Now that you have developed an understanding of the policy tools that are available to address economic challenges, your task is to prepare material that will go towards a Policy Brief analysing Australia’s economic recovery from the COVID pandemic and building an equitable and resilient economy in the future. Imagine you are now employed as a Graduate Economist working for the Australian Treasury. Your team is responsible for putting together a Policy Brief for the department that summarises some key aspects of the government’s policy responses to the COVID-19 recession and provides policy analysis to strengthen Australia’s economy in the future. You have a very important job! Your task is to provide clear answers to the following queries that have been requested from your department manager, using the knowledge and skills that you have gained from your macroeconomics course. The large increase in Government spending to support the economy during the pandemic contributed to a large budget deficit. Last year’s Budget reported that the Government ran a budget deficit of $134.2 billion in 2020-21 (as measured by the underlying cash balance) and was forecast to accumulate a net debt of $864.7 billion (equivalent to 33.1% of GDP) by 2025-26. See the Budget Aggregates below. Your team of economists is aware that there is concern among the general public and business community about running a large budget deficit and the increasing size of the government debt. This concern needs to be addressed in the Policy Brief. Write a simple explanation of what is meant by a budget deficit. You should make reference to the formula for the government’s budget balance that we learnt in class. Explain in what circumstances would a government’s fiscal position be in deficit, and in what circumstances would it be running a budget surplus? Using your economic knowledge, give your expertise on whether Australians should be worried about running a large budget deficit and accumulating a large debt as a result of the government’s response to the pandemic? Provide reasons to support you answer why or why not. (4-5 sentences)

Now that you have developed an understanding of the policy tools that are available to address economic challenges, your task is to prepare material that will go towards a Policy Brief analysing Australia’s economic recovery from the COVID pandemic and building an equitable and resilient economy in the future.

Imagine you are now employed as a Graduate Economist working for the Australian Treasury. Your team is responsible for putting together a Policy Brief for the department that summarises some key aspects of the government’s policy responses to the COVID-19 recession and provides policy analysis to strengthen Australia’s economy in the future. You have a very important job!

Your task is to provide clear answers to the following queries that have been requested from your department manager, using the knowledge and skills that you have gained from your

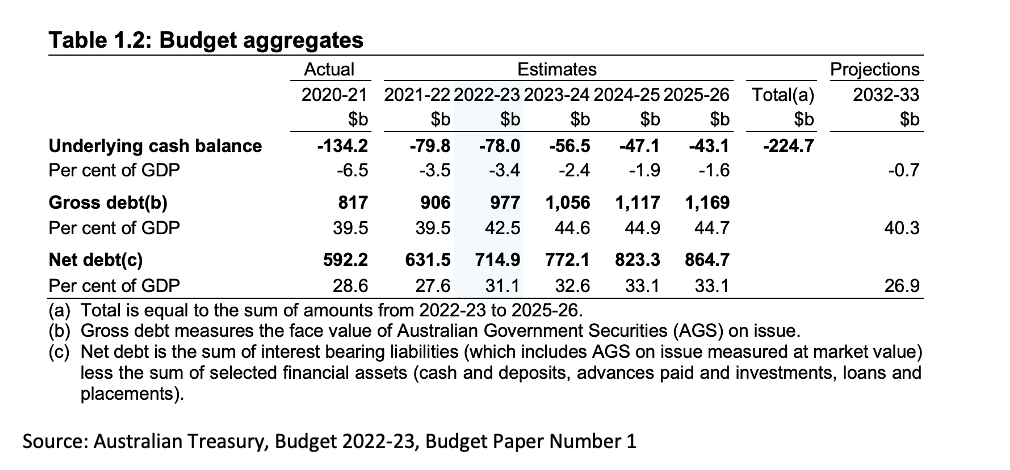

- The large increase in Government spending to support the economy during the pandemic contributed to a large budget deficit. Last year’s Budget reported that the Government ran a budget deficit of $134.2 billion in 2020-21 (as measured by the underlying cash balance) and was

forecast to accumulate a net debt of $864.7 billion (equivalent to 33.1% of GDP) by 2025-26. See the Budget Aggregates below.

Your team of economists is aware that there is concern among the general public and business community about running a large budget deficit and the increasing size of the government debt. This concern needs to be addressed in the Policy Brief.

Write a simple explanation of what is meant by a budget deficit. You should make reference to the formula for the government’s budget balance that we learnt in class. Explain in what circumstances would a government’s fiscal position be in deficit, and in what circumstances would it be running a budget surplus? Using your economic knowledge, give your expertise on whether Australians should be worried about running a large budget deficit and accumulating a large debt as a result of the government’s response to the pandemic? Provide reasons to support you answer why or why not. (4-5 sentences)

Step by step

Solved in 3 steps with 1 images