n the problem on excel : 1.What are the decision variables 2.What is the objective functions 3. What are the constraints and explain

n the problem on excel : 1.What are the decision variables 2.What is the objective functions 3. What are the constraints and explain

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 37P

Related questions

Question

In the problem on excel :

1.What are the decision variables

2.What is the objective functions

3. What are the constraints and explain

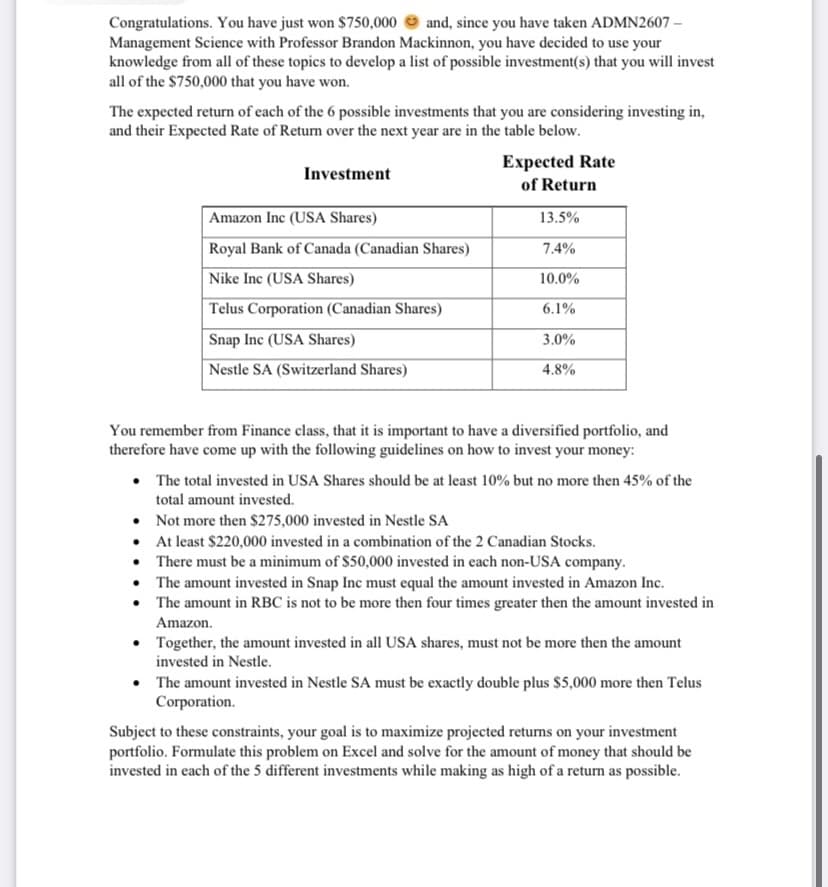

Transcribed Image Text:Congratulations. You have just won $750,000 and, since you have taken ADMN2607-

Management Science with Professor Brandon Mackinnon, you have decided to use your

knowledge from all of these topics to develop a list of possible investment(s) that you will invest

all of the $750,000 that you have won.

The expected return of each of the 6 possible investments that you are considering investing in,

and their Expected Rate of Return over the next year are in the table below.

Investment

Amazon Inc (USA Shares)

Royal Bank of Canada (Canadian Shares)

Nike Inc (USA Shares)

Telus Corporation (Canadian Shares)

Snap Inc (USA Shares)

Nestle SA (Switzerland Shares)

Expected Rate

of Return

13.5%

7.4%

10.0%

6.1%

3.0%

4.8%

You remember from Finance class, that it is important to have a diversified portfolio, and

therefore have come up with the following guidelines on how to invest your money:

• The total invested in USA Shares should be at least 10% but no more then 45% of the

total amount invested.

Not more then $275,000 invested in Nestle SA

• At least $220,000 invested in a combination of the 2 Canadian Stocks.

There must be a minimum of $50,000 invested in each non-USA company.

• The amount invested in Snap Inc must equal the amount invested in Amazon Inc.

The amount in RBC is not to be more then four times greater then the amount invested in

Amazon.

Together, the amount invested in all USA shares, must not be more then the amount

invested in Nestle.

The amount invested in Nestle SA must be exactly double plus $5,000 more then Telus

Corporation.

Subject to these constraints, your goal is to maximize projected returns on your investment

portfolio. Formulate this problem on Excel and solve for the amount of money that should be

invested in each of the 5 different investments while making as high of a return as possible.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,