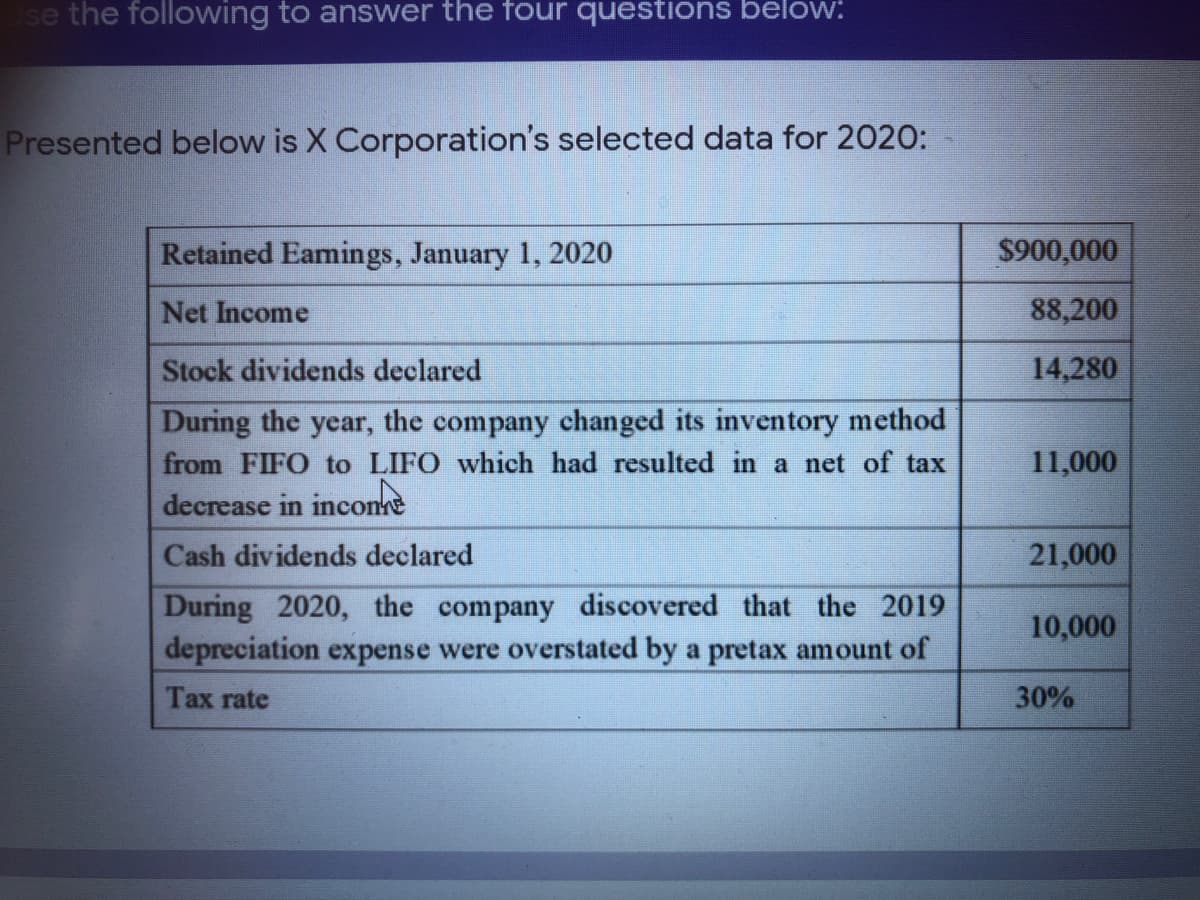

Net Income 88,200 Stock dividends declared 14,280 During the year, the company changed its inventory method from FIFO to LIFO which had resulted in a net of tax decrease in inconhe Cash dividends declared 11,000 21,000

Q: a. Ratio of fixed assets to long-term liabilities fill in the blank 1 b. Ratio of liabilities to…

A: Hello, since the student has posted multiple requirements, only the first three are answerable.…

Q: Apex Inc. reports the following for a recent year: Income from continuing operations before income…

A: Income before irregular items = Income from continuing operations before income tax - Income tax…

Q: How would I start to solve this problem?

A: Hey, since there are multiple sub-parts posted, we will answer the first three sub-part. If you want…

Q: Given the following information about a corporation's current year activities, answer the question…

A: Retained earnings is the amount left after deducting dividend paid from the net income.

Q: Bubbles Corporation’s account balances during the year showed the following changes: increase…

A: Current assets 278,000 Non-current assets (97,000) Total increase in assets…

Q: Six Measures of Solvency or Profitability The following data were taken from the financial…

A: a. Calculate the ratio of fixed assets to long term liabilities.

Q: What is the net income for the current year? Presented below are the changes in all the account…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity. It…

Q: The ending balance of ABC’s equity shows P 1,260,000. Tihs is affected by the following…

A: Solution: Ending balance of equity = P1,260,000 Share capital = P1,000,000 Ending balance of…

Q: Mori Company's net income last year was $25,000 and cash dividends declared and paid to the…

A: Cash flow statement is a statement which shows cash inflows and cash outflows of the business.

Q: Selected current year-end financial statements of Cabot Corporation follow. All sales were on…

A: Financial ratio analysis: It can be defined as an analysis tool that is based upon the relative…

Q: Presented below are changes in all the account balances of Sheffield Furniture Co. during the…

A: Change in assets = Change in laibilities + Change in Stockholders'equity Change in stockholders'…

Q: Sedona Corporation declared and paid a cash dividend of $6,800 in the current year. Its comparative…

A: Since, you have specifically asked for parts 4 to 8, we will solve 1st three from 4 to 8. To get the…

Q: parative financial statements for Weller Corporation, a merchandising company, for the year ending…

A: Calculation of Return on Total Assets Return on Total Assets = Net Operating Income/ Average total…

Q: Effects of Transactions on Various Financial Ratios In the right-hand column below, certain…

A: Ratios: A ratio can be defined as a measure calculated to know the relation of two variable, that…

Q: Determine the missing amounts. Concord Corporation Bridgeport Enterprises Beginning of year: Total…

A: Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the…

Q: Six Measures of Solvency or Profitability The following data were taken from the financial…

A: Since we are entitled to answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Morera Company's net income last year was P37,000 and cash dividends declared and paid to the…

A: Net Cashflow from operation = Net Income -Increase in current assets- Decrease in current…

Q: Income Statement Goldfinger Corporation had account balances at the end of the current year as…

A: This question deals with the preparation of income statement. Income statement are prepared by the…

Q: The income statement for Hudson Company reported net income of $345,000 for the year ended December…

A:

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Bubbles Corporation’s account balances during the year showed the following changes: increase…

A: Current assets 278,000 Non-current assets (97,000) Total increase in assets…

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: Six Measures of Solvency or Profitability The following data were taken from the financial…

A: d.Calculate return on total assets:Return on total assets = Net income / Average total assetsReturn…

Q: balances of AOCI $27,000 (debit), APIC $77,000, and Retained Earnings $313,000. For Year 2, the…

A: The company can issue shares for the whole accounting year and it can sell at any time for the need…

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: Dividend yield ratio depicts how much dividend a company is paying on each share as a proportion to…

Q: Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a…

A: Working capital = Current assets - Current liabilities Current ratio = Current assets / Current…

Q: The following information is taken from the current year financial statement of EC (dollar figures…

A: Loss from continuing operations: It refers to the loss incurred from ongoing business, it can be…

Q: Please explain this to me thoroughly, It's need for a homework assignment and I am completely…

A: The first step in the question is to find out the begining balance of each itme. The begining…

Q: Common stock outstanding January 1, 2022, was 24,700 shares, and 37,100 shares were outstanding at…

A: Earning per share is the portion of a company's profit allocated to each outstanding share of common…

Q: Comparative Income Statement and Reconciliation (dollars in thousands) This Year Last Year $89,000…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: 1. Multiple-step and single step income statement. Holler, Inc. has the following data for the year…

A: Net income is the excess of revenues over total expenses.

Q: Goldfinger Corporation had account balances at the end of the currentyear as follows: sales revenue,…

A: The income statement shows the income earned during the year by the company.

Q: Net income of Fernandez Co The following selected accounts and their current balances appear in the…

A: Net income is the final result that is generated by preparing income statement. Income statement…

Q: DIVIDENDS Brooks Sporting Inc. is prepared to report the following 2018 income state- ment (shown in…

A: Honor code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: Financial data, such as balance sheets and income statements, are used in ratio analysis to get…

Q: Apex Inc. reports the following for a recent year: Income from continuing operations before income…

A: Incorporation A Partial Income statemememt Year Ended December 31 Particulars Amount ($)…

Q: Moravec Company's net income last year was P46,000 and cash dividends declared and paid to the…

A: Net Cashflow from operation = Net Income -Increase in current assets- Decrease in current…

Q: Assume a company starts operations on 1/1/2013 with an equity investment of $776,750. The companies…

A: In the given question taxable income can be called as EBT itself. Taxes payable can be calculated by…

Q: Administrative expenses Loss on sale of equipment Income tax expense 100,800 7,000 89,600 Shares of…

A: Net Income = $134,400 Total Shares Outstanding = Outstanding at January 1 + Additional Issued At may…

Q: The following information is available for Wildhorse Corporation for the year ended December 31,…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: Financial ratios refer to an accounting or business metric used by companies for comparing two…

Q: A portion of the combined statement of income and retained earnings of Seminole Inc. for the current…

A: Calculate net income available for common stockholders.

Q: Comparative financial statements for Weller Corporation, a merchandising company, for the year…

A: EPS stands for Earnings Per Share, which measures or evaluates how many amount of net income earned…

Q: Morey Company's net income last year was P27,000 and cash dividends declared and paid to the…

A: Net Cashflow from operation= Net Income -Increase in current assets- Decrease in current Liabilities…

Step by step

Solved in 2 steps

- Bloom Company had beginning unadjusted retained earnings of 400,000 in the current year. At the beginning of the current year, Bloom changed its inventory method from LIFO to FIFO, and the cumulative effect (net of taxes) of this change was 28,000. In addition, Bloom earned net income of 150,000 and paid dividends of 30,000 in the current year. Prepare Blooms retained earnings statement for the current year.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO belter represented the flow of their inventory. Management prepared the following analysis showing the effect of this change: Frost reported net income of 2,500,000, 2,400,000, and 2,100,000 in 2018, 2019, and 2020, respectively. The tax rate is 21%. Required: 1. Prepare the journal entry necessary to record the change. 2. What amount of net income would Frost report in 2018, 2019, and 2020? 3. If Frosts employees received a bonus of 10% of income before deducting the bonus and income taxes in 2018 and 2019, what would be the effect on net income for 2018, 2019, and 2020?

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Income Statement, Lower Portion Cunningham Company reports a retained earnings balance of 365,200 at the beginning of 2019. For the year ended December 31, 2019, the company reports pretax income from continuing operations of 150,500. The following information is also available pertaining to 2019: 1. The company declared and paid a 0.72 cash dividend per share on the 30,000 shares of common stock that were outstanding the entire year. 2. The company incurred a pretax 21,000 loss as a result of an earthquake, which is not unusual for the area. This is included in the 150,500 income from continuing operations. 3. The company sold Division P (a component of the company) in May. From January through May, Division P had incurred a pretax loss from operations of 33,000. A pretax gain of 15,000 was recognized on the sale of Division P. Required: Assuming that all the pretax items are subject to a 30% income tax rate: 1. Complete the lower portion of Cunningham's 2019 income statement beginning with Pretax Income from Continuing Operations. Include any related note to the financial statements. 2. Prepare an accompanying retained earnings statement.