need help answering the questions below

Q: HOW TO SOLVE QUESTION D&E

A: One of the most important theorems in corporate finance is the M&M Theorem, often known as the…

Q: look at the image to help me solve the problem

A: In Double Entry System, the total of assets are always equal to the total of liabilities.

Q: e missing amounts.

A: We know that Revenue - Cost of Goods sold = Gross Profit Gross Profit - Expenses = Operating…

Q: Please help me to solve this problem

A: Here discuss about the accrual basis accounting treatment of the vacation payable liability which…

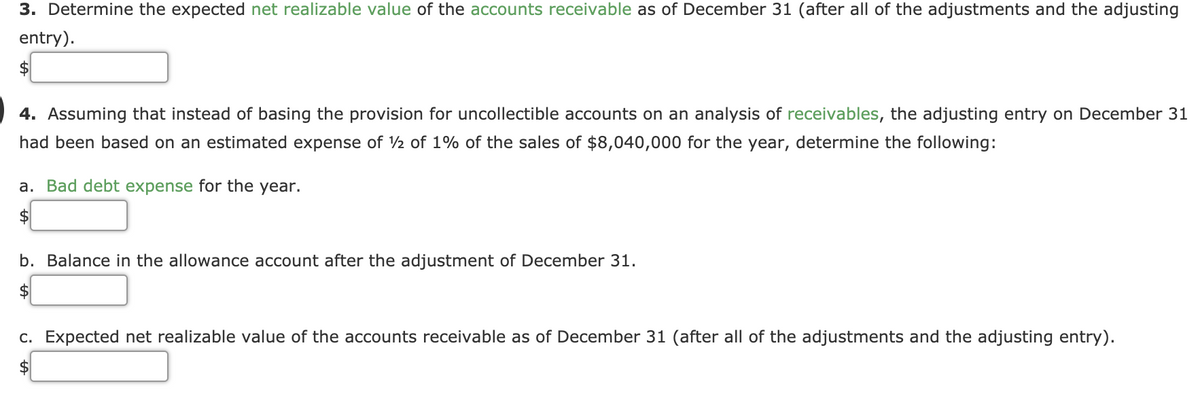

Q: Can someone please explain how I answer this question? It's question number 3

A: As per 2022 table, CPP is 5.7% of gross pay subject to basic personal exemption of $ 3500 and the…

Q: Can you please help me to find solution to question 2

A: Here asked for multi sub part question we will solve for first three sub part question for you. If…

Q: Please answer this question with brief solution. I need the answer ASAP thank you!

A: Depreciation is a cost charged over the fixed assets for over a period of time. Fixed Assets are the…

Q: lease help solve ste

A: Direct material are those material that are consumed during manufacturing process and directly…

Q: How to solve this problem? How does the answer look all solved? I am struggling to answering this…

A: Multi-step income statement: It is the presentation of a normal income statement in a more detailed…

Q: litary Sç

A: Which of the following documents are issuede by VA for disability payments…

Q: Answer please

A: Total payroll =250000 income tax =10%=25000 Remaining =250000-25000=225000 Remaining =225000 Union…

Q: Need help with question 2, if you could please just explain to me how this done.

A: Any number with decimal of more than 0.5, will rounded off to the next number. If it is less than…

Q: I need help with question B

A: Hi, I am only answering (b) as per your requirement. Thank you Business are the organizations formed…

Q: Write a response to Cory. Explain your position.

A: Bonus is the amount which is given to the employee which is usually based on certain conditions and…

Q: need answers thank you.

A: The question is based on the concept of Financial Accounting.

Q: lease help me to solve this problem

A: A budget is used in forecasting to determine supplier payments, and receipts from customers which in…

Q: in

A: For an individual gross income is the total income earned by that…

Q: Please help me with this question

A: Assets: Assets are the resources of an organization used for the purpose of business operations.…

Q: Please help me to solve this problem

A: Formula: Material Cost Variance Standard Cost - Actual Cost This Material Cost Variance is further…

Q: answer all part of the

A: Here we will calculate standard and actual profit based on given info.…

Q: Choice

A: The Right Answer is $3,936.

Q: ble vable

A: Preparation of the journal entries is the first step in the double-entry system of bookkeeping.…

Q: Hi I need help wit

A: Success of any country generally depends on some factor based on employment, banking system,…

Q: Please help me solve this problem please

A: Value added activities means those activities which increase value of the product to some extent.

Q: er question B.

A: The given problem can be computed using VAR and STDEV formula in excel.

Q: could you please help with part b please

A: Face Value of bond or Future Value is $100 Time period is 5 years Coupon amount is Zero Current…

Q: I need all parts of the questions answered. Thanks.

A: Price or Value(VB) of a Bond is computed by discounting all cash benefits that will arise from bond…

Q: kindly post the solution to the question thanks

A: Total cost of the product comprises of material cost, direct labor cost, variable as well as fixed…

Q: Please answer properly

A: The depreciation expense is charged on fixed assets as reduction in the value of the fixed assets…

Q: Can you help me with this question please Thank you

A: The question is related to busniess started on 1st July 2020. The transactions for the month of July…

Q: I need help with questions 1 and 2

A: Profitability ratio is a ratio which indicate the return on resources used for productivity in terms…

Q: Please answer all parts of the question

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts.…

Q: In your own words explain the agency theory and give atleast2 personal experience.

A: The agent is a person who does all the work to the principal. The principal will appoint the agent…

Q: In need of answer for question number 3.

A: Expense payable is the liability for the business.

Q: e this question, thanks

A: The present value of a future sum of money or stream of cash flows is the current value of the…

Q: ase answer all pro

A: Given information : Time period 23 Par value $1,000 Coupon interest rate 9% Yield to…

Q: Please see below. I need help with this asap

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Need help on part A

A: Return on total assets is a ratio that indicates the income earned relative to total assets.

Q: Please help me to solve this probl

A: In this question we have to make the bank reconciliation statement and the updated cash book.

Q: s question

A: Cash Flow Statement consists of cash Ins and outs of an organization, and categorized as Operating…

Q: Can you help me with this question

A: The question requires entry on March 1 and March 20 March 1 : The day fund was established March 20…

Q: an someone help me with this question please?

A: Step 1 Journal is the part of book keeping.

Q: xpected

A: Formula to calculate free cash flow: Net operating profit after taxes - Net capital expenditure -…

Q: please help

A: Consolidated statements: Consolidated financial statements consist of Balance sheet, Income…

Q: Urgent, please answer the question below. This is how you answer the problem, (a) Identify the given…

A: Principal amount = P20,000 Period = January 15 to November 19 (309 days) Interest rate = 5%

Q: attached

A: Current Yeild = Annual Coupon payment / Current Market Price of Bond * 100 7% =…

Q: help with this questions

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: please make your answers clea

A: Income Statement

Q: What is the value of A?

A: Solution:- calculation of Net sales and Ending inventory as follows under:- The following formulas…

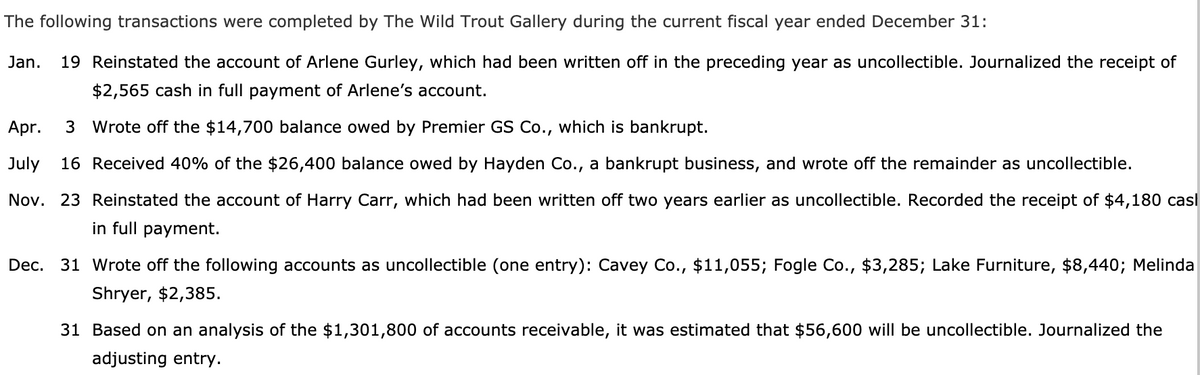

i need help answering the questions below

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?After all revenue and expenses have been closed at the end of the fiscal period ended December 31, Income Summary has a debit of 45,550 and a credit of 36,520. On the same date, D. Mau, Drawing has a debit balance of 12,000 and D. Mau, Capital had a beginning credit balance of 63,410. a. Journalize the entries to close the remaining temporary accounts. b. What is the new balance of D. Mau, Capital after closing the remaining temporary accounts? Show your calculations.Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.

- Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y1: The following accounts were unintentionally omitted from the aging schedule: Wig Creations has a past history of uncollectible accounts by age category, as follows: Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of 7,375 before adjustment on December 31, 20Y1. Journalize the adjustment for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.Window World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of window treatments on April 2. Terms of the sale are 2/60, n/150. The cost of the purchase to Window World is $56,200. On September 4, Window World determined that Nile Jenkinss account was uncollectible and wrote off the debt. On December 3, Mr. Jenkins unexpectedly paid in full on his account. Record each Window World transaction with Nile Jenkins. In order to demonstrate the write-off and then subsequent collection of an account receivable, assume in this example that Window World rarely extends credit directly, so this transaction is permitted to use the direct write-off method. Remember, however, that in most cases the direct write-off method is not allowed.

- Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions take place during the current year. A. On July 3, the company purchases thirty fountains for $1,200 per fountain, on credit. Terms of the purchase are 2/10, n/30, invoice dated July 3. B. On August 3, Serene does not pay the amount due and renegotiates with Kirkland. Kirkland agrees to convert the debt owed into a short-term note, with an 8% annual interest rate, payable in two months from August 3. C. On October 3, Serene Company pays its account in full. Record the journal entries to recognize the initial purchase, the conversion, and the payment.At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.