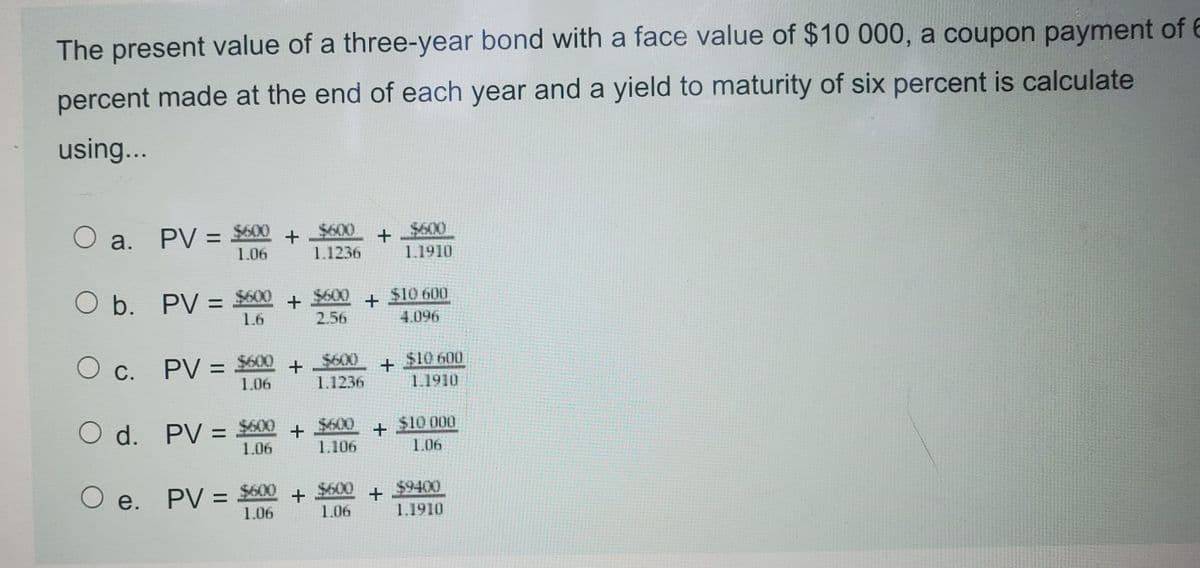

ne present value of a three-year bond with a face value of $10 000, a coupon paymer ercent made at the end of each year and a yield to maturity of six percent is calculate sing... PV = $600 1.06 Oa. $600 $600 1.1236 1.1910 O b. PV = $600 1.6 $600 $10 600 2.56 4.096

Q: I need a basic explanation of John Maynard Keynes work.

A: At the time of Great Depression of the 1930s all the basic existing economic theory was unable to ex...

Q: loans e) The bank also has a stated policy of not allowing the overall ratio of bad debts on all loa...

A: The correct answer is given in the second step.

Q: (c) Is U a homogeneous function? If so, what's its degree? If not, please explain.

A: Given Utility function: U(x,y)=Aaxr+byr1r .... (1) We have to check whether the functio...

Q: The diagram below depicts Lorenz curves for two countries, Gallifrey and Panem. 100% 80% 60% 40% Pan...

A: The Lorenz curve is a graphical representation of the distribution of income or wealth in a country ...

Q: uppose that the market demand for a certain product is given by P=370−2QP=370−2Q, where QQ is total ...

A:

Q: Consider a market in which the demand curve is P = 12 -Q and the supply curve is P = 2 + Q. Suppose ...

A: Demand curve P = 12 -Q Supply curve P = 2 + Q At equilibrium point, demand = supply => 12 -Q = 2 ...

Q: Question 7 The fact that in the USA, a municipal bond could have a lower yield compared to federal g...

A: Municipal bonds are issued by municipal corporations.

Q: Two firms compete as a Stackelberg duopoly. The demand they face is P = 402 - Q. The cost function f...

A:

Q: 18 of 27 The Great Depression of the 1930's and the Great Recession from 2007 to 2009 are two major ...

A: The great Recession and the Great depression are the two major economic downturns in the history.

Q: There always has to be some unemployment, because O there are always some people changing jobs, and ...

A: Unemployment means people are unemployed because they are looking for a job. It means they try to fi...

Q: Table Cost.EX2.2: Data for a Competitive Firm Marginal Marginal Output Cost Revenue (Q) (MC) (MR) 1....

A: Output MC TC MR TR Profit = TR -TC 1 3.5 3.5 7 7 3.5 2 4.5 8 7 14 6 3 5.5 13.5 7 21 7.5 4 6....

Q: Q4: An investor invests $1000 a month, on average, in a stock market security. Because the investor ...

A: Introduction Investor invest $1,000 in a stock market security. He keeps this investment as securiti...

Q: The profit maximizing output level for this firm is

A: Any firm maximizes profit where MR=MC

Q: 185.Suppose the government wanted to impose a tax and wanted the entire burden of the tax to fall on...

A: here we find the correct option as follow,

Q: An investment of $100,000 in safe 10-year corporate bonds yields an average of 9% per year, payable ...

A:

Q: -4. In a discriminating monopoly, the total demand function is P = 100 segmented markets are 2X and ...

A:

Q: Given the following profit function: T=-2Q^2+260Q-4500, Answer the following questions.

A: Profit is the difference between tital revenue and total cost . It is the amount left from the reven...

Q: Consider a town in which only two residents, Alex and Becky, own wells that produce water safe for d...

A: [a] Profit is calculated by taking the difference between total revenue and total cost. Profit = TR ...

Q: A farmer is considering adopting a soil conservation practice that will raise his profits next year ...

A: In order to find the present value, we discount the future cash flows with respect to the interest r...

Q: Briefly define the four dimension of globalization.

A: International ties are forged in business, politics, culture, society, and the environment. Analytic...

Q: Explain what the theory of money is in words and mathematical expressions, and then relate this prop...

A: The quantity theory of money holds that price changes are related to changes in the money supply. It...

Q: 2) Explain the relationship between short run ATC and MC and why ATC is U-shaped in short run?

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any sp...

Q: what is the relationship between wages and robbery?

A: Concept: Wages: In economics, wages refers to the price paid to the labor for the services rendered ...

Q: As more economic development occurs, A. capital accumulation decreases. B. the population growth rat...

A:

Q: People often sell goods (or raffle tickets) as part of a fund raising project. These projects typica...

A: A fundraising project is defined as an event with the objective of raising money for a given cause. ...

Q: ___ are now the largest single component of the supply side of GDP, representing over half of GDP. ...

A: Gross domestic product refers to total goods and services produced within the economy within the giv...

Q: Problem 2 (2 points) Given the demand function P = - QD2 – 2QD + 64, and the supply function P = QS...

A: Given: P = - QD2 – 2QD + 64 P = QS2 – 2QS + 14.

Q: Question 36 Single Cholce PlayOut is an online booking app for using city-wide playgrounds for vario...

A: Answer-

Q: and Cheryl are competitors in a small town and each is trying to decide if it is wrtl advertise. If ...

A: Payoff matrix as follows. Jim Advertise Not Advertise Cheryl Advertise (10,000 10,...

Q: Who did John Maynard Keynes advise with his economic theory?

A: The macroeconomic economic theory of total expenditure in the economy and its consequences on output...

Q: what you see as "your" strengths and shortcomings for becoming a social entrepreneur.This is again e...

A: We show The great thing àbout mistakes is that even if you need to see whàt is around you, your oppo...

Q: Q3. Consider the following tw0-stage game: Stage 1: Player 1 moves first to choose either L or R. St...

A:

Q: The sharp rise in housing prices from 2003 to 2005 was driven by a high level of housing. Select the...

A: Dear student, you have asked multiple questions in a single post. In such a case, I will be answerin...

Q: There are only two brands of tennis balls Tom purchases: "Wilson" and "Penn." The more he purchases ...

A: Here, Tom purchases two types of balls that are "Wilson" and "Penn." Tom can maximize his utility by...

Q: Circle the Nash equilibrium. Network 2 Sitcom Game show Talent show Network 1 Sitcom (55%, 45%) (52%...

A: In other to find the nash equilibrium, underlying the maximum payoff to a player given the action of...

Q: Assume that the Black-Scholes framework holds. Sam has arranged for a shipment of rare wine to be de...

A: Sam is concerned that the dollar may depreciate, causing him to be unable to afford the cost of the ...

Q: Which of the following items is an example of using a public good? O A. playing frisbee with some fr...

A: A public good is a product or service that is made available to all members of a society in economic...

Q: why is the supply chain and the macroeconpmic is important in the businesses in the healthcare

A: A supply chain refers to a network that links a company's suppliers to create and distribute a produ...

Q: L consists of M2 plus all other products that may be transferred into money. Lis the most liquid cat...

A: One definition of a liquid asset is readily convertible into money. Cash is the most significant kin...

Q: Consider a competitive industry with a large number of firms, all of which have identical cost funct...

A: In a competitive market a firm produces output at P=MC Where MC = dC/dY

Q: Problem 4: Consider the two alternatives below and answer the questions: i. A high efficiency turbin...

A: Initial investment on high efficiency turbine=$10000000 Annual operating cost=$1500000 per year Init...

Q: Mays and McCovey are beer-brewing companies that operate in a duopoly (two-firm oligopoly). The dail...

A: Given:- MC of producing can=$1.2 MC=ATC After cartel formation, output will be divided equally May d...

Q: (9) Suppose the market for tennis shoes has one dominant firm and five fringe firms. The market dema...

A:

Q: The Phillips curve describes the relationship between... O a. The unemployment rate and the rate of ...

A: A. W Philips gave the concept of Philips curve which was based on empirical data of UK of around 100...

Q: Suppose the price level and value of the U.S. dollar in year 1 are 1 and $1, respectively. Instruc...

A: Price Level The worth of money decreases as the price level rises. The price level is the average of...

Q: Suppose you have an exponential utility function given by U(x) =1 - exp(-x/R) where, for you, R = 10...

A: The quantity of assets that makes a person hesitant to gamble/invest or refrain from participating i...

Q: Which of the following is included in GDP calculations? a crisp $50 bill received on your birt...

A: Gross Domestic Product (GDP) measures the market value of all final goods and services produced by a...

Q: What were Milton Friedman economic theory’s general principles and who did he advise? Could you also...

A: Milton Friedman was a Nobel Peace Prize winner and an American economist. He created a number of eco...

Q: Solve it correctly

A: Externality When some of the benefits or costs of producing or consuming a good or service fall on p...

Q: 35. Use Table 11.5 to calculate the four-firm concentration ratio for the U.S. auto market. Does thi...

A: A monopoly occurs when one firm has a dominant position in an industry or area to the point where al...

25

Step by step

Solved in 2 steps

- Suppose that you, on 1st of January 2023, enter a long position in a 10-year forward contract on a non-dividend-paying stock. The stock price is $50 and the risk-free rate of interest is 5% per annum with yearly compounding (as per 1st of January 2023). a) What are the forward price and the initial value of the forward contract? Five years later, 1st of January 2028, the price of the stock is $60 and the risk-free interest is still 5%. b) On 1st of January 2028, what are the forward price and the value of the forward contract that you entered into on 1st of January 2023? Explain. c) Suppose that you on 1st of January 2028 enter a short position in a forward contract on the same underlying stock and with expiration date in 5 years. What is the value of your total position? (I.e. what is the total value of the long position in the forward contract in a) and your short position). What is the payoff of your total position at maturity? d) On 1st of January 2028, what is the value…Suppose Ted deposits $10,000 in a savings plan earning 5% compounded annually and Tess deposits $10,000 ina savings plan earning 10% compounded annually. Both leave their money on deposit for 40 years. Because Tess’srate is twice as great as Ted’s rate, is it true that Tess will earn twice as much interest? Explain why or why not.Then show calculations to prove your point of view. What is the future value for each investment? N i PV PMT FV 5 10Rework part (f), assuming that Annie holds the bond for 10 years and sells it when the required return is 7.0%. Compare your finding to that in part (f), and comment on the bond's maturity risk. PV= 1,000 N=10 I/Y= 7% Assume that Annie buys the bond at its current price of $983.80 and holds it until maturity. What will her current yield and yield to maturity (YTM) be, assuming annual interest? After evaluating all of the issues raised above, what recommendation would you give Annie with regard to her proposed investment in the Atilier Industries bonds?

- Suppose you purchased a corporate bond with a 10-year maturity, a $1,000 par value, a 9% coupon rate ($45 interest payment every six months), and semiannual interest payments. Five years after the bonds were purchased, the going rate of interest on new bonds fell to 6% (or 6% compounded semiannually). What is the current market value (P) of the bond (five years after the purchase)?(a) P = $890(b) p = $1,223(c) P = $1,090(d) p = $1,128suppose that you invest $100 today in a risk-free investment and let the 4 percent annual intrest rate compound. Rounded to the full dollars, what will be the value of your investment 4 years from now?When Andrew was 10 years old, his mother invested $50,000 to use for his college education seven years later. After seven years, how much money did Andrew have if the interest rate was 2 percent a year? A. $57,434.28 B. $50,357.00 C. $50,000.00 D. $43,528.01

- Susie Lee won a lottery. She will have a choice of receiving $25,000 at the end of each year for the next 30 years, or a lump sum today. If she can earn an annual return of 10 percent on any investment she makes, what is the least she should be willing to accept today as a lump-sum payment? (Round to the nearest hundred dollars.) Use the NPV as you have equal cash flows of $25,000 for the next 30 years.What is the discount yield, bond equivalent yield, and effective annual return on a $7 million commercial paper issue that currently sells at 98.75 percent of its face value and is 122 days from maturity? (Use 360 days for discount yield and 365 days in a year for bond equivalent yield and effective annual return. Do not round intermediate calculations. Round your percentage answers to 3 decimal places. (e.g., 32.161))A corporate bond maturing in 15 years with a coupon rate of 10.9 percent was purchased for $970 and it now selling for $1,000. 1. What will be its selling price in two years if comparable market interest rates drop 4.9 percentage points? (Hint: Use Appendix A-2 and Appendix A-4 or the Garman/Forgue companion website.) Round Present Value of a Single Amount and Present Value of Series of Equal Amounts in intermediate calculations to four decimal places. Round your answer to the nearest cent. $ 2. Calculate the bond's YTM using Equation 14.5 or the Garman/Forgue companion website. Round your answer to two decimal places. %

- Which of the following investment options willmaximize your future wealth at the end of 18 years?Assume any funds that remain invested will earn anominal rate of 12% compounded monthly.(a) Deposit $8,000 now.(b) Deposit $120 at the end of each month for thefirst 12 years.(c) Deposit $105 at the end of each month for 18years.(d) Deposit a lump sum in the amount of $35,000 atthe end of year 12.As a manager of your company, you are considering to go for a project, with an initial outlay of $200,000. The project has a life of three years and yields (year-end) cash inflows of $ 100,000 in year-1, $150,000 in year-2 and $200,000 in year 3. What is the net present value of the project if the interest rate is 10 percent? Show your steps. Should you recommend to go for the project? Explain in details.Given the Given, solution and cash flow diagram. What value of money invested now at fifteen percent interest can provide the following education grants: P30,000 at the end of each year for six years; P40,000 for the next six years and P50,000 thereafter? Write your Cash-Flow Diagram. A. P333,333.00 B P65,441.60 C. P241,277.00 d. P113,535.00