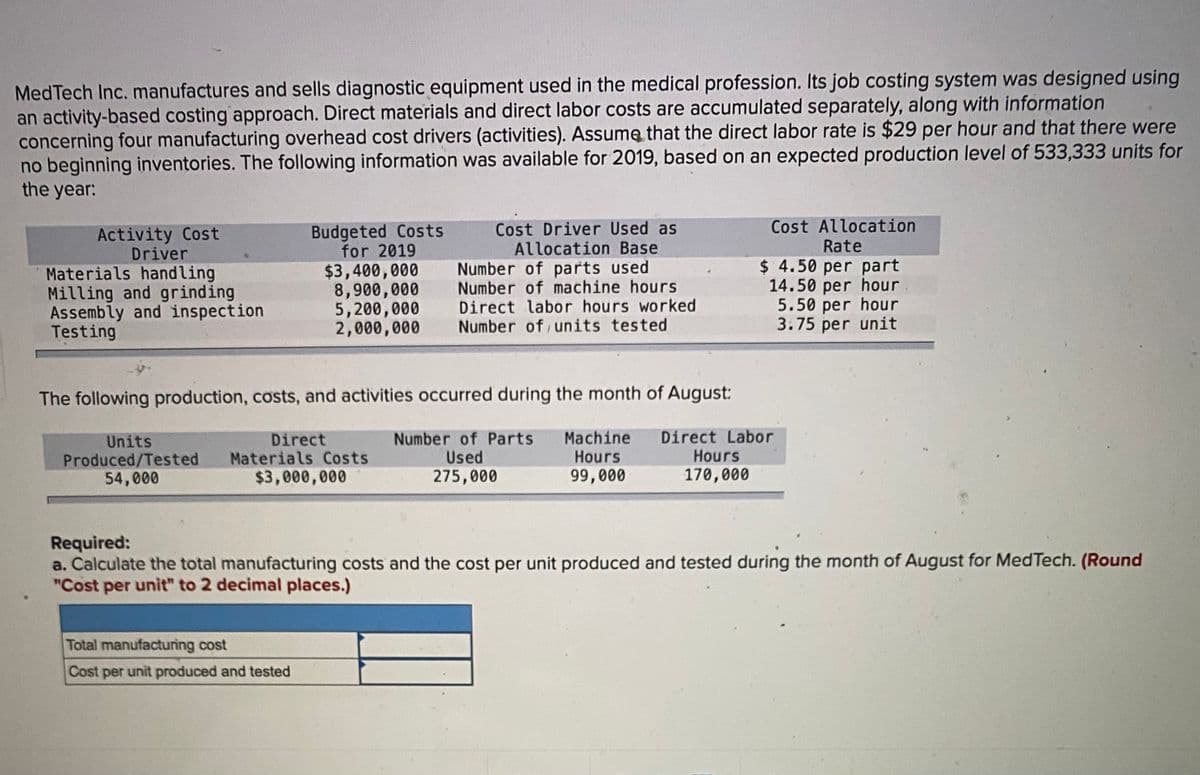

MedTech Inc. manufactures and sells diagnostic equipment used in the medical profession. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning four manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $29 per hour and that there were no beginning inventories. The following information was available for 2019, based on an expected production level of 533,333 units for the year: Budgeted Costs for 2019 $3,400,000 8,900,000 5,200,000 2,000,000 Cost Driver Used as Allocation Base Number of parts used Number of machine hours Direct labor hours worked Number of units tested Cost Allocation Rate $ 4.50 per part 14.50 per hour 5.50 per hour 3.75 per unit Activity Cost Driver Materials handling Milling and grinding Assembly and inspection Testing The following production, costs, and activities occurred during the month of August: Units Produced/Tested 54,000 Direct Materials Costs $3,000,000 Number of Parts Used 275,000 Machine Hours 99,000 Direct Labor Hours 170,000

MedTech Inc. manufactures and sells diagnostic equipment used in the medical profession. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information concerning four manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $29 per hour and that there were no beginning inventories. The following information was available for 2019, based on an expected production level of 533,333 units for the year: Budgeted Costs for 2019 $3,400,000 8,900,000 5,200,000 2,000,000 Cost Driver Used as Allocation Base Number of parts used Number of machine hours Direct labor hours worked Number of units tested Cost Allocation Rate $ 4.50 per part 14.50 per hour 5.50 per hour 3.75 per unit Activity Cost Driver Materials handling Milling and grinding Assembly and inspection Testing The following production, costs, and activities occurred during the month of August: Units Produced/Tested 54,000 Direct Materials Costs $3,000,000 Number of Parts Used 275,000 Machine Hours 99,000 Direct Labor Hours 170,000

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 1MAD: Antolini Enterprises produces mens sports coats that are sold by popular department stores. Each...

Related questions

Question

hello I need help please

Transcribed Image Text:MedTech Inc. manufactures and sells diagnostic equipment used in the medical profession. Its job costing system was designed using

an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with information

concerning four manufacturing overhead cost drivers (activities). Assume that the direct labor rate is $29 per hour and that there were

no beginning inventories. The following information was available for 2019, based on an expected production level of 533,333 units for

the year:

Cost Driver Used as

Allocation Base

Number of parts used

Number of machine hours

Direct labor hours worked

Number of units tested

Cost Allocation

Rate

$ 4.50 per part

14.50 per hour

5.50 per hour

3.75 per unit

Activity Cost

Driver

Budgeted Costs

for 2019

Materials handling

Milling and grinding

Assembly and inspection

Testing

$3,400,000

8,900,000

5,200,000

2,000,000

The following production, costs, and activities occurred during the month of August:

Units

Produced/Tested

54,000

Direct

Materials Costs

$3,000,000

Number of Parts

Used

275,000

Machine

Hours

Direct Labor

Hours

99,000

170,000

Required:

a. Calculate the total manufacturing costs and the cost per unit produced and tested during the month of August for MedTech. (Round

"Cost per unit" to 2 decimal places.)

Total manufacturing cost

Cost per unit produced and tested

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,