Natalie is thinking of repaying all amounts outstanding to her grandmother. Recall that Cookie Creations borrowed $2,000 on November 16, 2023, from Natalie's grandmother. Interest on the note is 9% per year, and the note plus interest was to be repaid in 24 months. Recall that a monthly adjusting journal entry was prepared for the months of November 2023 (1/2 month), December 2023, and January 2024. Calculate the interest payable that was accrued and recorded up to January 31, 2024. (Round answer to 0 decimal places, e.g. 125.) Interest payable $ List of Accounts Calculate the total interest expense and interest payable from February 1 to August 31, 2024. (Round answer to 0 decimal places, e.g. 125.) Total interest expense and interest payable $

Natalie is thinking of repaying all amounts outstanding to her grandmother. Recall that Cookie Creations borrowed $2,000 on November 16, 2023, from Natalie's grandmother. Interest on the note is 9% per year, and the note plus interest was to be repaid in 24 months. Recall that a monthly adjusting journal entry was prepared for the months of November 2023 (1/2 month), December 2023, and January 2024. Calculate the interest payable that was accrued and recorded up to January 31, 2024. (Round answer to 0 decimal places, e.g. 125.) Interest payable $ List of Accounts Calculate the total interest expense and interest payable from February 1 to August 31, 2024. (Round answer to 0 decimal places, e.g. 125.) Total interest expense and interest payable $

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

Please do not use Excel. Show your work please.

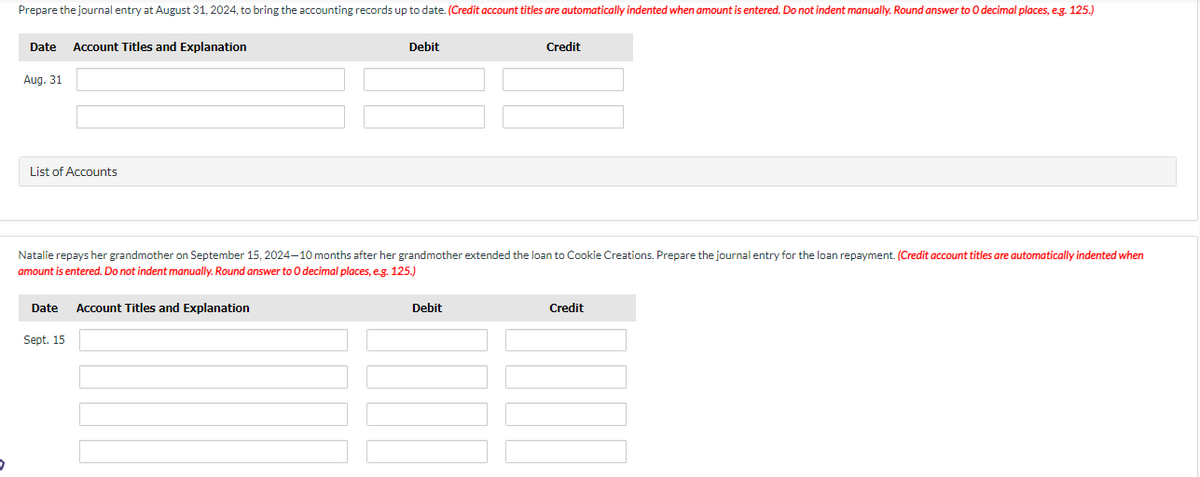

Transcribed Image Text:Prepare the journal entry at August 31, 2024, to bring the accounting records up to date. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answer to O decimal places, e.g. 125.)

Date Account Titles and Explanation

Aug. 31

List of Accounts

Date Account Titles and Explanation

Debit

Natalie repays her grandmother on September 15, 2024-10 months after her grandmother extended the loan to Cookie Creations. Prepare the journal entry for the loan repayment. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. Round answer to O decimal places, e.g. 125.)

Sept. 15

Credit

Debit

Credit

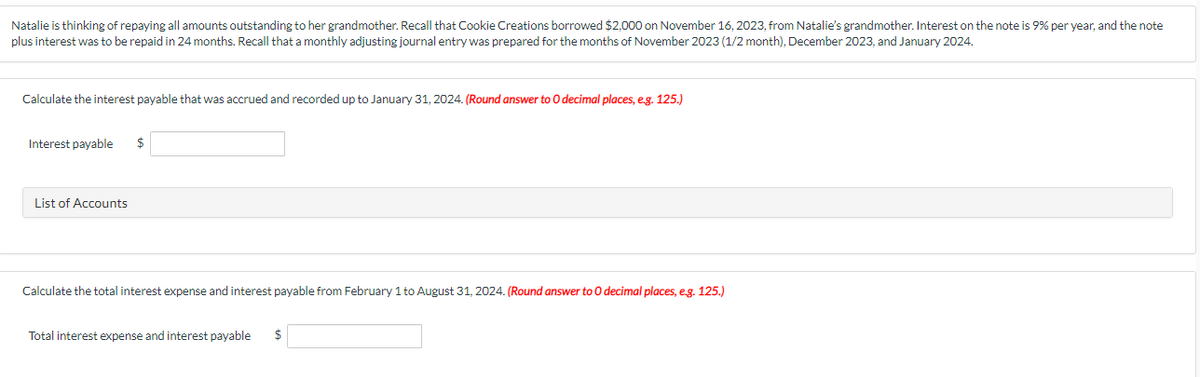

Transcribed Image Text:Natalie is thinking of repaying all amounts outstanding to her grandmother. Recall that Cookie Creations borrowed $2,000 on November 16, 2023, from Natalie's grandmother. Interest on the note is 9% per year, and the note

plus interest was to be repaid in 24 months. Recall that a monthly adjusting journal entry was prepared for the months of November 2023 (1/2 month), December 2023, and January 2024.

Calculate the interest payable that was accrued and recorded up to January 31, 2024. (Round answer to O decimal places, e.g. 125.)

Interest payable $

List of Accounts

Calculate the total interest expense and interest payable from February 1 to August 31, 2024. (Round answer to 0 decimal places, e.g. 125.)

Total interest expense and interest payable $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT