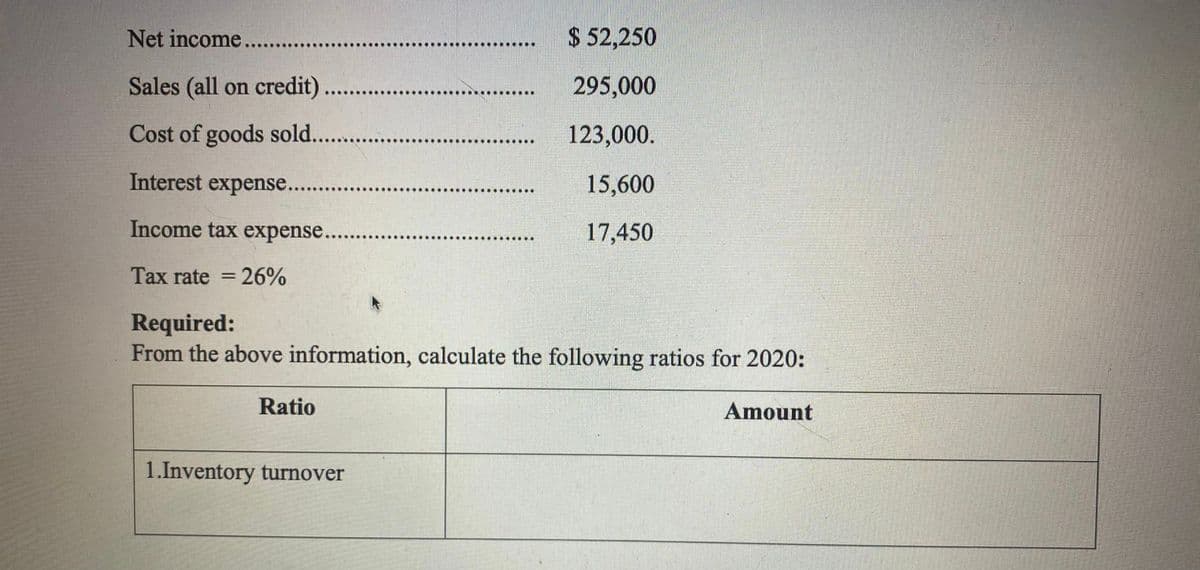

Net income. $ 52,250 Sales (all on credit). 295,000 Cost of goods sold.. 123,000. Interest expense. 15,600 Income tax expense... 17,450 Tax rate = 26% Required: From the above information, calculate the following ratios for 2020: Ratio Amount 1.Inventory turnover

Net income. $ 52,250 Sales (all on credit). 295,000 Cost of goods sold.. 123,000. Interest expense. 15,600 Income tax expense... 17,450 Tax rate = 26% Required: From the above information, calculate the following ratios for 2020: Ratio Amount 1.Inventory turnover

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 17PA: Using the following Company W information, prepare a Retained Earnings Statement. Retained earnings...

Related questions

Question

Transcribed Image Text:Net income....

$ 52,250

Sales (all on credit)..

295,000

Cost of goods sold...

123,000.

Interest expense...

15,600

Income tax expense....

17,450

Tax rate = 26%

%3D

Required:

From the above information, calculate the following ratios for 2020:

Ratio

Amount

1.Inventory turnover

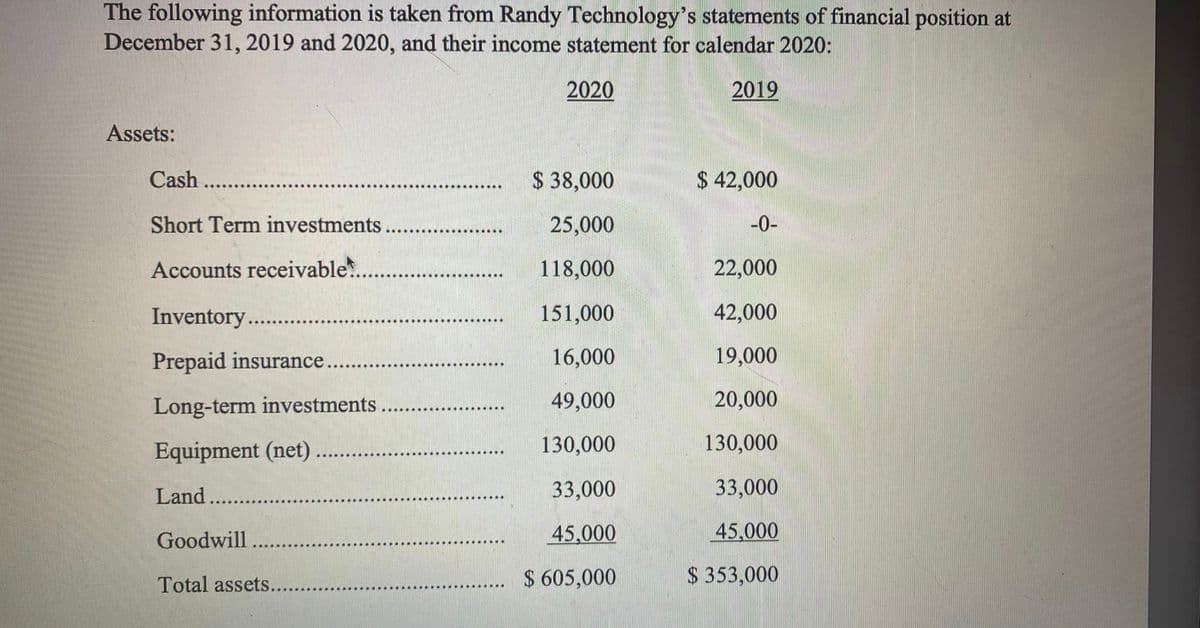

Transcribed Image Text:The following information is taken from Randy Technology's statements of financial position at

December 31, 2019 and 2020, and their income statement for calendar 2020:

2020

2019

Assets:

Cash ...

$ 38,000

$ 42,000

Short Term investments

25,000

-0-

Accounts receivable..

118,000

22,000

Inventory..

151,000

42,000

Prepaid insurance

16,000

19,000

Long-term investments

49,000

20,000

Equipment (net)..

130,000

130,000

Land..

33,000

33,000

Goodwill

45,000

45,000

Total assets..

$ 605,000

S 353,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning