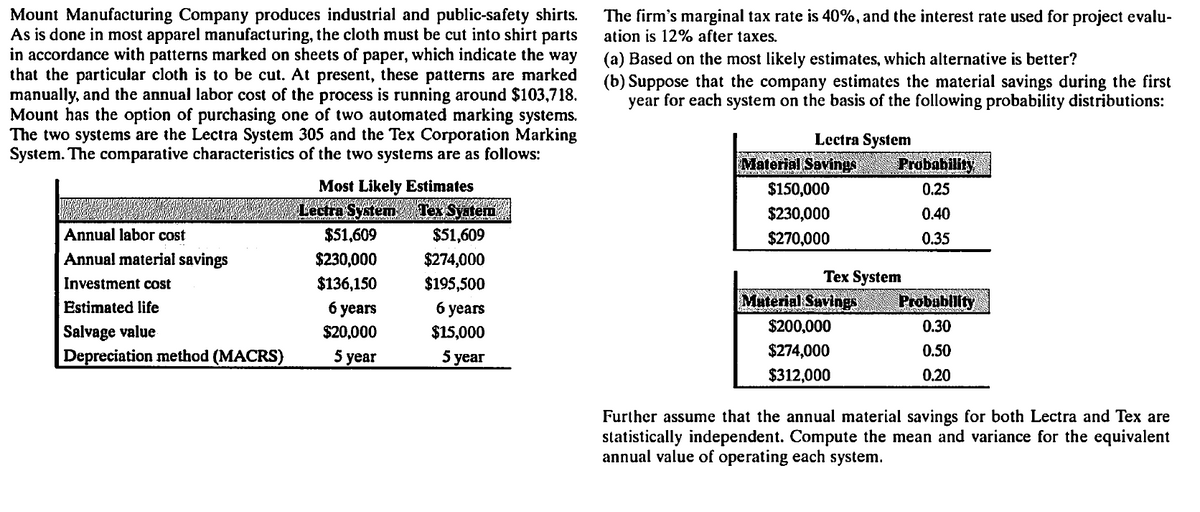

Mount Manufacturing Company produces industrial and public-safety shirts. As is done in most apparel manufacturing, the cloth must be cut into shirt parts in accordance with patterns marked on sheets of paper, which indicate the way that the particular cloth is to be cut. At present, these patterns are marked manually, and the annual labor cost of the process is running around $103,718. Mount has the option of purchasing one of two automated marking systems. The two systems are the Lectra System 305 and the Tex Corporation Marking System. The comparative characteristics of the two systems are as follows: The firm's marginal tax rate is 40%, and the interest rate used for project evalu- ation is 12% after taxes. (a) Based on the most likely estimates, which alternative is better? (b) Suppose that the company estimates the material savings during the first year for each system on the basis of the following probability distributions: Lectra System Material Savings Probability Most Likely Estimates $150,000 0.25 Lectra System Tex Syatem $230,000 0.40 Annual labor cost $51,609 $51,609 $270,000 0.35 Annual material savings $230,000 $274,000 Теx System Material Suvings Investment cost $136,150 $195,500 Estimated life 6 уears б уеars Probubliity $200,000 0.30 Salvage value Depreciation method (MACRS) $20,000 $15,000 5 year 5 year $274,000 0.50 $312,000 0.20 Further assume that the annual material savings for both Lectra and Tex are statistically independent. Compute the mean and variance for the equivalent annual value of operating each system.

Mount Manufacturing Company produces industrial and public-safety shirts. As is done in most apparel manufacturing, the cloth must be cut into shirt parts in accordance with patterns marked on sheets of paper, which indicate the way that the particular cloth is to be cut. At present, these patterns are marked manually, and the annual labor cost of the process is running around $103,718. Mount has the option of purchasing one of two automated marking systems. The two systems are the Lectra System 305 and the Tex Corporation Marking System. The comparative characteristics of the two systems are as follows: The firm's marginal tax rate is 40%, and the interest rate used for project evalu- ation is 12% after taxes. (a) Based on the most likely estimates, which alternative is better? (b) Suppose that the company estimates the material savings during the first year for each system on the basis of the following probability distributions: Lectra System Material Savings Probability Most Likely Estimates $150,000 0.25 Lectra System Tex Syatem $230,000 0.40 Annual labor cost $51,609 $51,609 $270,000 0.35 Annual material savings $230,000 $274,000 Теx System Material Suvings Investment cost $136,150 $195,500 Estimated life 6 уears б уеars Probubliity $200,000 0.30 Salvage value Depreciation method (MACRS) $20,000 $15,000 5 year 5 year $274,000 0.50 $312,000 0.20 Further assume that the annual material savings for both Lectra and Tex are statistically independent. Compute the mean and variance for the equivalent annual value of operating each system.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 26E: Ingles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other...

Related questions

Question

Transcribed Image Text:Mount Manufacturing Company produces industrial and public-safety shirts.

As is done in most apparel manufacturing, the cloth must be cut into shirt parts

in accordance with patterns marked on sheets of paper, which indicate the way

that the particular cloth is to be cut. At present, these patterns are marked

manually, and the annual labor cost of the process is running around $103,718.

Mount has the option of purchasing one of two automated marking systems.

The two systems are the Lectra System 305 and the Tex Corporation Marking

System. The comparative characteristics of the two systems are as follows:

The firm's marginal tax rate is 40%, and the interest rate used for project evalu-

ation is 12% after taxes.

(a) Based on the most likely estimates, which alternative is better?

(b) Suppose that the company estimates the material savings during the first

year for each system on the basis of the following probability distributions:

Lectra System

Material Savings

Probability

Most Likely Estimates

$150,000

0.25

Lectra System Tex Syatem

$230,000

0.40

Annual labor cost

$51,609

$51,609

$270,000

0.35

Annual material savings

$230,000

$274,000

Теx System

Material Suvings

Investment cost

$136,150

$195,500

Estimated life

6 уears

б уеars

Probubliity

$200,000

0.30

Salvage value

Depreciation method (MACRS)

$20,000

$15,000

5 year

5 year

$274,000

0.50

$312,000

0.20

Further assume that the annual material savings for both Lectra and Tex are

statistically independent. Compute the mean and variance for the equivalent

annual value of operating each system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College