1. If SnowDelights cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level? 2. Assume SnowDelights has found ways to cut its fixed costs to $27,000,000. What is its new target variable cost per skier/snowboarder?

1. If SnowDelights cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level? 2. Assume SnowDelights has found ways to cut its fixed costs to $27,000,000. What is its new target variable cost per skier/snowboarder?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 25P

Related questions

Question

Complete all requirements

<><>

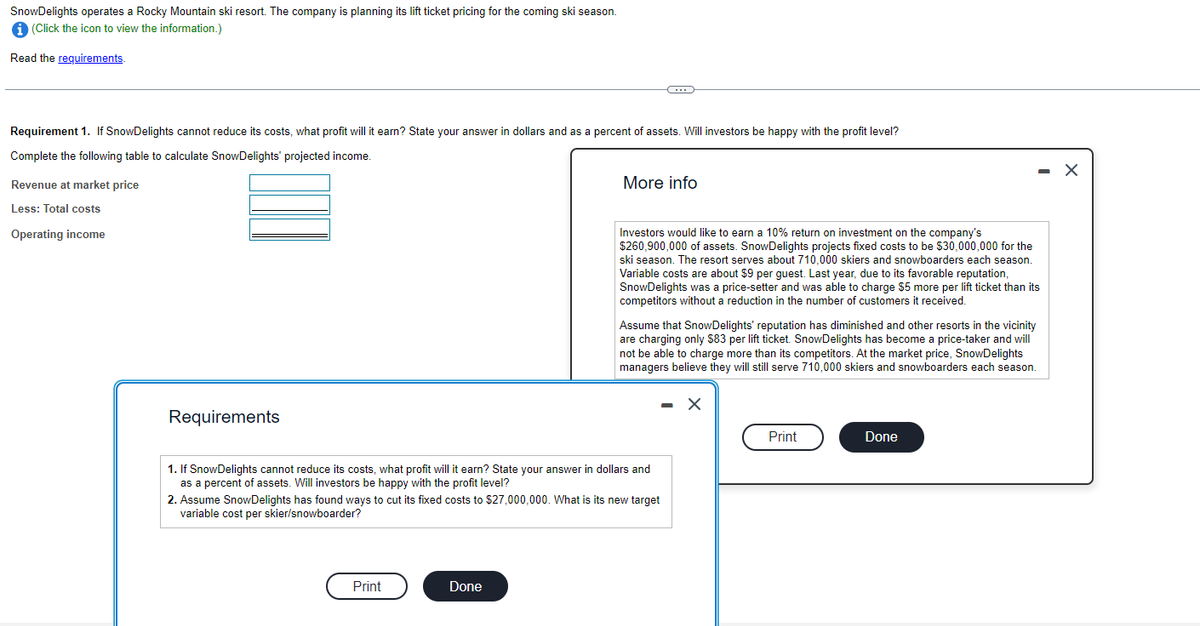

Transcribed Image Text:SnowDelights operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for the coming ski season.

i (Click the icon to view the information.)

Read the requirements.

Requirement 1. If SnowDelights cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level?

Complete the following table to calculate SnowDelights' projected income.

Revenue at market price

Less: Total costs

Operating income

Requirements

Print

C

More info

1. If SnowDelights cannot reduce its costs, what profit will it earn? State your answer in dollars and

as a percent of assets. Will investors be happy with the profit level?

Done

Investors would like to earn a 10% return on investment on the company's

$260,900,000 of assets. SnowDelights projects fixed costs to be $30,000,000 for the

ski season. The resort serves about 710,000 skiers and snowboarders each season.

Variable costs are about $9 per guest. Last year, due to its favorable reputation,

SnowDelights was a price-setter and was able to charge $5 more per lift ticket than its

competitors without a reduction in the number of customers it received.

2. Assume SnowDelights has found ways to cut its fixed costs to $27,000,000. What is its new target

variable cost per skier/snowboarder?

Assume that SnowDelights' reputation has diminished and other resorts in the vicinity

are charging only $83 per lift ticket. SnowDelights has become a price-taker and will

not be able to charge more than its competitors. At the market price, SnowDelights

managers believe they will still serve 710,000 skiers and snowboarders each season.

X

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning