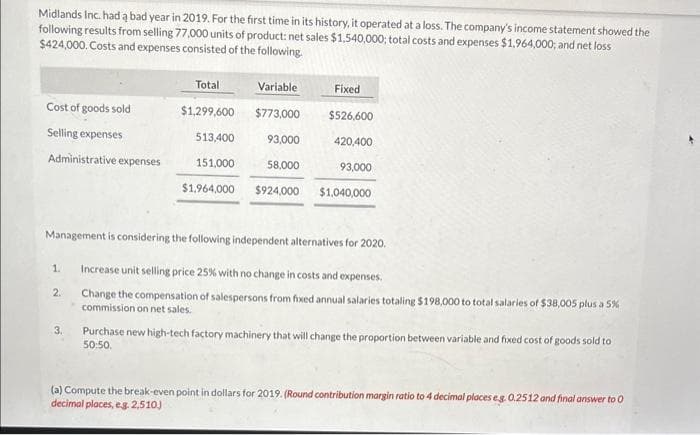

Midlands Inc. had a bad year in 2019. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 77,000 units of product: net sales $1.540,000; total costs and expenses $1,964,000; and net loss $424,000. Costs and expenses consisted of the following. Cost of goods sold Selling expenses Administrative expenses Manager Total Variable $1,299,600 $773,000 513,400 93,000 151,000 58,000 $1,964,000 $924,000 Fixed $526,600 420,400 93,000 $1,040,000

Midlands Inc. had a bad year in 2019. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 77,000 units of product: net sales $1.540,000; total costs and expenses $1,964,000; and net loss $424,000. Costs and expenses consisted of the following. Cost of goods sold Selling expenses Administrative expenses Manager Total Variable $1,299,600 $773,000 513,400 93,000 151,000 58,000 $1,964,000 $924,000 Fixed $526,600 420,400 93,000 $1,040,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 14E: For each of the following independent situations, calculate the missing values: 1. The Belen plant...

Related questions

Question

Please help me with all answers thanku

Transcribed Image Text:Midlands Inc. had a bad year in 2019. For the first time in its history, it operated at a loss. The company's income statement showed the

following results from selling 77,000 units of product: net sales $1.540,000; total costs and expenses $1,964,000; and net loss

$424,000. Costs and expenses consisted of the following.

Cost of goods sold

Selling expenses

Administrative expenses

1.

2.

Total

$1,299,600

513,400

3.

151,000

Variable

$773,000

93,000

58,000

Management is considering the following independent alternatives for 2020.

Increase unit selling price 25% with no change in costs and expenses.

Change the compensation of salespersons from fixed annual salaries totaling $198,000 to total salaries of $38,005 plus a 5%

commission on net sales.

$1,964,000 $924,000

Fixed

$526,600

420,400

93,000

$1,040,000

Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to

50:50.

(a) Compute the break-even point in dollars for 2019. (Round contribution margin ratio to 4 decimal places eg. 0.2512 and final answer to 0

decimal places, e.g. 2,510)

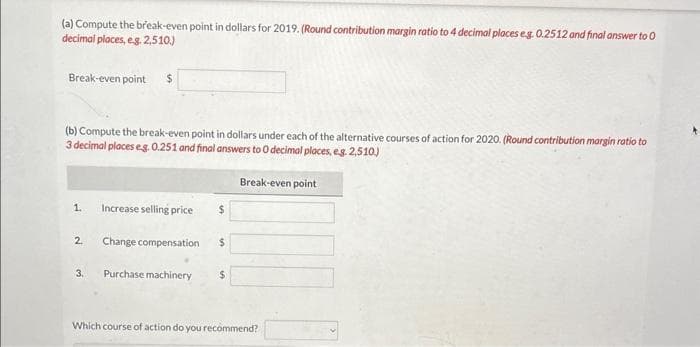

Transcribed Image Text:(a) Compute the break-even point in dollars for 2019. (Round contribution margin ratio to 4 decimal places eg. 0.2512 and final answer to O

decimal places, e.g. 2,510.)

Break-even point

(b) Compute the break-even point in dollars under each of the alternative courses of action for 2020. (Round contribution margin ratio to

3 decimal places eg. 0.251 and final answers to O decimal places, eg. 2,510.)

1.

2

$

3.

Increase selling price $

Change compensation

Purchase machinery

$

$

Break-even point

Which course of action do you recommend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning