an someone help me with this question please?

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

100%

Can someone help me with this question please?

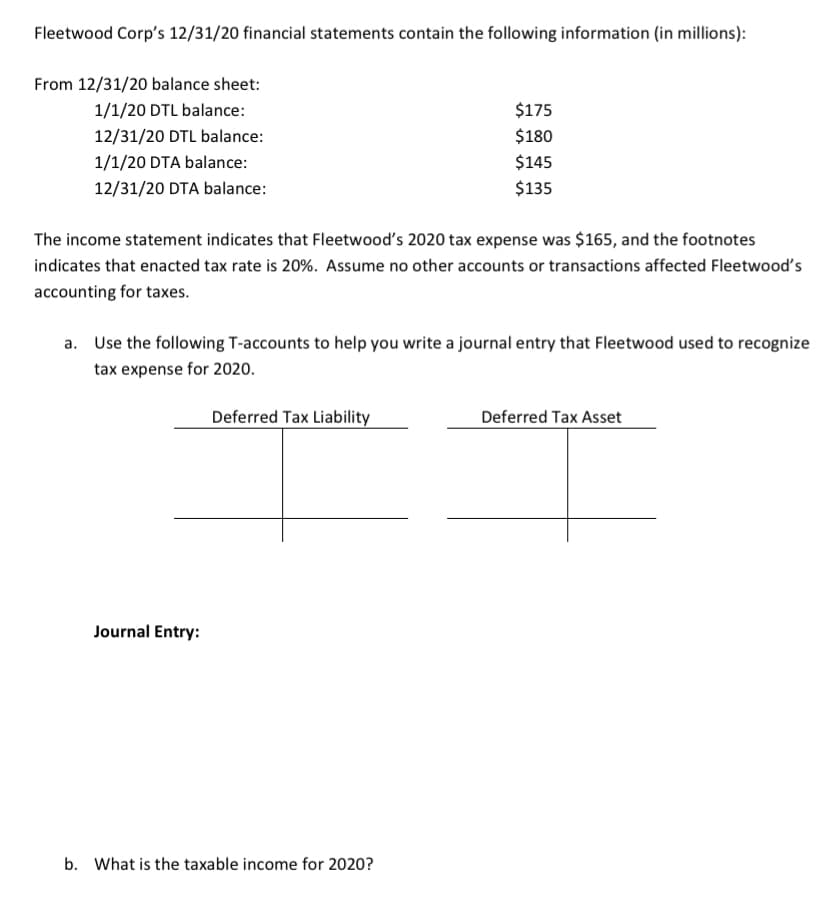

Transcribed Image Text:Fleetwood Corp's 12/31/20 financial statements contain the following information (in millions):

From 12/31/20 balance sheet:

1/1/20 DTL balance:

$175

12/31/20 DTL balance:

$180

1/1/20 DTA balance:

$145

12/31/20 DTA balance:

$135

The income statement indicates that Fleetwood's 2020 tax expense was $165, and the footnotes

indicates that enacted tax rate is 20%. Assume no other accounts or transactions affected Fleetwood's

accounting for taxes.

a. Use the following T-accounts to help you write a journal entry that Fleetwood used to recognize

tax expense for 2020.

Deferred Tax Liability

Deferred Tax Asset

Journal Entry:

b. What is the taxable income for 2020?

Expert Solution

Step 1

Step 1

Journal is the part of book keeping.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning