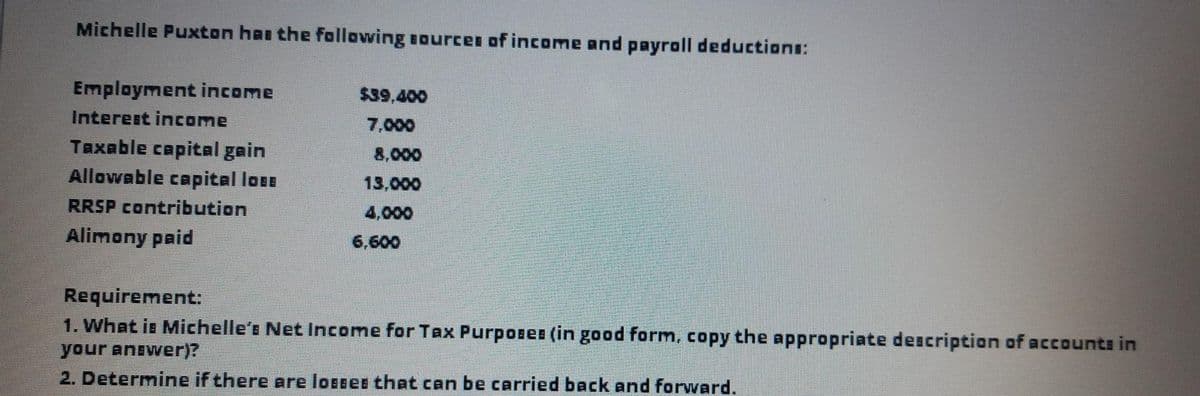

Michelle Puxton has the fallowing sources of income and payroll deductions: Employment income $39,400 Interent income 7,000 Taxable capital gain Allowable capital lose 8,000 13,000 RRSP contribution 4,000 Alimony paid 6,600 Requirement: 1. What is Michelle's Net Income for Tax Purposes (in good form, copy the appropriate description of accounts in your answer)? 2. Determine if there are losses that can be carried back and forward.

Michelle Puxton has the fallowing sources of income and payroll deductions: Employment income $39,400 Interent income 7,000 Taxable capital gain Allowable capital lose 8,000 13,000 RRSP contribution 4,000 Alimony paid 6,600 Requirement: 1. What is Michelle's Net Income for Tax Purposes (in good form, copy the appropriate description of accounts in your answer)? 2. Determine if there are losses that can be carried back and forward.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

100%

Transcribed Image Text:Michelle Puxton has the following Bourcer of income and payroll deductions:

Employment income

$39,400

Interest income

7,000

Taxable capital gain

Allowable capital lose

8,000

13,000

RRSP contribution

4,000

Alimony paid

6,600

Requirement:

1. What is Michelle's Net Income for Tax Purposes (in good form, copy the appropriate description of accounts in

your anewer)?

2. Determine if there are losses that can be carried back and forward.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT