Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 11C

Related questions

Question

please solve this question, thanks

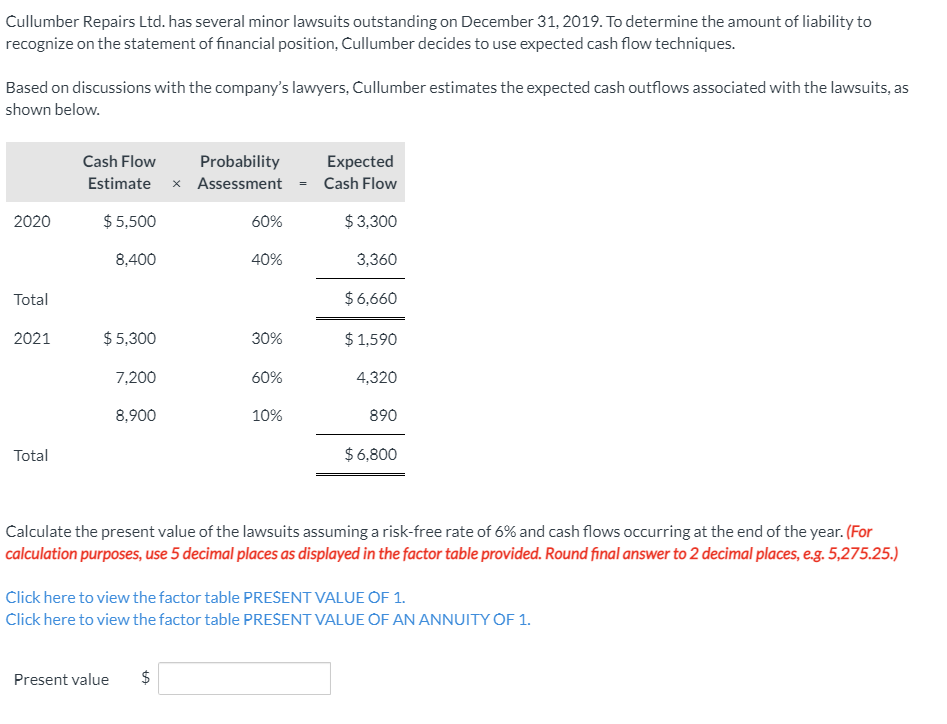

Transcribed Image Text:Cullumber Repairs Ltd. has several minor lawsuits outstanding on December 31, 2019. To determine the amount of liability to

recognize on the statement of financial position, Cullumber decides to use expected cash flow techniques.

Based on discussions with the company's lawyers, Cullumber estimates the expected cash outflows associated with the lawsuits, as

shown below.

Cash Flow

Probability

Expected

Estimate x Assessment = Cash Flow

2020

$ 5,500

60%

$ 3,300

8,400

40%

3,360

Total

$6,660

2021

$ 5,300

30%

$ 1,590

7,200

60%

4,320

8,900

10%

890

Total

$6,800

Calculate the present value of the lawsuits assuming a risk-free rate of 6% and cash flows occurring at the end of the year. (For

calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answer to 2 decimal places, e.g. 5,275.25.)

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

Present value

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning