Lisa has sent through the following information. Can you pull this together with what you have examined already so we can have a tax estimate ready to go. B.1 Calculate Lisa’s Medicare Levy Surcharge. Show all workings. B.2 Calculate Lisa’s Net Tax Payable. Show all workings. Wages (Melbourne employment) - $125,000 net wages, PAYG withheld of $43,000 plus a bonus of $5,000 was paid. Wages (Darwin employment) - $25,000 net wages, PAYG withheld of $1,500 Interest income $1,000 Allowable general deductions $3,300 Allowable specific deductions $1,000 Lisa is single with no private health insurance. Lisa has no reportable fringe benefits or reportable superannuation contributions.

From: Ahmed

Sent: Thursday, 17 September 2020, 11:23AM

Subject: Lisa Eastwood – additional information

Good morning,

Lisa has sent through the following information. Can you pull this together

with what you have examined already so we can have a tax estimate ready

to go.

B.1 Calculate Lisa’s Medicare Levy Surcharge. Show all workings.

B.2 Calculate Lisa’s Net Tax Payable. Show all workings.

Wages (Melbourne employment) - $125,000 net wages, PAYG withheld

of $43,000 plus a bonus of $5,000 was paid.

Wages (Darwin employment) - $25,000 net wages, PAYG withheld of

$1,500

Interest income $1,000

Allowable general deductions $3,300

Allowable specific deductions $1,000

Lisa is single with no private health insurance.

Lisa has no reportable

contributions.

Again, I need this by the end of Friday.

Ahmed.

Senior Accountant

M&M Tax Accountants

As per Australian Taxation, assessees not having personal health insurance cover have to pay Medical Levy Surcharge above a definite income level on their taxable income. The purpose is to encourage the taxpayers to take private health insurance benefits so that the burden on the public medicare system is reduced.

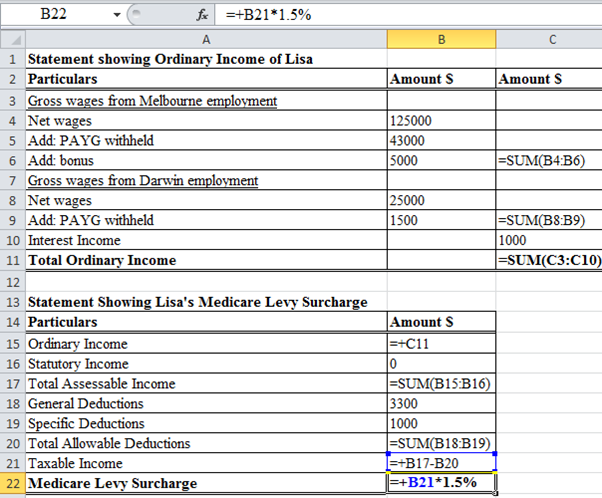

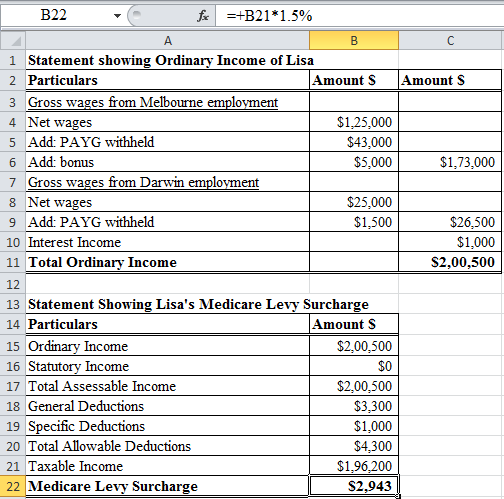

B.1 Lisa’s Medicare Levy Surcharge is calculated as under:

Reference:

Calculation:

Note: Since Lisa's Taxable income falls under the tier 3 bracket and she is a single threshold medical levy surcharge will be 1.5% of total taxable income

Step by step

Solved in 3 steps with 4 images