Morton Company's contribution format income statement for last month is given below. Sales (46,809 units × $21 per unit) Variable expenses Contribution nargin Fixed expenses $ 96,000 676, 200 289, 890 231,840 Net operating income $ 57,960 The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits.

Morton Company's contribution format income statement for last month is given below. Sales (46,809 units × $21 per unit) Variable expenses Contribution nargin Fixed expenses $ 96,000 676, 200 289, 890 231,840 Net operating income $ 57,960 The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 36P: Faldo Company produces a single product. The projected income statement for the coming year, based...

Related questions

Question

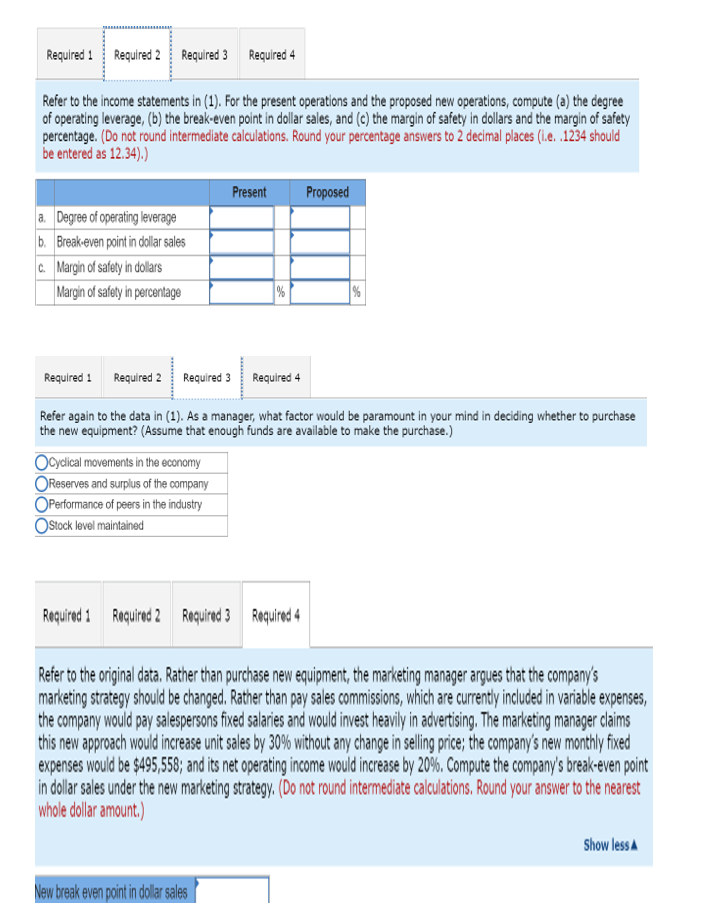

Transcribed Image Text:Required 1

Required 2 Required 3 Required 4

Refer to the income statements in (1). For the present operations and the proposed new operations, compute (a) the degree

of operating leverage, (b) the break-even point in dollar sales, and (c) the margin of safety in dollars and the margin of safety

percentage. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places (l.e. .1234 should

be entered as 12.34).)

Present

Proposed

a. Degree of operating leverage

b. Break-even point in dollar sales

c. Margin of safety in dollars

Margin of safety in percentage

Required 1

Required 2 Required 3 Required 4

Refer again to the data in (1). As a manager, what factor would be paramount in your mind in deciding whether to purchase

the new equipment? (Assume that enough funds are available to make the purchase.)

Ocyclical movements in the economy

OReserves and surplus of the company

OPerformanoce of peers in the industry

OStock level maintained

Required 1

Roquirad 2 Roquirad 3 Roaquired 4

Refer to the original data. Rather than purchase new equipment, the marketing manager argues that the company's

marketing strategy should be changed. Rather than pay sales commissions, which are currently included in variable expenses,

the company would pay salespersons fixed salaries and would invest heavily in advertising. The marketing manager claims

this new approach would increase unit sales by 30% without any change in selling price; the company's new monthly fixed

expenses would be $495,558; and its net operating income would increase by 20%. Compute the company's break-even point

in dollar sales under the new marketing strategy, (Do not round intermediate calculations. Round your answer to the nearest

whole dollar amount.)

Show less A

New break even point in dolar ales

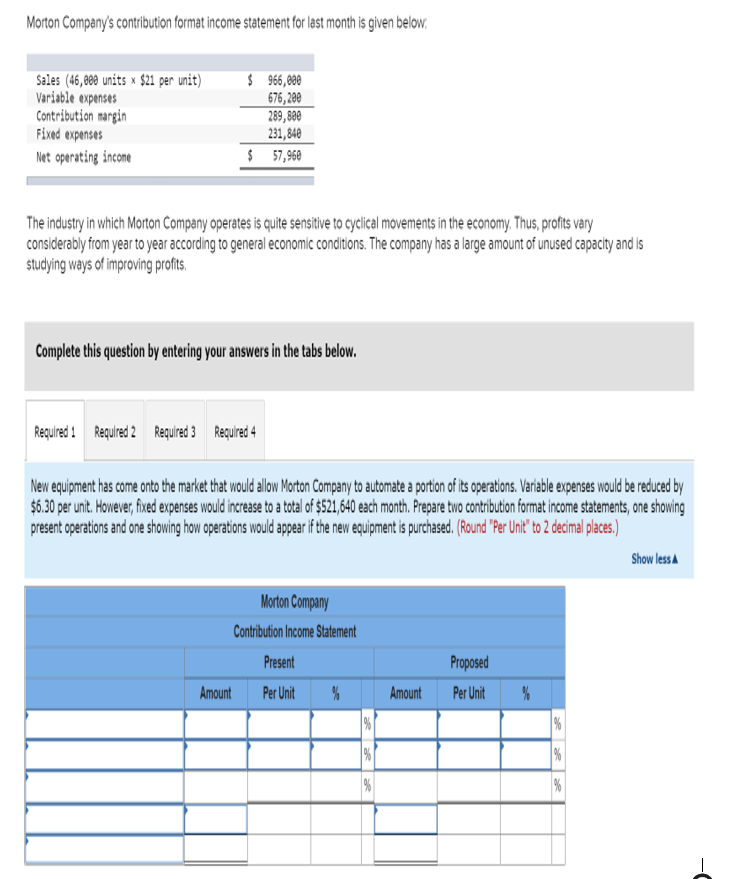

Transcribed Image Text:Morton Company's contribution format income statement for last month is given below.

Sales (46,000 units x $21 per unit)

Variable expenses

Contribution margin

Fixed expenses

$ 966,000

676, 200

289, 890

231, 840

Net operating incone

$ 57,960

The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary

considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is

studying ways of improving profits.

Complete this question by entering your answers in the tabs below.

Requlred 1 Requlred 2 Required 3 Required 4

New equipment has come onto the market that would alow Morton Company to automate a portion of ts operations. Varible expenses would be reduced by

$6.30 per unt. Hovever fived expenses would increase to a ota of $2,64 each month. Preare two contributon format income statements, one showing

present operations and one showing how operations would appear i the new equipment is purchased. (Round "Per Unt" to 2 decimal places,.)

Show less a

Morton Company

Contribution Income Statement

Present

Proposed

Amount

Per Unit

%

Amount

Per Unit

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College