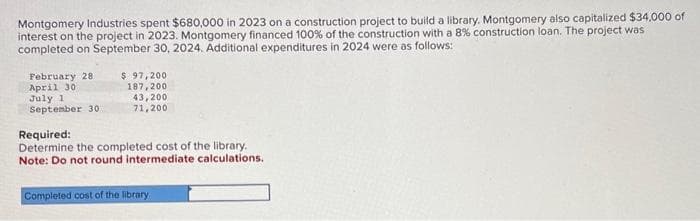

Montgomery Industries spent $680,000 in 2023 on a construction project to build a library. Montgomery also capitalized $34,000 of interest on the project in 2023. Montgomery financed 100% of the construction with a 8% construction loan. The project was completed on September 30, 2024. Additional expenditures in 2024 were as follows: February 28. April 30 July 1 September 30 $ 97,200 187,200 43,200 71,200 Required: Determine the completed cost of the library. Note: Do not round intermediate calculations. Completed cost of the library

Montgomery Industries spent $680,000 in 2023 on a construction project to build a library. Montgomery also capitalized $34,000 of interest on the project in 2023. Montgomery financed 100% of the construction with a 8% construction loan. The project was completed on September 30, 2024. Additional expenditures in 2024 were as follows: February 28. April 30 July 1 September 30 $ 97,200 187,200 43,200 71,200 Required: Determine the completed cost of the library. Note: Do not round intermediate calculations. Completed cost of the library

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 46P

Related questions

Question

(J)

Transcribed Image Text:Montgomery Industries spent $680,000 in 2023 on a construction project to build a library. Montgomery also capitalized $34,000 of

interest on the project in 2023. Montgomery financed 100% of the construction with a 8% construction loan. The project was

completed on September 30, 2024. Additional expenditures in 2024 were as follows:

February 28.

April 30

July 1

September 30

$ 97,200

187,200

43,200

71,200

Required:

Determine the completed cost of the library.

Note: Do not round intermediate calculations.

Completed cost of the library

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning