,920

$3,632,223

Stockholders' Equity

Preferred $0.70 stock, $50 par

$650,000

$650,000

Common stock, $10 par

740,000

740,000

Retained earnings

3,748,800

3,071,200

Total stockholders' equity

$5,138,800

$4,461,200

Total liabilities and stockholders' equity

$9,763,720

$8,093,423

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning