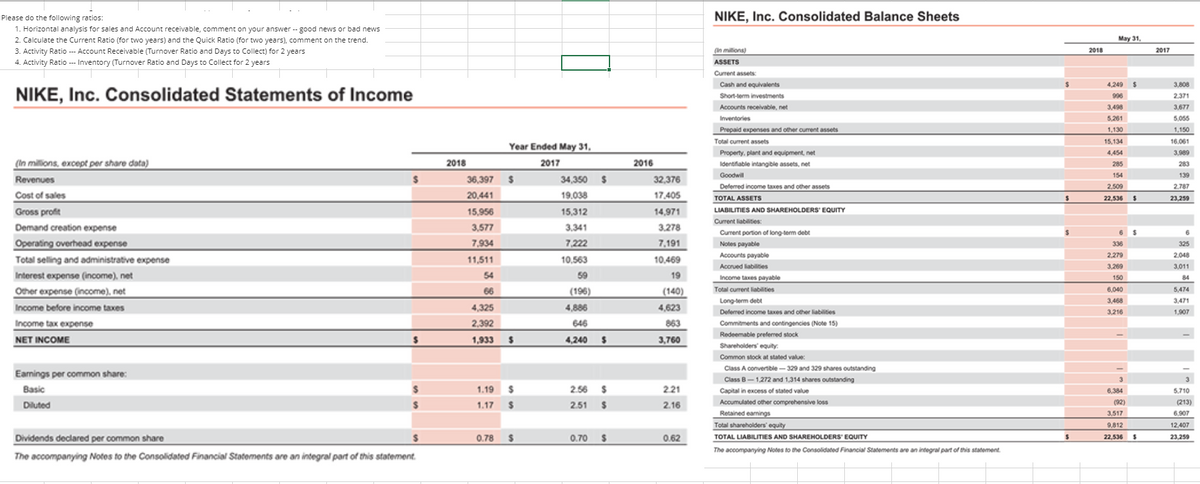

NIKE, Inc. Consolidated Balance Sheets Piease do the following ratios: 1. Horizontal analysis for sales and Account receivable, comment on your answer- good news or bad news 2. Calculate the Current Ratio (for two years) and the Quick Ratio (for two years), comment on the trend. 3. Activity Ratio -- Account Receivable (Turnover Ratio and Days to Collect) for 2 years 4. Activity Ratio - Inventory (Turnover Ratio and Days to Collect for 2 years May 31. nion 2018 2017 ASSETS Cument asses Cash and equivalents 4249 S 3808 NIKE, Inc. Consolidated Statements of Income Shoteminestmert 2371 Accounts recelvable, net 34 3677 Inventories 5.21 5.05 Prepaid expenses and other oument assets 1,130 1,150 Total oument assets 15,134 16.061 Year Ended May 31, Property, plant and equipment, net 4,454 3.90 (in millions, except per share data) 2018 2017 2016 Identfable intangble assets, net 25 283 Goodwill 154 139 Revenues 36,397 34,350 $ 32.376 Delemed income taves and other assets 2.509 2.787 Cost of sales 20,441 19.038 17.405 TOTAL ASSETS LIABILITES AND SHAREHOLDERS EQUITY 22.534 S 23.259 Gross proft 15,956 15.312 14.971 Cument lables Demand creation expense 3,577 3.341 3.278 Cument portion of longterm debt Operating overhead expense 7.934 7.222 7,191 Ntes payable 336 325 Accourts payable 2.279 2048 Total selling and administrative expense 11,511 10.563 10,469 Acoued labiles 3.209 3,011 Interest expense (income), net 54 59 19 Income taes payable 150 84 Oher expense (ncome), net Income before income taxes 66 (196) (140) Total curent lablites 6,040 5474 Longm de 3,48 3471 4,325 4,886 4,623 Defemed income taes and oher lablites 3.216 1.907 Income tax expense 2.392 646 863 Commitments and contingencies (Note 15 Redeemable prefered stock NET INCOME 1,933 4,240 S 3,760 Sharholdersuty Common stock at stated valu Cass A conventle-329 and 329 shares outstanding Eamings per common share: Class-1272 and 1314 shares outstanding Capitalin ecess of stated value Basic 1.19 $ 2.56 S 221 6.34 5.710 Diluted 1.17 S 2.51 $ 2.16 Accumulated other comprehensive loss 213 Retained eamings 6.907 3.517 Total shareholders equity 9.812 12.407 Dividends declared per common share TOTAL LIABLITIES AND SHAREHOLDERS EQUITY The accompanying Notesohe Consolidated Financia Statements are an integral part of ths statement 0.78 $ 0.70 $ 0.62 22.534 23.259 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement.

NIKE, Inc. Consolidated Balance Sheets Piease do the following ratios: 1. Horizontal analysis for sales and Account receivable, comment on your answer- good news or bad news 2. Calculate the Current Ratio (for two years) and the Quick Ratio (for two years), comment on the trend. 3. Activity Ratio -- Account Receivable (Turnover Ratio and Days to Collect) for 2 years 4. Activity Ratio - Inventory (Turnover Ratio and Days to Collect for 2 years May 31. nion 2018 2017 ASSETS Cument asses Cash and equivalents 4249 S 3808 NIKE, Inc. Consolidated Statements of Income Shoteminestmert 2371 Accounts recelvable, net 34 3677 Inventories 5.21 5.05 Prepaid expenses and other oument assets 1,130 1,150 Total oument assets 15,134 16.061 Year Ended May 31, Property, plant and equipment, net 4,454 3.90 (in millions, except per share data) 2018 2017 2016 Identfable intangble assets, net 25 283 Goodwill 154 139 Revenues 36,397 34,350 $ 32.376 Delemed income taves and other assets 2.509 2.787 Cost of sales 20,441 19.038 17.405 TOTAL ASSETS LIABILITES AND SHAREHOLDERS EQUITY 22.534 S 23.259 Gross proft 15,956 15.312 14.971 Cument lables Demand creation expense 3,577 3.341 3.278 Cument portion of longterm debt Operating overhead expense 7.934 7.222 7,191 Ntes payable 336 325 Accourts payable 2.279 2048 Total selling and administrative expense 11,511 10.563 10,469 Acoued labiles 3.209 3,011 Interest expense (income), net 54 59 19 Income taes payable 150 84 Oher expense (ncome), net Income before income taxes 66 (196) (140) Total curent lablites 6,040 5474 Longm de 3,48 3471 4,325 4,886 4,623 Defemed income taes and oher lablites 3.216 1.907 Income tax expense 2.392 646 863 Commitments and contingencies (Note 15 Redeemable prefered stock NET INCOME 1,933 4,240 S 3,760 Sharholdersuty Common stock at stated valu Cass A conventle-329 and 329 shares outstanding Eamings per common share: Class-1272 and 1314 shares outstanding Capitalin ecess of stated value Basic 1.19 $ 2.56 S 221 6.34 5.710 Diluted 1.17 S 2.51 $ 2.16 Accumulated other comprehensive loss 213 Retained eamings 6.907 3.517 Total shareholders equity 9.812 12.407 Dividends declared per common share TOTAL LIABLITIES AND SHAREHOLDERS EQUITY The accompanying Notesohe Consolidated Financia Statements are an integral part of ths statement 0.78 $ 0.70 $ 0.62 22.534 23.259 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 2TIF: Real-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E...

Related questions

Question

Practice Pack

Hello, I need formulas explaining the answers, thank you.

Please calculate the

Transcribed Image Text:Please do the following ratios:

NIKE, Inc. Consolidated Balance Sheets

1. Horizontal analysis for sales and Account receivable, comment on your answer -- good news or bad news

2. Calculate the Current Ratio (for two years) and the Quick Ratio (for two years), comment on the trend.

May 31,

3. Activity Ratio --- Account Receivable (Turnover Ratio and Days to Collect) for 2 years

(In millions)

2018

2017

4. Activity Ratio --- Inventory (Turnover Ratio and Days to Collect for 2 years

ASSETS

Current assets:

Cash and equivalents

4,249 $

3,808

NIKE, Inc. Consolidated Statements of Income

Short-term investments

996

2,371

Accounts receivable, net

3,498

3,677

Inventories

5,261

5,055

Prepaid expenses and other current assets

1,130

1,150

Total current assets

15,134

16.061

Year Ended May 31.

Property, plant and equipment, net

4,454

3,989

(In millions, except per share data)

2018

2017

2016

Identifiable intangible assets, net

285

283

Goodwill

154

139

Revenues

36,397 $

34,350

%24

32,376

Deferred income taxes and other assets

2,509

2.787

Cost of sales

20,441

19.038

17.405

TOTAL ASSETS

LIABILITIES AND SHAREHOLDERS' EQUITY

22,536

23,259

Gross profit

15,956

15,312

14,971

Current liabilities:

Demand creation expense

3,577

3,341

3.278

Current portion of long-term debt

6 S

Operating overhead expense

7,934

7,222

7,191

Notes payable

325

336

Accounts payable

2,279

2.048

Total seling and administrative expense

11,511

10,563

10,469

Accrued liabilities

3,269

3,011

Interest expense (income), net

54

59

19

Income taxes payable

150

84

66

Total current liabilities

Other expense (income), net

(196)

6,040

5,474

(140)

Long-term debt

3,468

3,471

Income before income taxes

4,325

4,886

4,623

Deferred income taxes and other liabilities

3,216

1,907

Income tax expense

2.392

646

863

Commitments and contingencies (Note 15)

Redeemable preferred stock

NET INCOME

1,933 $

4,240 S

3,760

Shareholders' equity:

Common stock at stated value:

Class A convertible - 329 and 329 shares outstanding

Eamings per common share:

Class B-1,272 and 1,314 shares outstanding

3.

3

Basic

1.19 $

2.56 S

221

Capital in excess of stated value

6,384

5,710

5,710

Diluted

24

1.17 $

2.51 $

2.16

Accumulated other comprehensive loss

(92)

(213)

Retained earnings

Total shareholders' equity

3,517

6.907

9,812

12,407

Dividends declared per common share

0.70 S

22,536

0.78 $

0.62

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

23,259

The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement.

The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College